The Death Of U.S. Shale Has Been Greatly Exaggerated

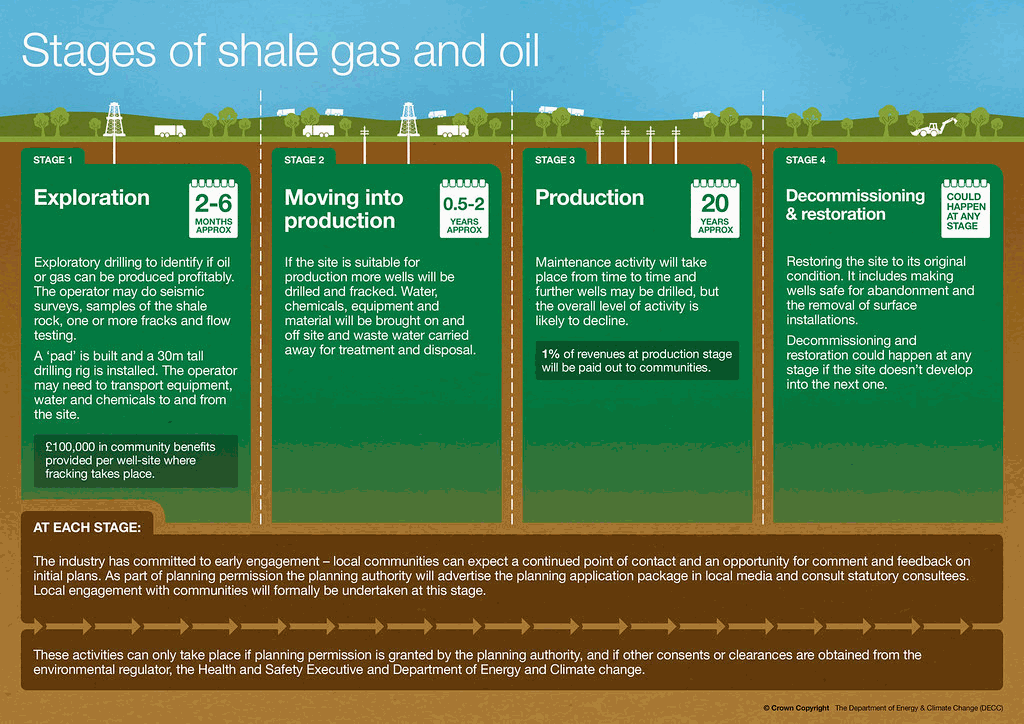

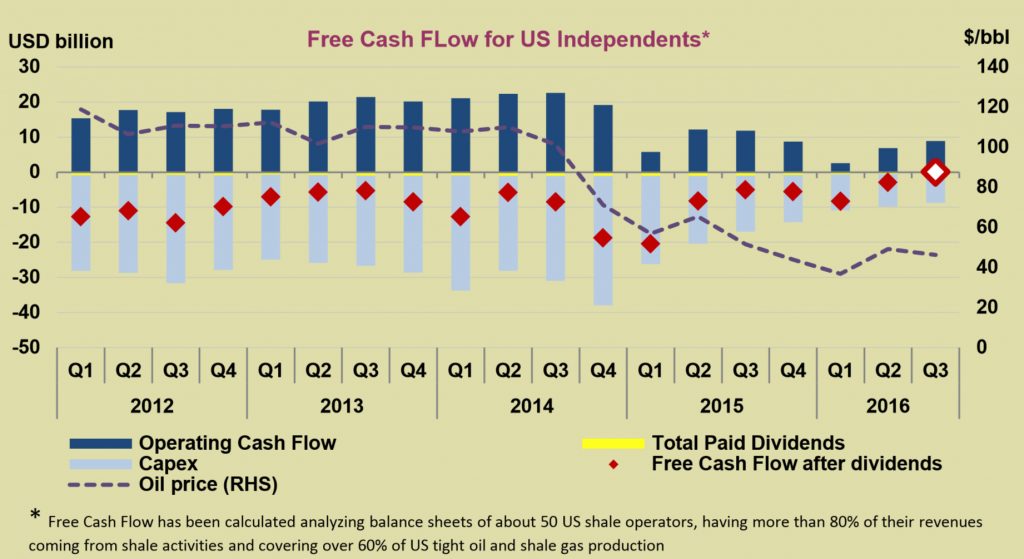

The current year marks the 15th anniversary of the U.S. shale boom, a period in which fracking technology across such states as Texas, Colorado, New Mexico, North Dakota, and Wyoming helped establish the nation as a top oil and gas producer. Unfortunately, high costs of production compared with conventional drilling has led to the sector consistently printing red ink and resulted in considerable destruction of shareholder value. The Covid-19 pandemic and subsequent oil price crash has led to investors souring on the industry further, credit becoming harder to come by, and a cross-section of Wall Street calling the end to the sector.

The Death Of U.S. Shale Has Been Greatly Exaggerated Read More »