There is an old stock market saying that says, “don’t fight the FED” and that turns out to be pretty good advice. The Federal Reserve Bank (FED) has been called the 800-pound gorilla of the market. But even that is probably understating the case. Apple and Microsoft can each reasonably be called an 800-pound gorilla, but if that is the case, the FED makes those gorillas combined look like ants in comparison.

The FED’s Dual Mandate

So when the FED acts, markets move. And for the last several decades, the FED has followed a “Dual Mandate” i.e. maximum employment combined with price stability. By this they mean low inflation and high employment. The St. Louis FED claims that “The Fed’s goals of maximum employment and price stability are generally complementary.” But that seems like a rather far-fetched claim because, in order to maximize employment, the FED generally pumps up the money supply which causes inflation. This obviously is the opposite of “price stability”. The St. Louis FED does admit that “In the late 1970s and early 1980s, for example, the economy experienced both high inflation and high unemployment (low employment). “ Basically, the FED’s “pump-priming” stopped working and no longer goosed the economy it just created more inflation. This was called stagflation and forced an either/or decision. The FED chose to fight inflation which resulted in two successive recessions. So, that is an obvious case where the FED action i.e. tightening, caused the market to crash and the economy to tank.

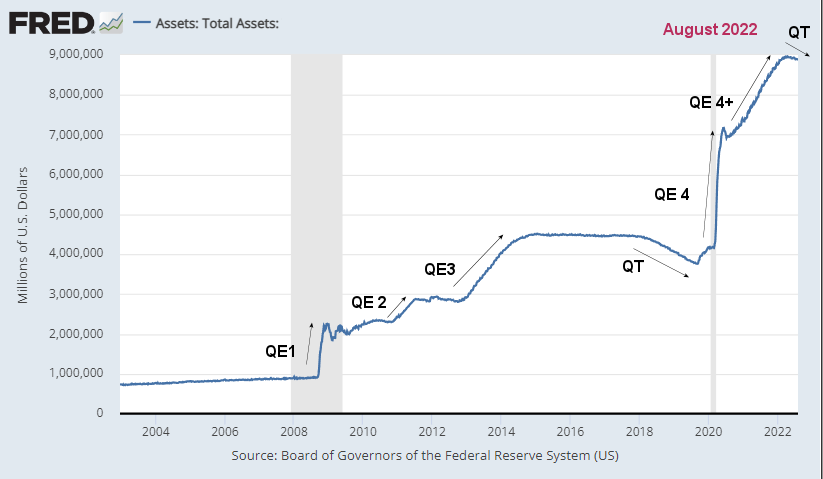

It is interesting to note that although the FED’s dual mandate involves employment and inflation but nowhere does it mention the stock market. But throughout most of this millennium, the FED has targeted the stock market as a proxy for its employment mandate. The FED bailed out the markets in 2008 and again (to a lesser extent) in 2018 when its tightening caused the stock market to swoon.

The FED’s Track Record

Recently analysts at Bank of America reported that the last seven consecutive bear markets — defined as a peak-to-trough decline of at least 20% — ended only after the Federal Reserve started cutting interest rates again. In other words, when the FED is creating liquidity, some of it inflates the stock market, and when it reduces liquidity (in an effort to fight inflation), the market deflates.

This makes perfect sense if you think about it. Excess liquidity has to go somewhere, and the logical place is “real assets” such as Real Estate and the stock market. Both have seen massive runups over the last decade as the FED has drastically increased liquidity.

Conversely, when money is tight and people need capital, they have to sell their stocks to get it, thus putting downward pressure on the market. So the takeaway here is that it is almost guaranteed that the market will continue to languish until the FED reverses course and reduces interest rates and/or starts quantitative easing again.