Latest Recession Alarm

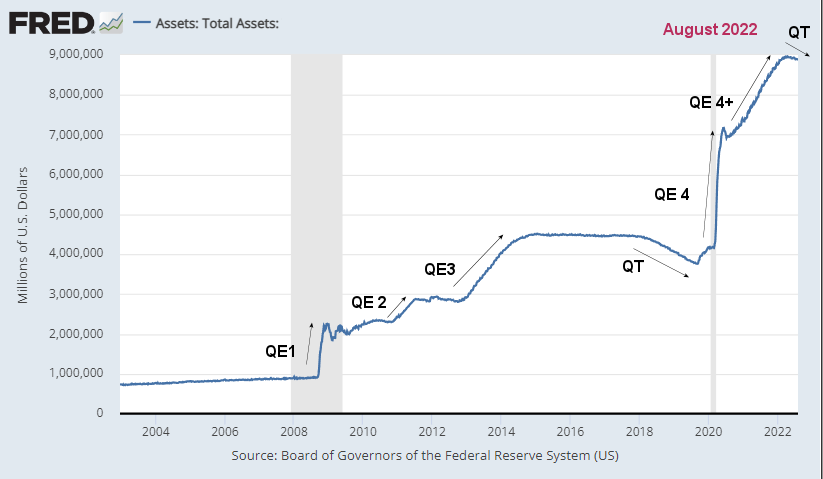

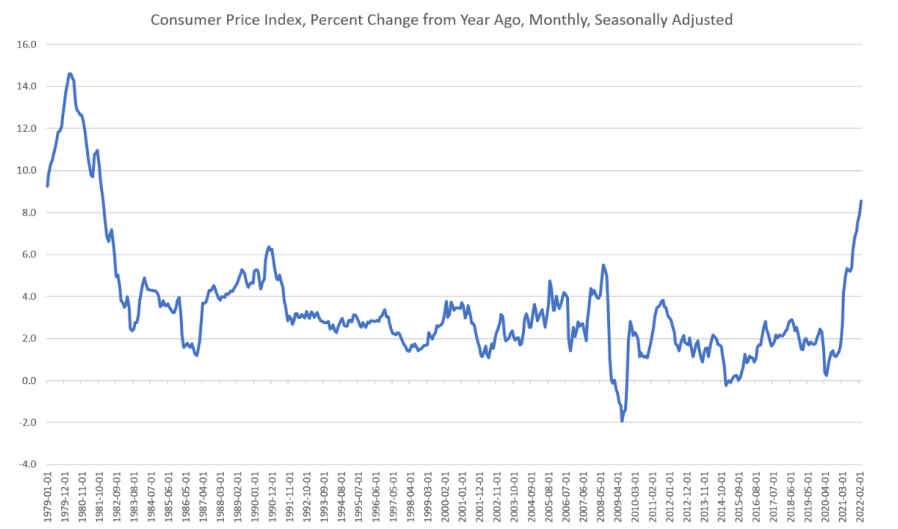

There’s a new Recession Alarm! Money Supply Growth can have a significant influence on the state of the economy. When the FED is pumping, and the money supply is growing, Woo Hoo, it’s happy days, but when the flow dries up, the economy goes into a tailspin. As we have repeatedly implied, via the FED’s massive Quantitative Easing, the money supply has grown exponentially over the last decade.

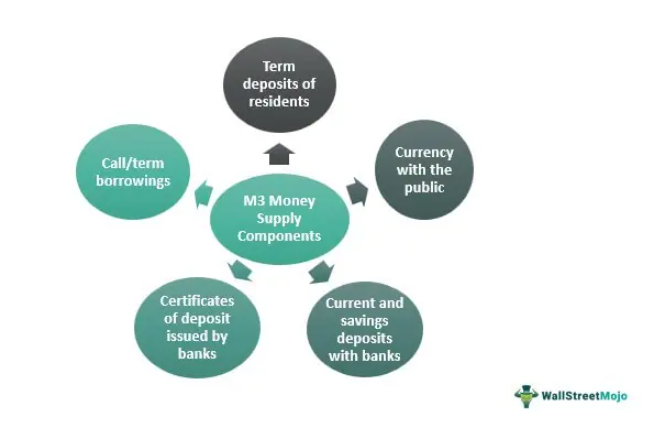

But today, let’s look at the M3 money supply itself. The M3 money supply is a broad measure of money, including M2 plus much more. It is an indirectly derived measure of the supply of money which includes currency in circulation, checking and savings deposits, certificates of deposit, term deposits, call/term borrowings from ‘non-depository’ corporations by the banking system, and ‘Other’ deposits with the central bank.

Latest Recession Alarm Read More »