There’s no doubt Europe’s financial markets for the summer of 2015 were all affected by the Greek ‘tragedy’. But as of this writing, it remains uncertain whether Greece will leave the Euro-zone or not. However, without aiming to downplay the magnitude of the recession on Greek shores, many experts agree that there’s a risk to overplay it. After all, we’re looking at country, which only ranks 13th among the 28 European economies in terms of size, and which only contributes 1.3% of the European Union GDP.

Whether Greece will have to return to the drachma is still uncertain and Greece’s Prime Minister Alexis Tsipras has announced that he is resigning after only being in office since January. Today we will look at some other trends making their mark on the current direction of Europe’s markets. Should you invest in the Eurozone, or should you bide your time? Let’s take a look at what various experts across the board are saying.

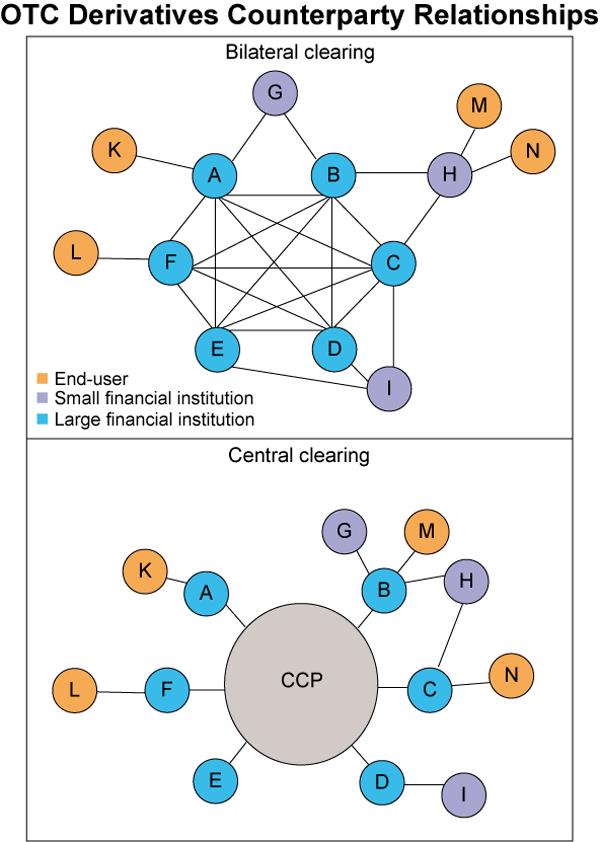

#1 OTC Financial Instruments Will Soon Have To Be Centrally Cleared

The European Union is considering new regulations regarding the clearing of over-the-counter (OTC) financial instruments like interest rate swaps. The EC has just recently approved this reform, which has since been submitted to the European Parliament for approval. According to finance industry analysis experts at Whistlebrook, these rules will come into effect twenty days after they are published in the Official Journal of the EU. Central clearing for transactions among lenders will likely come into effect from April 2016. These will include fixed-to-float interest rate swaps and basis swaps in all major currencies: GBP, EUR, USD, and JPY, Forward Rate Agreements in EUR, GBP, and USD, and Overnight Index Swaps in EUR, USD, and GBP. This, in turn, will necessarily affect the high- and low-risk debt markets, already weakened by the recent string of crises. For a better understanding of how central clearing will change the OTC derivatives trading process, check out the graph below.

Image source: RBA

Image source: RBA

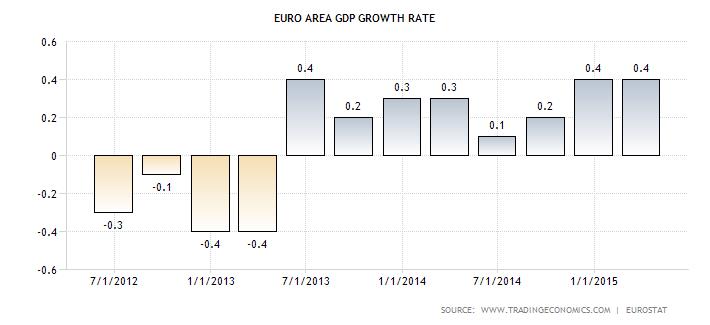

#2 Several EU Economies Are Doing Rather Well, Thank You Very Much

The insulars will be the first ones to let you know that their economy is looking peachy. In the United Kingdom, several indexes are pointing to a prosperous, evolving market in several sectors, with plenty of stability to boast. For one thing, May 2015 data confirmed the month as the 25th one in a row to see retail prices take a nose dive. According to the British Retail Consortium and Nielsen’s Shop Price Index, shop prices saw a 1.9% deflation that month, with food prices falling a further .9% for the third consecutive month. Wages are on a rise, while employment increased to a record-breaking 73.5% in March.

