Rumors have been rife about the treasury minting a single trillion dollar platinum coin to bypass the debt ceiling limitations. But it is probably just a pipe dream because first of all where would they get a trillion dollars worth of platinum? Do you know how many tons of platinum that is? And secondly if they just took say 100 ounces of platinum and called it a Trillion dollar coin the everyone would know that the American Banking system is a scam and it could trigger a crisis in confidence actually making the situation worse rather than better.

But gold on the other hand might still provide the answer. The pieces of the puzzle are beginnig to come together:

According to a recent Wall Street Journal article Germany is calling all its gold in and bringing it home (repatriating). We’ve been telling you for a while now that China’s Booosting the Price of Gold in an effort to become the world’s reserve currency which they plan to back by gold. Now it looks like Germany doesn’t want to be left behind or have its gold in the hands of foreigners. We’ve said that it is quite possible that Germany Will Exit the Euro and if so that could be another reason they want to have control of their gold within their borders so it won’t be subject to confiscation by foreign powers for some supposed debts of other Euro countries.

According to a recent Wall Street Journal article Germany is calling all its gold in and bringing it home (repatriating). We’ve been telling you for a while now that China’s Booosting the Price of Gold in an effort to become the world’s reserve currency which they plan to back by gold. Now it looks like Germany doesn’t want to be left behind or have its gold in the hands of foreigners. We’ve said that it is quite possible that Germany Will Exit the Euro and if so that could be another reason they want to have control of their gold within their borders so it won’t be subject to confiscation by foreign powers for some supposed debts of other Euro countries.

I am all for Governments backing their currency with real hard assets, my one concern is that the last time the U.S. government tried to shore up its balance sheets with gold, they confiscated it from citizens and promptly made 40.9% profit on the deal. They did this because the gold price had been fixed at the official price of $20.67/oz since 1880 but inflation had been occurring behind the scenes so the real price was closer to $35. So in 1933, President Franklin Roosevelt outlawed the private ownership of gold and bought it from the gullible public at the market price and then promptly revalued it to the real price of $35/oz.

So will the government try something similar this time around? If the government declared gold ownership illegal tomorrow and offered you a deal you couldn’t refuse at $1800/oz or even $2000/oz would you sell?

Would you feel cheated if shortly after forcing you to sell at $2,000 they promptly revalued the gold to $20,000? Is $20,000/oz unreasonable? It certainly sounds unreasonable, like one of those pipe dreams that arrise near the peak of any mania. But in this case, maybe it’s not… according to the following article by Dan Amoss.

The Golden Reset Button

The global monetary system rests on a fragile foundation of trust. But thanks to the regrettable actions of central banks around the world, especially those of the Federal Reserve, that foundation of trust is rotting away beneath us.

All hope is not lost, however.

A golden “reset” button could strengthen the fragile global monetary system. It would require reintroducing some sort of gold standard. Holders of gold own the crucial ingredient for a reset. And holders of gold mining stocks own in-ground gold supplies that could form the foundation of a future monetary system. [editor’s note: and the only gold asset that the government probably won’t confiscate.]

Since the end of the gold standard, debt has skyrocketed. Public- and private-sector debts amount to tens of trillions of dollars. Debt weighs down the economy. Pushing interest rates down to zero for years and years is no real solution. Look at Japan! Its economy has been half-alive for 20 years.

Writing off debt is the only way to restore solvency. The economy would be unshackled from its burden of servicing debts. But there is a way to slash debt without resorting to a deflationary collapse. It involves restoring the gold standard at prices of $10,000, $20,000 or even higher.

In a recent investor letter, QB Asset Management explains how an inflationary reset button could slash the real value of the rapidly growing US national debt:

Using the US as an example, the Fed would purchase Treasury’s gold at a large and specified premium to its current spot valuation. The higher the price, the more base money would be created and the more public debt would be extinguished. An eight-tenfold increase in the gold price via this mechanism would fully reserve all existing US dollar-denominated bank deposits (a full deleveraging of the banking system).

