Featured Charts

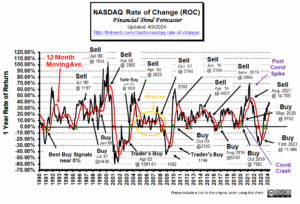

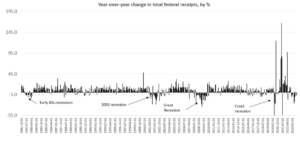

NASDAQ Rate of Change (ROC)©

By Tim McMahon Updated April 9, 2024 Current Analysis: Hold Signal! The NASDAQ peaked at 16,212 on November 22, 2021, three months after the NASDAQ ROC generated a “sell signal” in August of 2021. By October 13th,2022 it was down to a low of 10,088. Following our sell signal you would have avoided a 37.7% […]

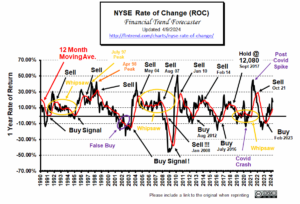

NYSE Rate of Change (ROC)®

What is the NYSE Rate of Change (ROC)®? The NYSE Rate of Change (ROC) chart helps quickly get the “big picture” of the stock market. The old saying “a picture is worth a thousand words” is very applicable to this chart. Once you understand how to read the ROC chart, you can easily spot the […]

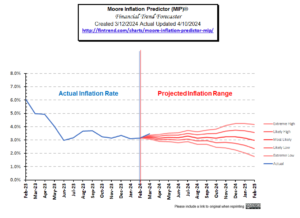

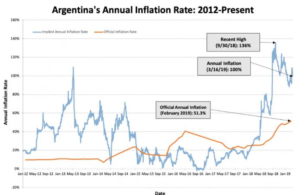

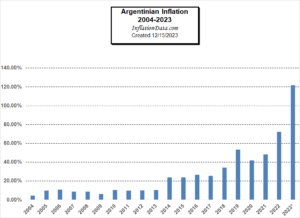

Inflation Forecast: Moore Inflation Predictor (MIP) ©

Forecasting Inflation: Using the Moore Inflation Predictor© By Tim McMahon, editor The Moore Inflation Predictor© (MIP) is a highly accurate graphical representation designed to forecast the inflation rate. By watching the turning points, we can profit from inflation hedges (like Gold, Real Estate, and Energy Producers) when the inflation rate is trending up and from […]