The situation looks just as rosy on the continent. In Germany, unemployment hasn’t been this low in several decades and employee purchase power is rising at the slow, but certain pace of wage increases. Finally, a weak Euro has prompted a surge in the rate of global exports from Ireland, Spain, and Germany. The end result: a Eurozone that’s definitely upping its pace of growth.

Image source: tradingeconomics.com

Image source: tradingeconomics.com

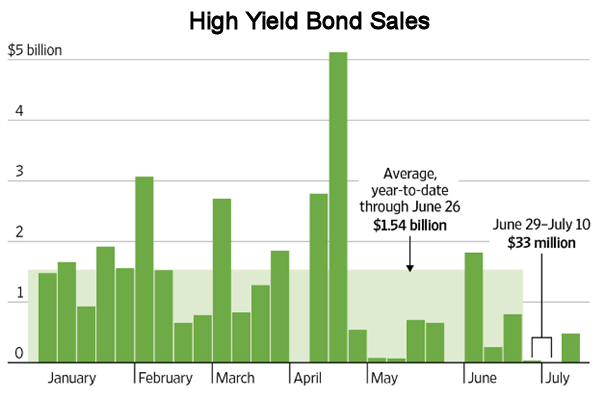

#3 Higher Risk Debt Is Finally Bouncing Back

In early July 2015, the high-yield debt market in Europe came to all but a screeching halt, as the Greek crisis intensified. Investors were weary of adding more risk to their portfolios and pricing debt issues became difficult. As the situation slowly improved throughout the month, demand for European cash bubbled just underneath the surface. And companies readied to meet it head on. According to Wall Street Journal reports, late July saw a genuine “deluge of new pitches from non-investment grade companies”. Among those cited stood Germany’s GFKL Financial Services AG, owned by Permira since June this year, Austria’s Uniqa Insurance Group AG, and Thames Water (UK utility company), Balta (flooring firm from Belgium).

Data provider Dealogic says only $33 million in high-yield non-financial corporate bonds were traded from June 29 to July 10. That’s a paltry sum, compared to the year-on-year weekly average of $1.54 billion up to June 26. A similar situation was recorded on the investment-grade bonds market, according to a BNP Paribas SA spokesperson. In mid-July, European companies only managed to make EUR9.5 billion, compared to the typical weekly EUR30 billion. The same source described the bounce-back determined by Greece’s eventual stabilization as a window of opportunity, bound to close in August. The traditional month of holiday-making is a time for lower trade volume levels.

What Does This All Mean For The Future Of European Markets?

A wider-angle look at Europe’s bond markets across all segments still has to factor in a fair degree of uncertainty, come the colder season of the year. However, there’s plenty of reason to believe that, regardless of Greece’s fate, the Euro zone can be deemed fairly stable. For one thing, Portugal, France, Italy, Ireland, and Spain have all relaxed their labor market policies, in order to stimulate job growth. The latter two countries in that enumeration, Ireland and Spain, have been showing tremendous growth, and Portugal is trailing their blaze. Business confidence across the Union is booming and, at a ratio of price/earnings marked 15x, European stocks remain affordable compared to historic levels.

Image source: CNN Money

Finally, perhaps a bigger reason for worry is the late-July market crash in China. Several expert voices on the investment scene rushed to warn against a potential slowdown in Europe’s recovery, since the Old World markets are very exposed to the goings-on in China. To put things in perspective, the daily trade volume between the two economies is valued at EUR1.1 billion. The graph above shows the proportion of sales in China for two major European brands—undoubtedly, the level of exposure is significant.

For the time being, though, there are plenty of routes to investing in Europe’s recovering market. Perhaps the soundest one is through one of the several affordable exchange-traded funds (ETFs). The IB Times recommends db x-trackers MSCI EMU Index UCITS ETF (coded as XD5S). Their management fee is a measly 0.25% per annum and they’re currency-hedged in pounds sterling, so not exposed to fluctuations of the Euro. And this is just one of the many options at your disposal!