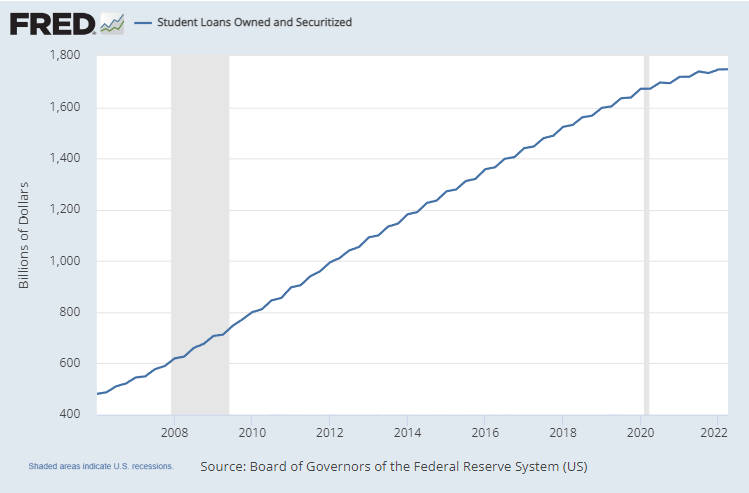

For years we’ve been tracking college costs and adjusting them for inflation. See Education and Tuition Inflation for more information. During that time, I’ve repeatedly said that one of the primary drivers of increased education costs was the ease of getting a loan. Unfortunately, the vast majority of college freshmen see a loan as “free money” and don’t seem to understand the difference between a “Loan” and a “Grant”. And apparently, this past week, many college loans effectively became grants.

Looking at it from a different perspective, we might wonder what lessons former college students will learn from this largess. Will they determine that debt is good? Or perhaps, they will surmise that no matter how stupid their decisions are, the government will always bail them out. Today’s article comes from the halls of Academia but doesn’t praise the government’s philanthropy as you might expect. ~Tim McMahon, editor

Biden’s College Loan Forgiveness Program Will Raise College Costs

When I interviewed for a teaching job at private college in Alabama more than twenty years ago, the recently elected governor had won partly on a platform in which the state would install a lottery system that would give students a $3,000 grant for college. As the provost and I discussed the prospects of this new program, he smiled and said, “We hope this lottery passes. Then we can raise tuition by $3,000.”