Company Bonds

Company bonds have been a hot topic in many financial publications including the Wall Street Journal lately, though you might not be familiar with the term. Allow me to offer a brief primer on the topic.

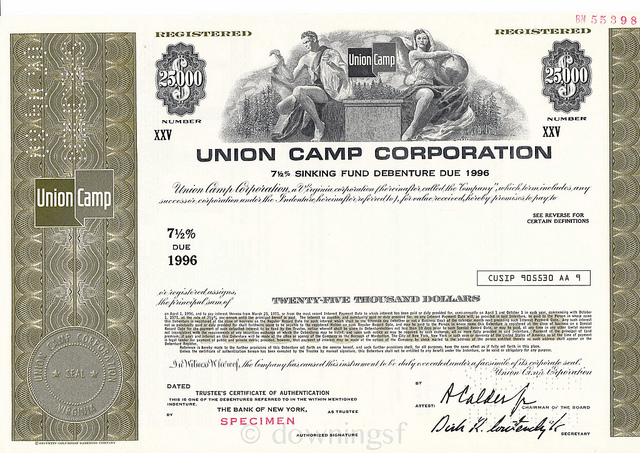

Company bonds (aka corporate bonds) are a type of debt security issued by companies to raise capital. A related form of debt is a “debenture.” Debentures are corporate bonds that are NOT secured by any assets or line of income. Companies of varying sizes and states of profitability will issue bonds as a means to generate funds for any number of reasons pertaining to long term growth and investment. For instance, investors might buy bonds from a start-up company with a solid business model but little capital so as to help grow the business. Company bonds are a critical source of funding for all companies from those in their infancy trying to finance projects, pay employees, or invest in long term plans for expansion, to well established corporations interested in updating a multimillion dollar plant or enter a new global market. Let’s take a closer look at the mechanics of company bonds and how they function within the greater financial market.

Basics: How a Company Bond Works

A company bond is essentially an IOU that a company issues to an investor. Bonds are issued at a “Par Value” aka. “Face Value”. Typically “Par Value” for a single company bond is $1,000. After the initial issue the bond can be sold from one investor to another at the “Market Value”. The market value is based on the interest rate the bond pays (called “coupon Rate”) and the risk rating of the issuing company. Market value will fluctuate based on how the coupon rate compares to the interest rate offerred by government bonds which are considered “low risk”.

The bond then “matures” to its par value with interest over a set amount of time over the course of some years. Interest payments will usually occur in biyearly installments. The coupon rate offered by the company at the initial bond offering will vary depending on a wide array of factors, but it will ultimately determine how much you can expect to get back every year. For example, a 5% coupon on a $1,000 par value company bond will pay $50 a year.

If interest rates fall in the overall market to say 4% the company can not change their interest payment because they are contractually obligated to the “Coupon Rate”. So to adjust for this the market raises the value of the bond. If the market value of the bond rises to $1250 (and the company is still paying $50/yr) the current yield on this company bond is now at 4% equivalent to the going market interest rate for a company with this particular risk profile. So as interest rates go down bond values go up. When they are selling above par value they are said to be trading at a “Premium”. If on the other hand market interest rates rise bonds will sell below par value called “selling at a discount”.

When a bond reaches its contratual end it is called “reaching maturity”. This can take anywhere from a single year to over twenty years, depending on the initial contractual terms of the bond. At maturity the company must pay the current bond holders the Par or Face Value of the Bond. Most companies set up a “Sinking Fund” to have the money to pay this obligation. A sinking fund is simply setting aside a portion of the value each year. So if it is a 20 year bond the company will set aside 1/20th of the total amount of the bond issue each year so in the 20th year they can repay the bondholders. Interestingly, if you bought the bond at a premium you will receive back less than you paid. This loss of principal over time is taken into consideration when calculating the bond’s “Yield to Maturity”.

Stocks vs. Bonds

It’s a common mistake to confuse company bonds with stocks issued by a company. But the two investments are entirely different. As I’ve explained, a corporate bond is essentially a debt that a company owes an investor; they have a set amount of time to return your principal investment and will do so with interest. Stocks, on the other hand, are bought by investors who want a share of the company’s ownership. Someone with stock in a company won’t necessarily be guaranteed any money from that company but stockholders do own a fraction of the company with their shares. Thus they are entitled to a share of the profits which in a well run company should be a higher percentage than they are paying bondholders. After all why would they borrow money unless they expected to be able to make more with it than what they are paying out? Profits can be returned to share holders via dividends or gains in the value of the shares. Somewhat paradoxically, a person with millions in corporate bonds will have less ownership over the company (none) than someone with a few stocks in the company.

Because company bonds are considered debt security (that is, a debt to be repaid to investors who bought the bonds), their repayment takes priority over anything given to stockholders. In the event of bankruptcy, payments are made in the following order: (1) Wages, (2) Taxes, (3) Secured Creditors (including Secured Bond holders), (4) General Creditors (including Debenture holders), (5) Subordinate Creditors (including Subordinated Debenture holders), (6) Preferred Stockholders and (7) Common Stockholders.

Company Bonds Still Have Some Risk

Though company bonds are designed to be paid back by the company, if the business goes bankrupt it may fail to repay them in full. Bonds from companies that are not on a secure financial footing are called, High risk bonds or “Junk Bonds” these pay higher rates of return but have a greater chance of default. The riskiness of a Bond is rated by companies like Standard & Poors and Moody’s.

Bonds come in all levels of riskiness from junk bonds to bonds of well established companies like IBM, and General Electric. The least risky bonds are considered to be government bonds because companies can’t just print money to repay their bonds. Cities also issue bonds called “Municipal Bonds” which may rely on taxes or income from specific programs to fund the repayment.

For more information see:

Have anything more to add?

Do you have anything that you’d like to add about company bonds? It’s a complex subject deserving of far more than a single post, but hopefully this gives some useful information to a reader who’s unfamiliar with the subject. Feel free to chime in in the comments below!

Author Bio:

This is a guest post by Nadia Jones who blogs about education, college, student, teacher, money saving, movie related topics. You can reach her at nadia.jones5 @ gmail.com.