John Maynard Keynes is credited with calling the gold standard a “barbarous relic,” back in 1923-24. But then again Keynes’ disciples, i.e., “economists” are fans of inflation because they believe it “promotes economic activity“. So of course Keynes would be opposed to any limits on government spending that might hamper the artificial creation of fiat currency.

Austrian economists, on the other hand, believe that in essence governments are untrustworthy and will always tend to destroy the value of their currency and need to have external controls placed on the quantity of currency available in order to maintain its function as a store of value.

Interestingly, that was the premise behind the creation of Bitcoin since by definition it is of limited supply and it becomes increasingly difficult to “mine”. Every so often based on an intrinsic formula it becomes twice as difficult to create (mine) more bitcoins. This is called “halving”. Based on the current rate of increase, the next halving event is estimated to occur toward the end of April 2024. If demand remains the same, as the rate of increase slows the existing Bitcoins become more valuable. This is exactly the opposite of what happens as the government prints more dollars. Because of its ease of portability, in recent years, bitcoin has tended to give gold “a run for its money” (pun not intended). But so far in 2024,

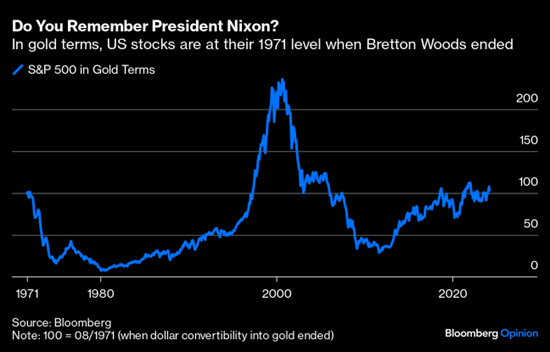

Gold has shown some resiliency as well. Recently, John Authers at Bloomberg published the following comparison of gold vs. the S&P 500. With all the hype around the magnificent gains in the stock market you might think that it has massively outperformed gold. But currently, one ounce of gold buys the same number of shares of the S&P 500 as in 1971 when Nixon severed the link between gold and the dollar. ~ Tim McMahon, editor

A Barbarous Relic

Richard Nixon ended the Bretton Woods agreement in 1971 and cut the dollar’s last tie to gold, creating a fascinating indicator. When the ratio of the S&P 500 to the gold price (effectively the amount of gold you’d need to buy the index) has been falling, as in the 1970s and 2000s, it means that the economy is in trouble. When rising gently, it suggests all is well, as in the 1980s and most of the 1990s. And when it goes berserk, as in 2000, stocks may be in an unsustainable bubble.

What’s fascinating is that after all we’ve lived through in the last half-century, the S&P 500 is worth almost exactly as much gold now as in 1971:

The ratio remains below its post-pandemic high. That’s an argument against a bubble; 2024 looks nothing like 2000 here. It also suggests that the market is comfortable with the past decade’s economic expansion, but concerned that it’s been bought with cheap money. Which seems exactly right.

From , John Authers at Bloomberg

You might also like:

- Comparing Keynesian and Austrian Economics

- Argentina Mulls Dollarization- What is it?

- America & Money: Cool Facts About the History of Our Monetary System

- Keynesians and Market Monetarists Didn’t See Inflation Coming

From InflationData:

- Another Way to Measure Inflation

- Stock Market vs. Gold

- Inflation-Adjusted Annual Average Gold Prices

- Does Inflation Increase Economic Output?

- What is Fiat Currency?

- Gold is a “Crisis Hedge” not an Inflation hedge

- Comparing Oil vs. Gold