Interest rates in the United States are rising, the stock market is falling, so investors are being very cautious and looking for a monetary safe haven. Does this mean it’s finally time to turn back to gold?

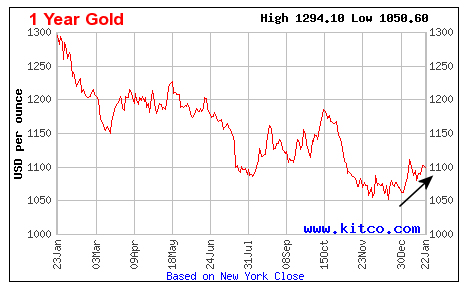

During most of 2015, the U.S. price of gold plummeted… beginning the year around $1300 and finishing near $1050 for an almost 20% loss. As the economy and construction in China slows, other commodities have also been hit by the current bear market conditions. But so far in 2016 gold has improved slightly to around $1100. So where is gold headed now?

U.S. Gold Prices Recently Hit Five-Year Lows

Historically, low interest rates have been good for Gold as there is no “opportunity cost” i.e. when interest rates are high gold earns you nothing so gold has to appreciate by at least as much as the interest rate just to break even. But when interest rates are low the lost interest involved in holding gold is minimal.

Historically, low interest rates have been good for Gold as there is no “opportunity cost” i.e. when interest rates are high gold earns you nothing so gold has to appreciate by at least as much as the interest rate just to break even. But when interest rates are low the lost interest involved in holding gold is minimal.

Generally the primary driver for the price of gold has been a fear of inflation and market fear in general, since gold is the only asset that is not simultaneously someone else’s liability. So if markets are crashing due to imploding debt, gold can be considered a “safe-haven”.

In 2006 the U.S. Federal Reserve set interest rates at 5% and over the next few years it lowered rates incrementally until in 2008 when then FED chairman Ben Bernanke entered uncharted territory, pushing interest rates nearly to zero. This low interest rate environment saw gold rise from $600 to over $1800 with a minor correction during the worst of the market crash in 2008. This 20% correction was significantly better than the 50+% correction that the overall stock market experienced. What caused gold to fall at all, was that some highly leveraged investors were forced to sell their gold to cover their debts in the stock and bond markets. With gold being the only safe haven and the economy faltering people scrambled to raise cash and sold jewelry, gold and silver coins and some people even went so far as to rush to places like CrownBuyers to sell their gold fillings. 🙂 All this selling combined with a lack of cash for potential buyers forced the price of gold down but not anywhere near as much as paper assets fell. But once the panic was over and liquidity returned to the market, gold resumed its upward trend.

The Stock Market and the FED

With global markets relatively stable over the last few years and inflation low, gold has lost some of its luster; however, this does not mean it will be ignored in 2016. After three straight years of decline, some analysts are projecting that investors will sit on the sidelines and waiting for gold to hit bottom while others think we may have already seen that bottom. It helps to note that the last three years correspond with a recovery in the American economy, and thus decreasing fear and uncertainty but currently market uncertainty is building once again.

Much of the stock market rise since 2008 has been due to the FED’s easy money policies, so recently when the new FED Chair Janet Yellen announced she would begin to raise interest rates again, the markets took a turn for the worse. It is important to note that investors were already jittery because of the situation in China, where the government is looking for economic solutions to help them fend off a downturn in economic growth.

Global Gold Considerations

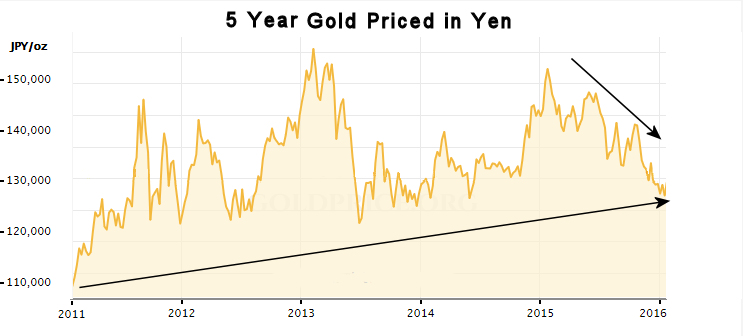

Another consideration in the price of gold is that it can be used like an alternative currency. By that I mean, since Gold is a world-wide commodity when the U.S. dollar is strong it tends to make gold priced in Dollars fall. In other words, as the Dollar gains strength it buys more gold (or oil, copper, etc). But that doesn’t necessarily mean that world wide prices of gold are falling. It just means that the dollar is rising. To get the true picture we need to also look at the price of gold in other currencies. Looking at Gold priced in Yen, we do not see the steady decline from July 2011 that we see in the Dollar price. Instead we see a peak in 2013 and another one in early 2015 which resulted in the Yen price of gold being actually higher than it was at the peak in 2011. So market psychology in Japan would not see gold falling continuously for the last five years, instead it would see prices slightly off their peak of last year.

Will Gold See a Major Spike This Year?

Will Gold See a Major Spike This Year?

A point of view shared by many technical analysts is that now that gold prices have approached $1,000 buying will begin to pick up from knowledgeable investors, with the crowd only joining in once the up move has gained momentum. Typically the time to buy is when the general sentiment is bad and gold is considered a “Barbarous relic”. Currently we may be approaching that point once again. I recently saw the following comment on an article about gold buying for investment purposes…

Isn’t buying Gold today just like buying a horse ?

It being a purely romantic move for an object with no current use.

Sure it looks pretty and it will still get you there, though slowly,

but why would anyone have it as their primary source of investment travel ?

Contrast that to the market sentiment just a few years ago as gold neared $1800, when everyone wanted to own gold since it was the best performing asset from 2001 through 2011. So with market sentiment so low it might be a good time to begin accumulating gold once again. Looking at the chart above we can see major resistance at the $1175 and $1200 levels so if gold breaks above those levels we could begin to see investment interest in gold reawakening.

Contrast that to the market sentiment just a few years ago as gold neared $1800, when everyone wanted to own gold since it was the best performing asset from 2001 through 2011. So with market sentiment so low it might be a good time to begin accumulating gold once again. Looking at the chart above we can see major resistance at the $1175 and $1200 levels so if gold breaks above those levels we could begin to see investment interest in gold reawakening.