How Can Oil Be Worth Less than Nothing?

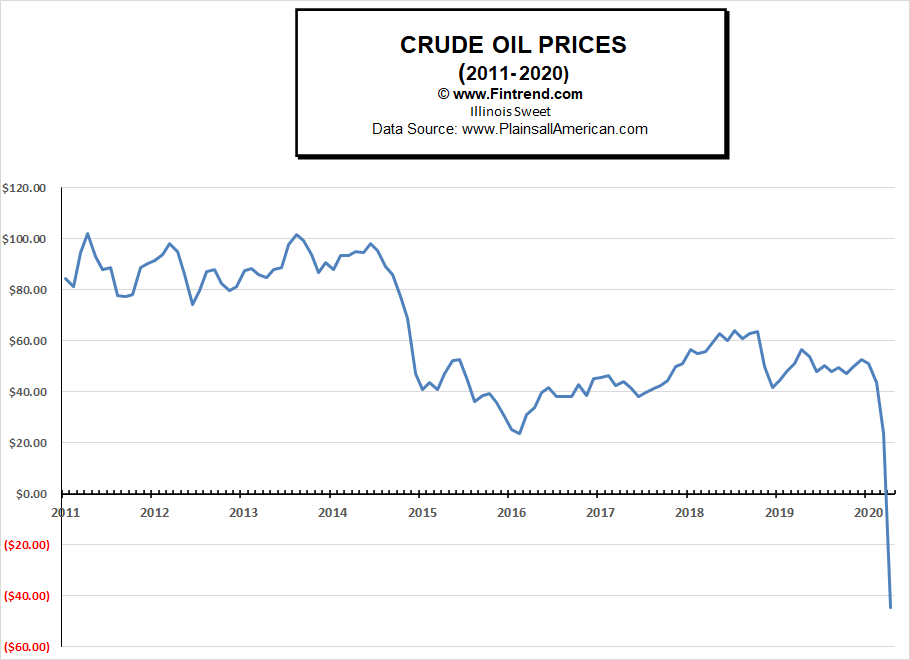

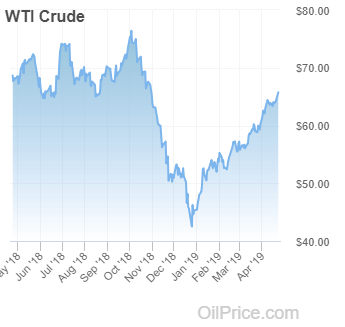

April 20th, 2020, is a day that will go down in history. Not because of wars or even because of the Coronavirus but simply because it was the first day ever where oil prices were negative. Yes, they were actually paying to try to give it away. Last month we said, that Saudi Arabia’s Oil Price War Is Backfiring. They picked a very bad time to boost production in order to drive prices down just as the Coronavirus stalled the world economy and drove demand to historic lows. It appears that Monday’s price fall is the culmination of that disastrous decision.

How Can Oil Be Worth Less than Nothing? Read More »