Why These Stock Market Indicators Should Grab Your Full Attention

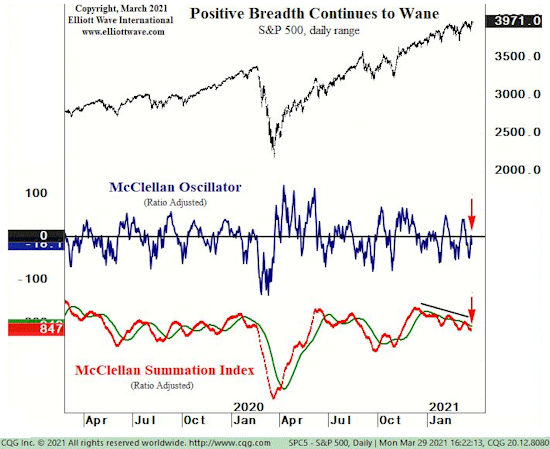

What is the McClellan Index and why should you care? According to Investopedia, “The McClellan Summation Index is a long-term version of the McClellan Oscillator, which is a market breadth indicator based on stock advances and declines. The McClellan Summation Index is used in technical analysis and can be used to identify bullish or bearish bias, as well as the strength of the trend. It is a different way of quantifying the movements in the market other than looking at the price levels of the different indices.”

Why These Stock Market Indicators Should Grab Your Full Attention Read More »