Several factors determine the U.S. price of gold. Inflation, market uncertainty (i.e. worry), the value of the Dollar compared to other currencies (a falling dollar increases the gold price), supply and demand. Market supply can come from three sources: mining, scrap (people selling jewelry to raise cash), and Central banks selling reserves. Demand can come from industrial and commercial sources and investment demand (i.e. people hedging against uncertainty or expecting a rise in gold prices). Recently, overall market and political uncertainty in the world is rising while the Dollar is falling. ~ Tim McMahon, editor

Optimistic Future for Gold

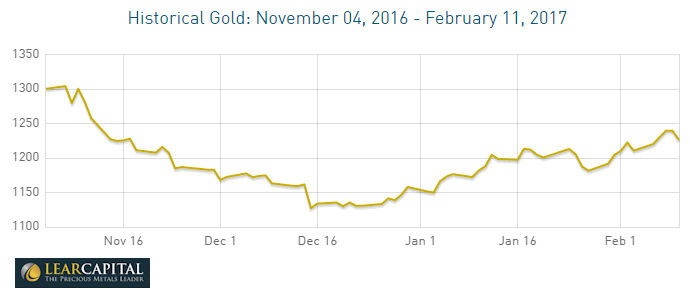

Gold prices were quite positive as markets closed on the final days of January. From an intra-day low of $1122.81 on December 15th, by January 30th, gold prices had risen to $1,191.98 per ounce; about $69 (or just over 6%) in 6 weeks. (Learn how to check current gold prices for the most recent estimates).

The rise of gold prices is largely attributed to the newly elected Trump administration in the U.S. The surprising upset win by Trump was predicted to plunge the markets into chaos. However, following a rather presidential speech by the notoriously vocally combative President Elect, the markets largely stabilized. However, as the Trump administration begins to draft anti-immigration policies and mouth off on trade deals like NAFTA, the markets are not so sure anymore.

On the evening of January 31, Trump adviser, Peter Navarro, made a statement suggesting that Germany is “taking advantage” of the United States and the European Union by a “grossly undervalued” Euro. President Trump has repeatedly said that countries like China are manipulating currencies to take advantage of the richest nation on earth. Following Navarro’s comments, Trump added fuel to the fire by legitimizing the claims against the Euro. As a result, the first day of February began with gold prices rising by 1.7 percent, to $1,212 per ounce. Gold prices are currently consolidating just below $1,240 per ounce (another 2.3% increase since February 1).

India Concerns

While Trump is fanning the flames that make gold prices go higher, India is throwing cold water on it. Since India’s Prime Minister Narendra Modi instituted a ban of certain rupee bills claiming to battle corruption, the country has been embroiled in a cash crisis. Poorer Indians who mainly transact in cash are severely affected. Initially this resulted in Indians severely restricting their gold purchases. According to the World Gold Council demand for gold fell by 28% in Q3-2016. The Indian government has also been pushing for Indians to buy local gold, which hurts international prices since India is one of the largest markets where people continue to buy gold and save in gold. Rural India accounts for 60% of gold consumption in India, and January saw an increase in gold demand from rural India but jewelry sales remained 30% lower than a year ago due to weak urban demand representing a potential for increase in gold demand should the Indian government remove their recently imposed tariffs .

Buying Gold

Gold specialists like Lear Capital are encouraging consumers to buy gold to hedge against potential currency losses in the future. If the Trump administration launches a trade war against a giant like China, it will certainly affect the dollar and the currency market. Rather than waiting for calamity, investors prefer to prepare for it. Many are buying gold as a hedge against political uncertainty, and potential Dollar weakness.