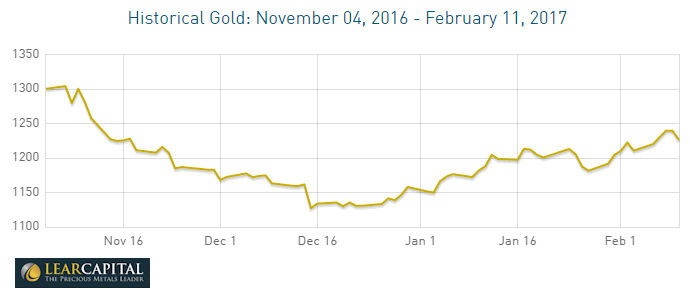

Gold Prices Inching Higher

Several factors determine the U.S. price of gold. Inflation, market uncertainty (i.e. worry), the value of the Dollar compared to other currencies (a falling dollar increases the gold price), supply and demand. Market supply can come from three sources: mining, scrap (people selling jewelry to raise cash), and Central banks selling reserves. Demand can come from industrial and commercial sources and investment demand (i.e. people hedging against uncertainty or expecting a rise in gold prices). Recently, overall market and political uncertainty in the world is rising while the Dollar is falling.

Gold Prices Inching Higher Read More »