Quoth the Maven, “Evermore”

By Grant Williams

On January 29, 1845, the New York Evening Mirror published a poem that would go on to be one of the most celebrated narrative poems ever penned. It depicted a tragic romantic’s desperate descent into madness over the loss of his love; and it made its author, Edgar Allan Poe, one of the most feted poets of his time.

The poem was entitled “The Raven,” and its star was an ominous black bird that visits an unnamed narrator who is lamenting the loss of his true love, Lenore. (We’ll get back to Bart Simpson dressed as the Raven later on.)

The poem was entitled “The Raven,” and its star was an ominous black bird that visits an unnamed narrator who is lamenting the loss of his true love, Lenore. (We’ll get back to Bart Simpson dressed as the Raven later on.)

Today, the sad tale would be splashed on the cover of a million tabloid magazines with a title such as “Lenore Dumps Narrator,” “I’ll Never Find True Love Again — Narrator Spills on Tragic Split With Lenore,” or even “Kanye & Lenore — It’s Love! But Don’t Tell The Narrator.” But 1845 was the very epitome of “old school,” and so the poor, bereft narrator’s tale was shared with the world through a complex rhyme…

Now, as the narrator slips slowly, desperately into the pit of insanity, he discovers that the raven, with the license afforded the poet, can talk; and so he sets about asking the mysterious bird for guidance in navigating his torment:

Unfortunately for the narrator, the raven’s vocabulary is limited to the single word nevermore, which, in a rare moment of clarity, the narrator reasons can only have been learned from an unhappy former owner.

It’s at this point that the narrator demonstrates beyond any last vestige of remaining doubt that he is, in fact, completely insane when, knowing full well that there is only one possible answer to any question he might pose his strange visitor, he pulls up a “cushioned seat” in front of the bird and proceeds to question him.

So, with the vision firmly planted in your mind’s eye of a man completely out of touch with reality, seeking wisdom from a mysterious talking bird — knowing that there is only one response, no matter the question — Dear Reader, allow me to present to you a chart.

It is one I have used before, but its importance is enormous, and it will form the foundation of this week’s discussion (alongside a few others that break it down into its constituent parts).

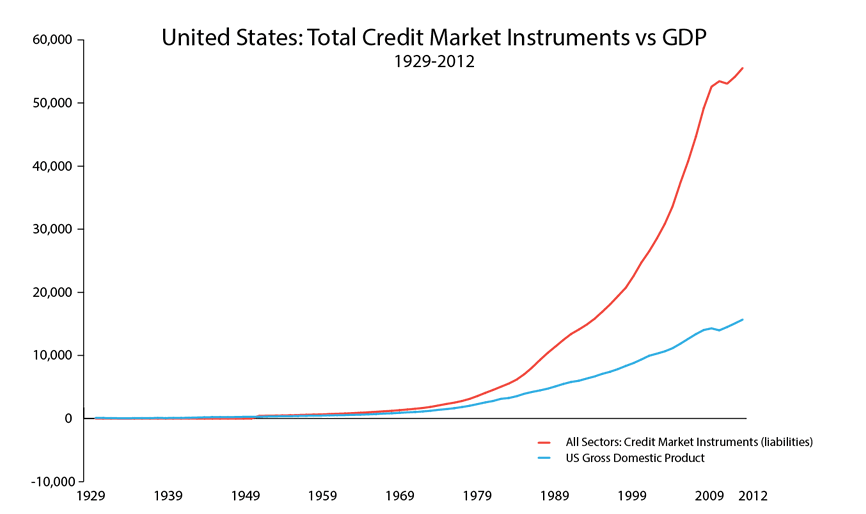

Ladies and gentlemen, I give you (drumroll please) total outstanding credit versus GDP in the United States from 1929 to 2012:

Source: St. Louis Fed

This one chart shows exactly WHY we are where we are, folks.

From the moment Richard Nixon toppled the US dollar from its golden foundation and ushered in the era of pure fiat money (oxymoron though that may be) on August 15, 1971, there has been a ubiquitous and dangerous synonym for “growth”: credit.

The world embarked upon a multi-decade credit-fueled binge and claimed the results as growth.

Fanciful.

Floated ever higher on a cushion of credit that has expanded exponentially, as you can see. (The expansion of true growth would have been largely linear — though one can only speculate as to the trajectory of that GDP line had so much credit NOT been extended.) The world has congratulated itself on its “outperformance,” when the truth is that bills have been run up relentlessly, with only the occasional hiccup along the way (each of which has manifested itself as a violent reaction to the over-extension of cheap money.

Along the way, the cost of that cheap money has drifted consistently lower from its peak in 1980 — and the falloff was needed in order that we be able to keep squeezing juice from an increasingly manky-looking lemon….

This is an excerpt from Things That Make You Go Hmmm… – a free weekly newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore – to see the rest of this article and how this relates to Excess Reserves and see the total capital and Assets of the Federal Reserve… please click here.

You might also like: