Penny stocks are higher-risk securities with a share price under $5.00, and often under $1.00, usually traded outside of the leading stock exchanges like the New York Stock Exchange and the NASDAQ. For most of these stocks, you have to trade them on an over-the-counter bulletin board (OTCBB), and as a result, they usually have a much lower level of liquidity than the more popular blue-chip stocks.

Even so, many traders seek out penny stocks in an attempt to turn a small investment into a large gain. With just a few hundred dollars, you can buy tens of thousands of shares, and if that company manages to hit the big time, then you could be spending the rest of your days in the Bahamas sipping Mai Tais.

However, most people never make it that far as they continually make the same errors time and time again, both newbie traders and veterans alike. If that sounds like you, we have collected three of the most common mistakes to avoid when trading penny stocks so you can stand a better chance at turning a handsome profit.

Thinking Cheaper is Better

The most common reason why people trade penny stocks is because of their low prices. They tend to like the idea of getting hundreds of shares for each dollar then invest, knowing that if the stock shoots up in price they stand to make huge gains. While that is technically true, it neglects the fundamental function of trading.

For starters, the price of a stock doesn’t really matter. It doesn’t make a difference if you buy thousands of shares of cheap stock or a few shares of a more expensive stock. That’s because when you invest in a stock, the percentage increase (or decrease) in the share price is the only thing that affects your gains (or losses).

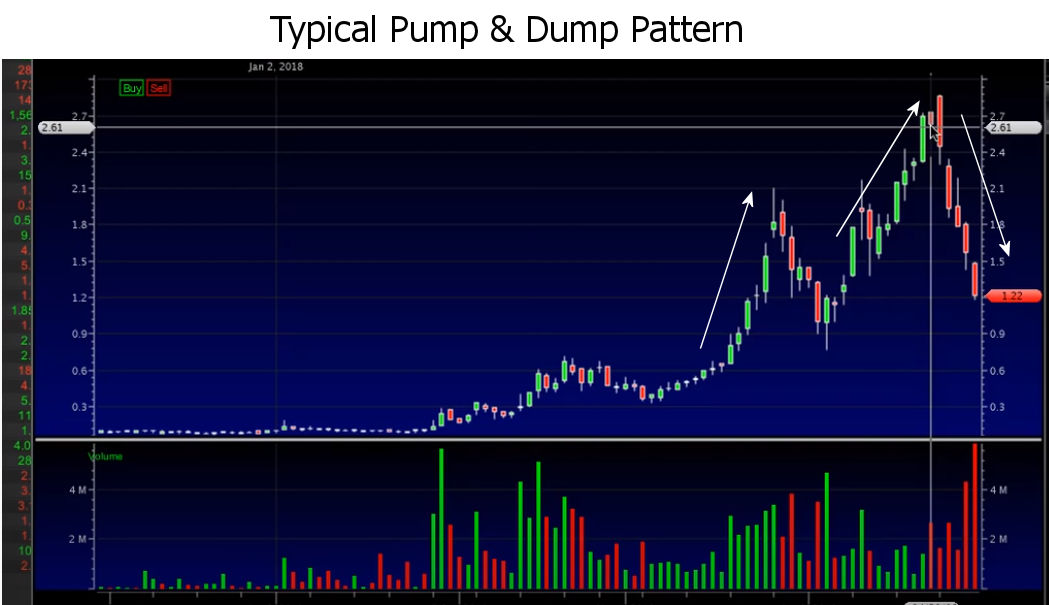

With that said, the main reason why penny stocks have a greater potential to make you huge profits is that they have a low market capitalization. Market capitalization is the total value of the company (or stock price times # of Shares). A small market “cap” opens the possibility of unscrupulous manipulators to “Pump & Dump”. They may issue press releases or mass mailings touting the wonders of a particular stock and once the price increases they will sell their shares often doing this multiple times for the same stock. As we can see in the chart below the stock was pumped and the promoters started selling driving the stock down again. Then they pumped it up again and sold more. In this scenario, the promoters win and the “suckers” who bought the stock at ever-higher prices lose.

