Are Low Crude Oil Prices a “Boom Or A Curse” For The World Economy?

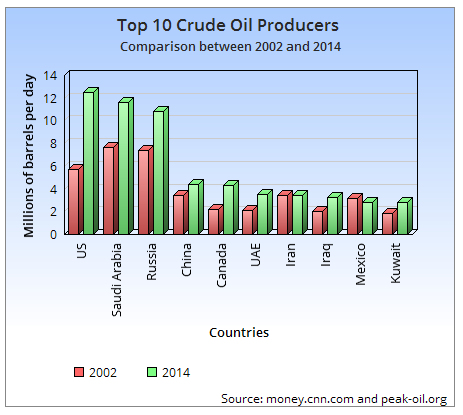

As the chart to the left shows, in the period from 2002 until 2014 the U.S. moved from 3rd place to 1st place in world crude oil production. This is primarily due to the improvement in “fracking” technology which has led to the massive increase in the production of shale oil. This does not sit […]

Are Low Crude Oil Prices a “Boom Or A Curse” For The World Economy? Read More »