The current financial sanctions against Russia are totally unprecedented. Although sanctions have been used against terrorists they have never been used like this against a Sovereign state. The U.S. and its allies have unleashed all sorts of economic sanctions against Russia as we talked about in our article Economic Warfare Deployed Against Russia. But there is a downside to all these sanctions not only against the Russian nation but also against key players within the country. If the U.S. can sanction foreign individuals what could they do to Citizens if they wanted to?

Although mostly symbolic, Russia has retaliated by placing sanctions against several Americans, including Joe and Hunter Biden, Hillary Clinton, Secretary of State Antony Blinken, Secretary of Defense Lloyd Austin as well as the Chairman of the Joint Chiefs of Staff Gen. Mark Milley. Russia’s foreign ministry also announced sanctions against 313 Canadians including Trudeau. Russia’s move prevents those named from entering Russia and freezes any assets the individuals have there, according to the BBC.

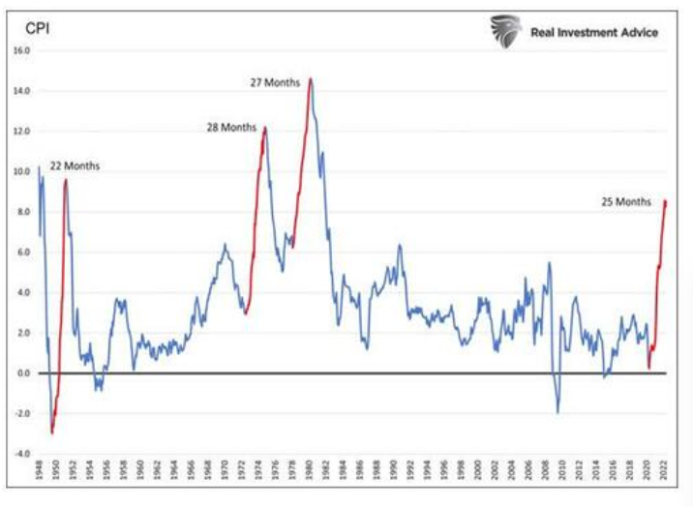

In addition to putting a massive (but temporary) hurt on Russia, sanctions will also negatively affect many Western Countries, although it won’t be too long before Asian and Middle Eastern countries take up the slack in Russian trade. In today’s article Brendan Brown looks at some of the possible long-term ramifications of these sanctions.~ Tim McMahon, edito