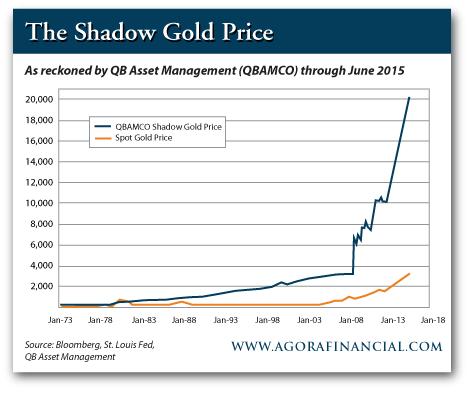

QB maintains a chart of the shadow gold price (SGP). The SGP uses the Bretton Woods calculation for determining the exchange rate linking gold to the US dollar. The calculation is base money divided by US official gold holdings. Here is QB’s latest chart. It includes projections of the base money supply through June 2015, assuming the Fed prints $85 billion per month. The SGP soars to $20,000 per ounce:

If the ratio between the SGP and actual gold prices stays constant, gold could be $3,400 per ounce by 2015! If gold rallies anywhere close to $3,400 by 2015 (QB Asset Management’s

scenario), quality gold mining stocks could rally by several hundred percent.

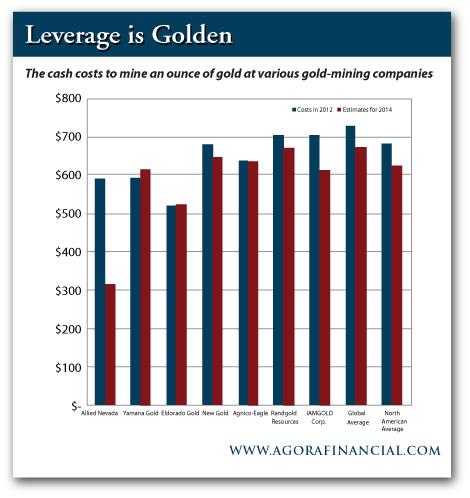

You could consider adding some of the midsized gold miners in the table below.The estimates are from RBC Capital Markets. Investors will pay a premium for gold miners with consistent execution and low, stable cash costs. The companies in the table below, courtesy of RBC Capital Markets, have these qualities. Stable cash costs should translate into good

stock price performance.

Let’s assume QB Asset Management’s scenario: a steady doubling in gold prices over the next three years. Most miners in this list would produce vast amounts of free cash flow in 2014. Any rise in gold prices above cash costs would flow straight to the bottom line. The most shareholder-friendly companies, like Agnico-Eagle Mines, for example, would probably return this cash to shareholders, rather than reinvest in the ground when project costs are too high.

Such a scenario would grab the attention of mainstream investors. Investors who now ignore gold stocks would fall in love with them. High-quality gold stocks remain very cheap and will one day become expensive. Meanwhile, dividend yields pay you to wait.

Regards,

Dan Amoss

for The Daily Reckoning

See Also:

- Germany Will Exit Euro

- So Long, US Dollar As World’s Reserve Currency

- China’s Booosting the Price of Gold

- Bank Runs Can’t Happen- Right?

Recommendations from Amazon:

- Gold: The Once and Future Money

- Rich Dad’s Advisors: Guide to Investing In Gold and Silver: Protect Your Financial Future

- All About Investing in Gold

- Buy Gold and Silver Safely: The Only Book You Need to Learn How to Buy or Sell Gold and Silver

This article was reprinted by permission of the Daily Reckoning see the original article here.

2013 Agora Financial, LLC. 808 Saint Paul Street, Baltimore MD 21202. This work is licensed under a CreativeCommons Attribution 3.0 Unported License. Reproduction, copying, or

redistribution (electronic or other wise, including on the World Wide Web), in whole or in part, is encouraged provided the attribution Daily Reckoning is preserved. Attribution must include a link to the original article url located on http://dailyreckoning.com. The Golden Reset Button