Driving Down Oil Prices Just to Hurt Russia is “Simplistic”

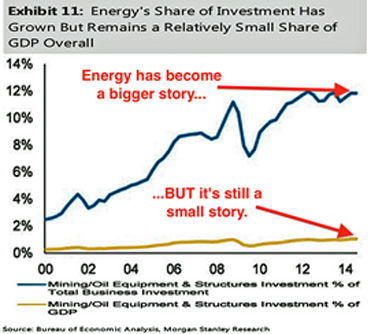

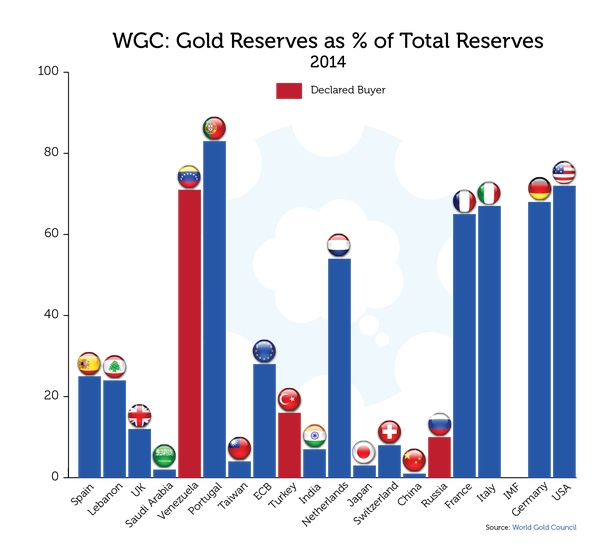

In the global chess game of energy politics every move affects more than a single opponent and the effects of low oil prices are not equally distributed. Some countries will be hurt by low prices more than others. Who will lower oil prices hurt more, Russia, Syria, Iran, Venezuela… the U.S. ? In today’s article, Andrew Topf of Oilprice.com looks at some of the background and cause and effect of lower energy prices.

Driving Down Oil Prices Just to Hurt Russia is “Simplistic” Read More »