By Tim McMahon, editor

Typically the best time to buy is when everyone else is selling. This one motto has made Warren Buffett a billionaire. He’s said,

Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it…

We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful. Warren Buffett

So in October 2008, when things looked their worst he invested $3 billion in General Electric (NYSE-GE). Four months later the market began to recover. Buffett has always been a long term optimist but he is also a realist.

It’s never paid to bet against America. We come through things, but its not always a smooth ride.

Warren Buffett

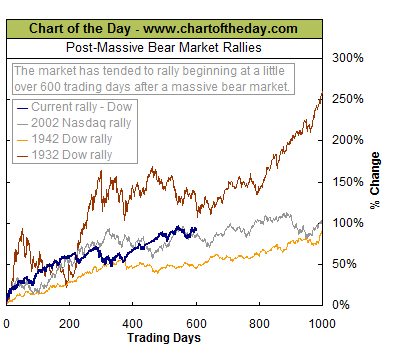

Since the creation of the Dow index there have only been three “Massive” corrections, where “Massive” is defined as a decline of more than 50%. Two of them happened at the beginning and end of the great depression. The third one began in 2007 and bottomed in 2009 and we are in the process of recovering from it. The only other comparable market decline was the Nasdaq “Dot Com bubble” that burst in 2000 resulting in a 78% decline in the NASDAQ with the associated post crash rally beginning in 2002.

So the following chart from our friends at Chart of the Day compares the four rallies that followed the four massive declines, i.e. the current 2009 rally, the 2002 NASDAQ rally, the 1942 Dow rally and the 1932 Dow rally.

From the chart we can see that the current rally is pretty much “Middle of the Road” but it has fairly closely tracked the 2002 NASDAQ rally. If the current rally continues to follow the 2002 NASDAQ pattern we would expect to see a possible decline for the next couple of months and then the market would resume the rally albeit at a slower pace than the initial rally from the bottom.

Although we are not following the 1932 rally pattern which was much larger, the one good thing is that the “slow and steady” 2002 pattern is much safer. Remember, the 1932 rally ended with the other “Massive” crash that led to the 1942 rally (although the 2002 NASDAQ rally also ended in the 2007 crash and another 56%+ correction).