By David Galland, The Casey Report

While I haven’t made a scientific study of the topic, I suspect the leading genre for popular entertainment – and for popular delusions of crowds, for that matter – revolves around magical worlds. As illustration, the Harry Potter series will serve.

The problem is that there is no such thing as magic, at least not in the mystical sense (versus sleight-of-hand variety). Rather, the physical world, and even the metaphysical world constructed by humans in their ancient and long-running quest for protection from the physical world, operates within the boundaries of certain irrefutable truths.

In the first instance, the laws of physics are only rarely found wanting; in the second, basic principles of economies are inviolate, or should be if you actually want an economy to succeed for any length of time.

This unblinking faith in an all-caring, omnipotent “Godvernment” is terrifyingly misplaced: it not only runs contrary to many of those truths but runs contrary to nearly every important lesson history has to teach. Look no further than the debts and deficits of Godvernments around the world to see the consequences of trying to keep this myth alive.

That this faith is on the increase, versus the opposite, should be very concerning… both to those who believe in the rights of individuals and to those trying to build and maintain a reasonable standard of living in this age of deep uncertainty.

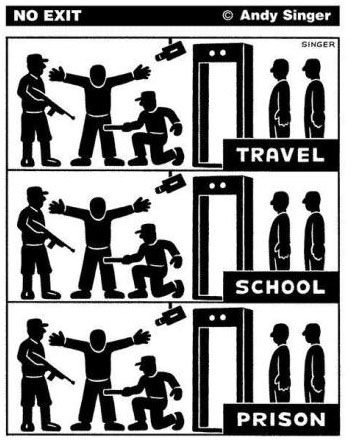

Especially in that most, if not all, of that uncertainty, as well as active threats to the general well-being, emanates from the very Godvernments people look to for salvation and sustenance. The graphic shown here demonstrates this point vis à vis US security policies soberingly well.

Now, I am sure that some of you view these remarks as just another libertarian tirade, and I guess to some degree, they are.

Yet, I think there is an important underlying point that requires serious reflection. Namely, with people the world over trapped in a delusional and self-destructive cycle of believing that the Godvernments can solve all that ails – even though almost all that ails is caused or made worse by those very same institutions – then things can only get worse from here.

It’s like all but the tiniest minority of the world’s population have been brainwashed into joining a dangerous cult. A cult whose leaders are unscrupulous about stripping their followers of their wealth, their dignity (see cartoon above) and their sense of individuality, while rewarding their most ardent supporters with pensions, tax breaks, a leg up over competitors and, if push comes to shove, hard cash in the form of bailouts.

Viewed through this lens, the thinking individual – you, for instance – should see the need to take certain self-protective measures. And since few things are as useful as a high net worth when it comes to protecting your independence, there are opportunities to chase down as well.

Some suggestions, a number of which you may have heard before.

- Expect the latest eurozone patch-up job to come unglued. When you have the heads of the eurozone’s largest countries talking about levering up bailout funds or ringing up the Chinese to ask for money, you know the latest “solution” to the eurozone’s intractable problems is little more than a hastily concocted plan to kick the wine bottle just a bit further down the road. The problem is that nothing suggested begins to resolve the structural problems of the eurozone – because nothing can be done to resolve those problems. Thus, a heads-up speculator will look for ways of betting on failure and place those bets during brief flare-ups of euro-optimism.

- Likewise, expect the US government’s new Super Committee to fail. Sure, they may come up with some optics in an attempt to mask the dire nature of the situation (for instance, by pushing the impact of any proposed measures out for five or more years – time enough to ignore them), but the fundamental truth in this case is that the Godvernment is hopelessly broke, at the same time the population expects it to do ever more.On the prospects for the Super Committee, and how the bond markets are likely to react if it fails, Casey Research Chief Economist Bud Conrad sent me an email:

David,

What do you think will happen when the Super Committee fails with deficit reduction and S&P follows through with its promise for another debt downgrade? Probably not that much, as the last time it didn’t wreck the markets, but if rates rise, it would not be a good call to be long stocks.

We have had good auctions from the Treasury until a very bad acceptance today that drove the 10-year Treasury to 2.4%. When I wrote my recommendation at the end of September confirming that rates were too low (for the October edition of The Casey Report), the rate was only 1.8%. This kind of move up would normally take months, not days. Here is the pretty dramatic chart:

Rising US interest rates will be a stake through the heart of the US economy. Even just a return to more normal historical averages will skyrocket the costs of servicing the US Godvernment’s mountain of debt, wreak havoc in the bond markets, and simultaneously smash any prospect of recovery in the hugely important housing sector. The key point is that this is big, important stuff you have to be preparing for.