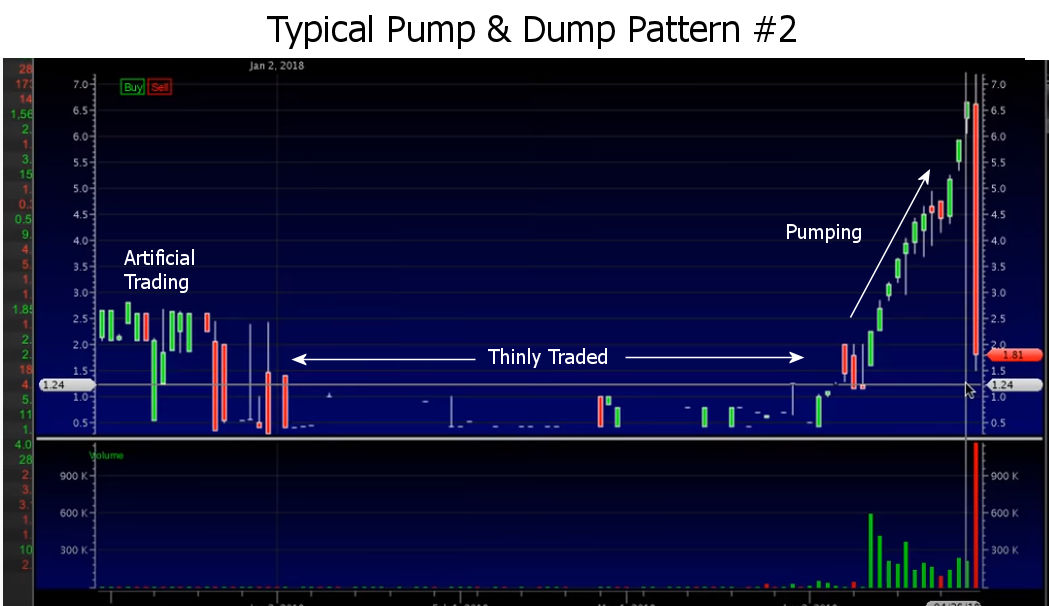

In the following chart, we see the early stages of pumping. If you look at the trading volume (bottom half of the chart) you will see that during the “artificial trading” period the volume was virtually non-existent, so initially, a few traders are buying and selling the stock among themselves (artificially setting the price), then there is little trading until they start touting the stock which drives up the price. When it is high enough the insiders dump their shares and eventually, the stock becomes virtually worthless again.

Not Accounting for Low Liquidity

Market liquidity refers to how easily stocks can be bought and sold. It’s the amount of cash that successfully moves in and out of the stock. The more volume traded on one particular asset, the more liquid it is.

One of the overriding issues with penny stocks is their lack of liquidity, as this creates two main problems. If you buy a large quantity of a penny stock with low liquidity, firstly, there is a very good chance you won’t be able to buy it at the offer price. For instance, suppose you want to buy 10,000 shares of a penny stock offered at $1.00. Often, you may find 100 or even 1,000 shares at the offer price of $1.00 then another 100 or 1,000 at $1.05, and some at $1.10, etc. So in order to buy your 10,000 shares, you may end up having to buy several lots at varying prices.

Then when it comes time to sell it, you will again be forced to sell in smaller lots at lower and lower prices. That’s because you won’t be able to find a buyer easily, and you may have to continue lowering the price until you find a buyer who finds it attractive.

Secondly, and somewhat more importantly, assets with low liquidity are prone to price manipulation. This usually involves a group of traders who buy large quantities of stock, hype it up, and wait for other people to buy it. Then they unload all of their shares for a tidy profit, leaving the unsuspecting traders high and dry.

To avoid this, always tread carefully when trading low liquidity stocks.

Not Accounting for Large Bid/Ask Spreads

Thinly traded stocks with low liquidity usually have huge bid/ask spreads that make it very difficult to make a profit when trading. Unfortunately, many newbie traders fail to see this, and they end up purchasing a stock that would make them a very significant loss if they tried to close their trade immediately.

For example, imagine a stock has a bid of 25 cents and an asking price of 35 cents. While this may not seem like much, the bid/ask spread is 10 cents. Thus if you bought at ask and immediately sold at the bid you would lose 33% of your investment (plus commissions). On the other hand, you could find a blue-chip stock at a bid of $100.25 and an ask of $100.35 so the spread is a fraction of a percent.

In many ways, the bid/ask is a hidden cost that many traders forget to account for, and it eats into their bottom line if they continue to make the same mistake.

Trading can revolve around fine margins, and if you open each trade at a -30% disadvantage, it’s going to be difficult for you to remain profitable.

Forgetting That There is a Reason They Are Cheap

Penny stocks are cheap for a reason. They are usually unknown with perhaps untested products/technologies or perhaps biotech stocks that have yet to obtain FDA approvals. At each successive hurdle, the price surges only to gradually decline as the next hurdle approaches. If any hurdle is failed the stock plunges back to obscurity. Other prime candidates are mining stocks on the verge of the next big discovery until none is found, or management stumbles.

Many penny stocks lack transparency, there is little or no verifiable information available and they could be nothing more than the brainchild of another Bernie Madoff. On the other hand, every successful company started out small. But for every penny stock that makes it into the big time, there are thousands that fail.

Business Insider provides the following advice when investing in penny stocks:

How to invest in penny stocks

If you’re still game to play penny stocks, bear these thoughts in mind:

- Only buy the best. Look for very high-quality companies with rock-solid balance sheets. Make sure you can find up-to-date financials or analyst reports so you can make well-informed decisions.

- Avoid “dark markets.” Companies trading on large exchanges, like the NYSE and Nasdaq, have to follow strict regulations to be listed, as do those on the OTC Bulletin Board and the OTC Link LLC. But avoid other over-the-counter exchanges, like the OTC-QX, the OTC-QB, and the Pink OTC Markets. They’re commonly called “dark markets” because their lack of listing requirements attracts less legitimate companies that have a higher risk of fraud.

- Use established stock brokers. Make sure any broker that you use follows the SEC’s rules. They should be willing to provide you with written research about the investments they’re promoting.

- Do your own research. The way to avoid scams is to research companies thoroughly. Don’t trust unsolicited emails, chatrooms, or cold calls. Instead, contact your state securities regulator or the SEC to get accurate information about a company you’re interested in. [Editor’s note: Fake “financial newsletters” touting penny stocks will generally include fine print somewhere saying something to the effect that they have received financial compensation for touting this stock… perhaps in the form of shares. Do not invest in these shares under any circumstances unless you enjoy throwing your money away.~ Tim McMahon, editor]

- Only invest what you can afford to lose. Don’t put all your (nest) eggs in the penny stock basket. It can be a good play with your “fun money,” but this isn’t the place to invest your retirement savings.

Final word

The allure of trading penny stocks is simple to see. The price is low; the potential rewards are high. What’s not to love, right? Well, despite their potential for hitting the big time, there are plenty of ways you can make mistakes and hurt your profit margins.

With that in mind, make sure you always approach each trade with a system and strategy in mind, remembering the three common mistakes we mentioned in this guide. If you do, who knows, maybe you will make it to that beach with your Mai Tais after all.

You might also like: