Global Debt Levels Are a Ticking Time Bomb

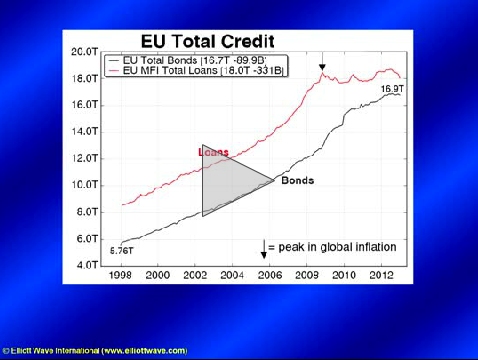

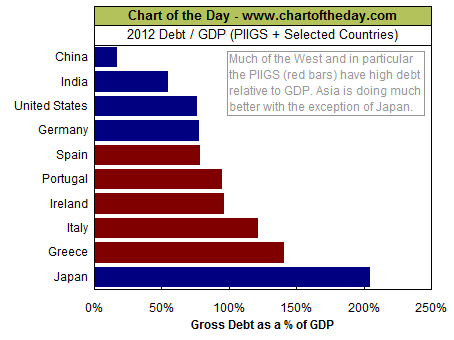

The relentless increase in global debt is an enormous problem for the economy. Public deficits are neither reserves for the private sector nor a tool for growth. Bloated public debt is a burden on the economy, making productivity stall, raising taxes, and crowding out financing for the private sector. With each passing year, the global debt figure climbs higher, the burdens grow heavier, and the risks loom larger. The world’s financial markets ignored the record-breaking increase in global debt levels to a staggering $313 trillion in 2023, which marked yet another worrying milestone.

Global Debt Levels Are a Ticking Time Bomb Read More »