The COVID-19 pandemic resulted in a surge in demand for online stock brokers. Stock markets worldwide were in freefall during the early stages of the pandemic, and many new investors recognized an opportunity to buy shares of beaten-up companies via online brokerage companies.

This was truly a global trend. While Robinhood dominated new account creations in the US and media headlines worldwide, other stockbrokers were competitive outside the USA.

For instance, Wealthsimple soared in popularity and beat out big banks to be crowned one of the best online stock brokers in Canada, while eToro dominated the European landscape.

In light of an exciting environment for online stock brokers in 2020, several are choosing to go “public” and issue stock themselves.

Back in 1975, the Securities and Exchange Commission (SEC) created new rules that abolished fixed commissions that had kept the cost of trading stock high making fortunes for brokers like Merrill Lynch. The new rules opened the gate for “Discount Brokers” like Charles Schwab to slash commissions from hundreds of dollars per trade down to $5 or $10.

Now, Robinhood is doing the same thing to the Discount Brokers that they did to “full-service” brokers. Robinhood was founded in 2013 with the mission of making investing even more accessible to everyone by offering zero-commission trading. At $5 or $10 per trade, a new investor that wants to start small and build a diversified portfolio out of $2,000 can lose 5% of their portfolio in buying fees alone. Add another 5% when the investor sells their stock and off the bat, the investor is down 10%.

So How Does Robinhood Make Money

If Robinhood doesn’t charge commissions how does it make money? One way is the same way that banks do. They invest any leftover money in your account that you haven’t “swept” into an investment. Like all brokerages, they also loan stocks to investors so that they can “short” them. (This will bite them as you will see in a minute). Another way they make money is by selling their “Robinhood Gold” program which is a suite of investing tools, giving you access to Morningstar research reports, NASDAQ Level II Market Data, bigger instant deposits, and margin investing. You pay a $5 monthly fee for the service. When you invest on margin, you’re borrowing funds from Robinhood Securities. If you use more than $1,000 of margin, you’ll pay 2.5% yearly interest on the settled margin amount you use above $1,000.

2020 Recap: Robinhood Dominates The US Spotlight

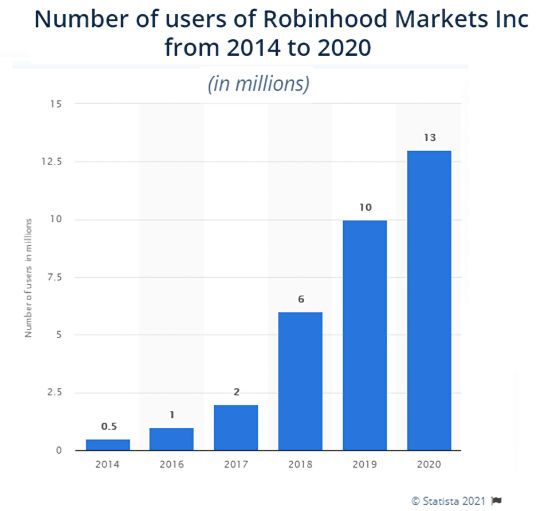

The massive coronavirus crash in early 2020 was the “perfect storm” for Robinhood. Stocks had become cheap again and people were stuck at home, wanting to make money and with nothing to do. And Millennials and young investors felt more comfortable with Robinhood’s easy-to-use social media “app-style” interface, so the platform took off.

Robinhood alone opened 2 million new accounts in the first quarter of 2020. For a non-bank online stockbroker, this number was massive. By comparison, Robinhood opened more accounts than Schwab, TD Ameritrade, and E*Trade combined. This helped Robinhood surge to a valuation of $11.2 billion by mid-2020.

Wealthsimple In Canada Saw Similar Trends

While Robinhood dominated in the US, Wealthsimple in Canada saw its own surge in demand. But unlike Robinhood, Wealthsimple rose to become one of the top online stock brokers by offering a new service known as robo advisors.

As the name implies, a robo advisor is merely a stock advisory platform that makes use of AI and other new-age technologies to offer personalized advice. At a time when new investors needed help in managing their assets during the market turmoil in 2020, Wealthsimple stood out from its rivals.

In fact, Wealthsimple added twice as many new users to its platform in March as it did in the same period in 2019. Wealthsimple CEO and Co-Founder Mike Katchen commented in an October 2020 press release:

“Our growth over the past six years shows how ready Canadians, and especially younger Canadians, are for a new model of financial services designed around their needs. But too many people still don’t have access to great financial products or are paying too much for them. There’s still so much room to grow, and to have investors of this caliber join us is an incredible vote of confidence in both our mission and our ability to deliver on it.”

EToro, Robinhood Will Go Public In 2021

One of the more notable events to take place in the online stock broker industry in recent memory is eToro inking a deal to become a public company. As part of a special purpose acquisition company (SPAC) deal, eToro will list its stock on a major US exchange as part of a plan that values the company at more than $10 billion.

Much like Robinhood and Wealthsimple, eToro targets new investors that want cheap access to trading with a social element. EToro’s massive valuation reinforces the importance and value that these online stock brokers bring to young people seeking to avoid high brokerage fees.

Robinhood suffered a bit of a setback as it was at the center of a controversy in 2021 when it banned trading shares of GameStop stock amid the Reddit-fueled short squeeze. The company issued the following statement, “In light of recent volatility, we are restricting transactions for certain securities to position closing only, including $AMC, $BB, $BBBY, $EXPR, $GME, $KOSS, $NAKD and $NOK. We also raised margin requirements for certain securities.” This hasn’t stopped Robinhood from eyeing its own initial public offering (IPO) as it continues to work hard to repair a bruised reputation.

One way that Robinhood is hoping to move past its controversial GameStop decision is by offering its investors access to purchase its stock before it hits the public market. Traditionally, in an IPO the company teams up with investment bankers who pitch the stock to hedge funds, ultra-wealthy investors, and other entities with deep pockets. Instead, Robinhood’s own clients will have access to buy in on the hot IPO before it goes public.

Conclusion:

2020 was a big year for the online stock broker industry and 2021 may be an even bigger year. The initial public offerings of eToro and Robinhood will leave both companies flush with plenty of capital to capitalize on that growth.

And the only competitors that will be able to outdo eToro and Robinhood will be those that are even more tech and social-focused and offer similar zero-commission fee structures. This is great news for investors of all shapes and sizes that want to work with an online stock broker that speaks directly to their needs.

You might also like: