Why Governments Villainize Assets That Protect Against Inflation

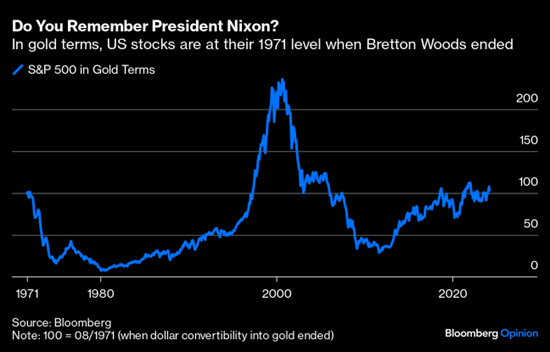

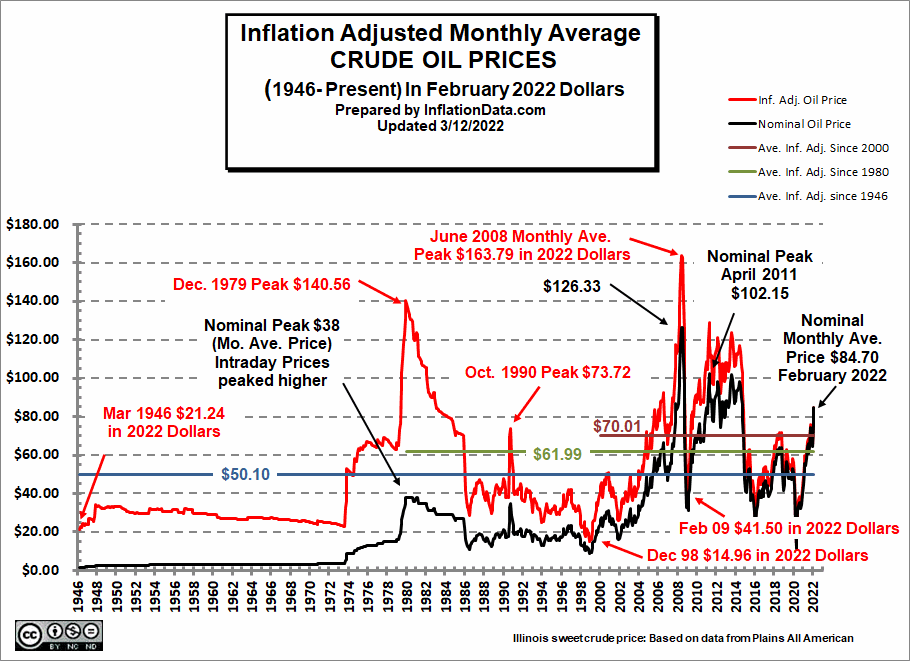

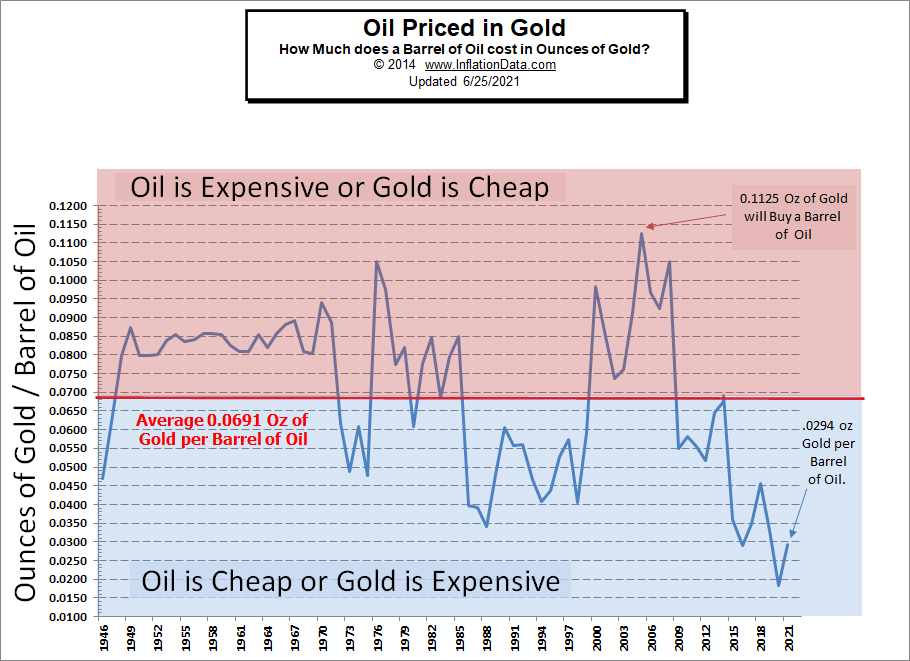

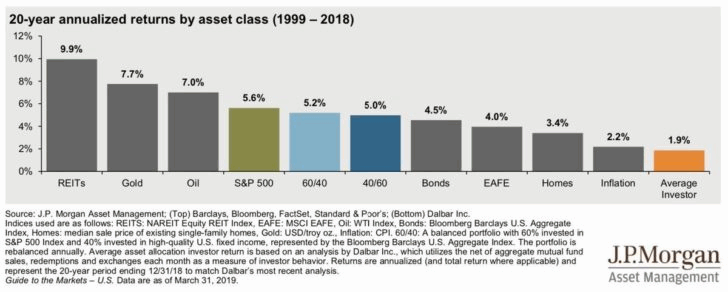

For years, in an effort to drive down prices, gold was attacked as a “barbarous relic” that paid no interest. But it was the only financial asset that wasn’t simultaneously another person’s liability. When an asset is also a liability it’s always possible that the liable party will be unable (or unwilling) to make good on that liability. In that case, the asset becomes worthless. But if you hold physical gold it will always be worth something. The price may fluctuate wildly, but it will never be worth zero. Being a commodity with many real-world uses (in addition to just jewelry), gold also tends to maintain its value during both times of inflation and deflation, plus gold tends to appreciate faster than inflation in times of crisis.

For years it seemed that governments around the world wanted to discourage their citizens from owning gold (while simultaneously hoarding it for their own treasuries). One reason for this seemingly duplicitous behavior is that without an alternative, citizens