Big Move Coming in Stocks

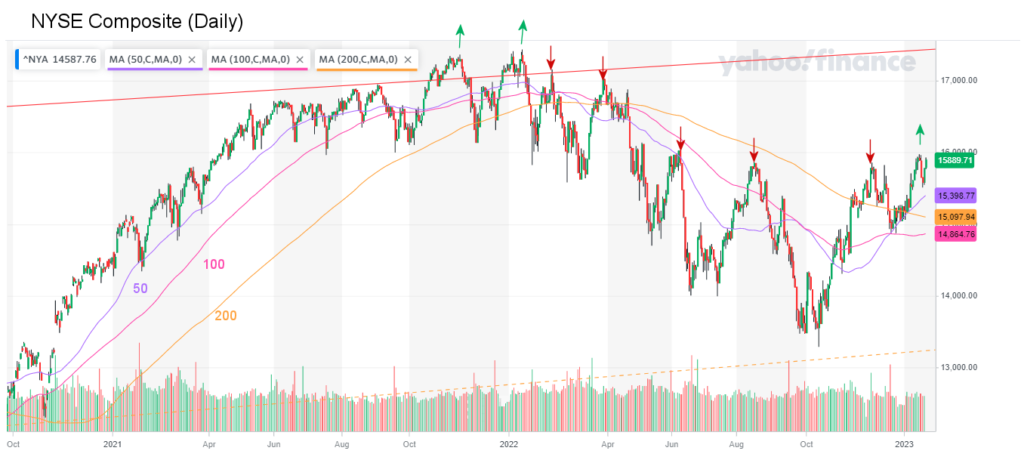

The stock market appears to be approaching an “inflection point.” Mr. Market is going to have to make up his mind… whether this is going to turn into a bullish or bearish market. At this point, it could still go either way, but the big caveat is that when it moves, the move will probably be dramatic. Looking at the following chart, we can see the two blue short-term support and resistance lines are forming a “pennant” formation. Generally, when that happens, it is like a spring being coiled up as the index gets compressed into the two lines. When it finally breaks free in one direction or the other, it is often explosive.

Big Move Coming in Stocks Read More »