are forced to spend (and save) using the government-sanctioned currency. If you have the alternative of opting out of depreciating currencies most logical people will do so, once the benefits outweigh the costs.

Another reason governments dislike alternatives to the official currency is that alternatives reveal the true value of the government currency. Governments with perpetually high inflation rates like Argentina often will publish dubious “official” inflation rates in an effort to convince their populace that inflation isn’t as bad as their pocketbook tells them that it is. But with a non-shifting yardstick like gold, their lies become apparent. So they discourage gold ownership and thus leave people foolish enough to listen to their lies, defenseless to the ravages of inflation.

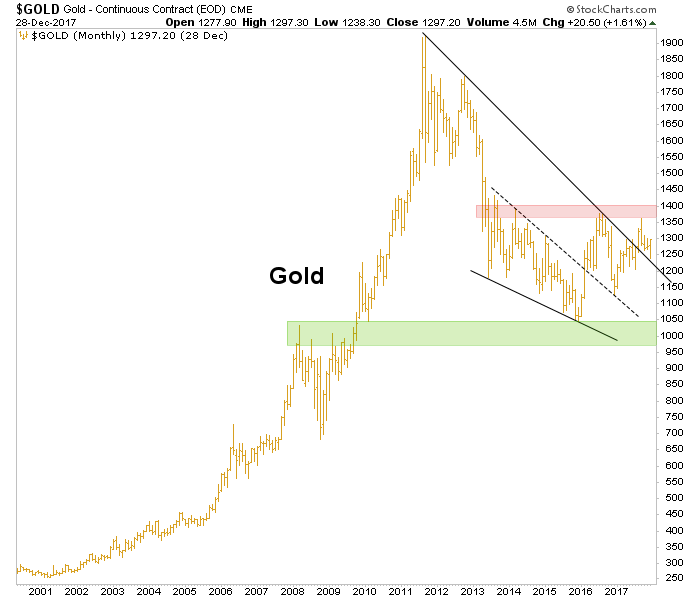

Now with the advent of cryptocurrencies governments have a new villain to demonize. It almost seems that gold has fallen out of favor and crypto has become the new gold. Millennials seem more likely to turn to modern alternatives like bitcoin rather than the antiquated (and time-tested) gold. And it is easy to see why. In recent years gold has remained relatively stable while crypto has skyrocketed.