By Bud Conrad, Casey Research

Though late to the party as usual, the proverbial man on the street – along with members of mainstream media and Wall Street heavyweights – is finally waking up to the decade-long, 700% increase in the price of gold, joining a growing buzz around the monetary metal. From questions whether gold is in a bubble to predictions that soaring prices are just around the corner, one thing is clear: a new phase of awareness for gold is upon us. How far might it move before these troubling times are over?

The Big-Picture Economic Environment

Kicking things off, I would like to explore several themes in order to put the current economic situation in context.

For example, continuing weakness in employment and housing indicates that the big slowdown that started in 2007 persists. Actually, the economy never exited the recession but rather – thanks to massive intervention – enjoyed a temporary reprieve that I have called the “Eye of the Storm.”

We experienced the first part of the storm from 2007 to 2009, but by late 2009 and into 2010 massive bailouts, stimulus, and deficit spending produced a false-dawn recovery. This recovery was most pronounced in the financial sector where the government transferred toxic private-sector debt – including large amounts held at Fannie and Freddie – onto the government’s own balance sheet.

We now are entering the second half of the storm, as it is becoming impossible to ignore the unprecedented and intractable sovereign debt problems sweeping the globe. These problems are especially obvious in the weak countries of Europe where punitive levels of interest rates are pushing weaker members of the eurozone to the brink. As the parts begin to fail, so will the whole.

And the US is not so far behind, with its own historic levels of government debt and deficits running at levels never seen before.

As we at Casey Research have warned of ahead of time, in their attempts to avert a 1929-style depression, governments took on the bubble in toxic private debt, stupidly transferring that burden onto the government (and taxpayers), causing the problem to morph into today’s sovereign debt crisis. Simply, with the government debt too big to ever be repaid, we are now beyond the point of no return.

The private debt problem is not resolved, either. That’s because much of the bad debt on the books of corporations and financial institutions was hidden through “Extend and Pretend” practices, starting with the elimination of mark-to-market accounting requirements. Much of this debt will eventually be revealed to be in default.

Worse, because sovereignties around the world have caused their finances to deteriorate to such extreme levels, they are now ill prepared, and maybe even unable, to step in yet again to soften the blow of private-debt deleveraging and write-downs. As a consequence, the next part of the storm could be prolonged as companies and banks are dragged down.

Furthermore, due to their poor decision-making to this point in the crisis, the governments themselves are now facing a loss of confidence in their sovereign debt, evidenced by soaring interest rates and the rising cost of credit default swaps (CDS) for the PIIGS.

There is no way to recapitalize the Greek debt, and Finland is right to demand collateral, which it recently has. The contagion will extend to the other PIIGs and to the stronger European countries of Germany and France – they can’t also bail out Spain and Italy, which are too big to fail, without destroying confidence in their own economies. Yet absent such a bailout, massive restructuring of weak-country debts held on the books of the banks in the stronger countries will further exacerbate and extend the crisis.

Meanwhile, the European Financial Stability Facility (EFSF) is too small, and the resources to cover all the countries in trouble just aren’t there. Economists now understand that the PIIGS are well past the point of no return with 130% or so of debt to GDP. The European Central Bank (ECB) will be expanded, like other central banks, to print more euros, but still the system is going to face more debt problems.

The ratio of debt to GDP in Europe, the US, and elsewhere (which is projected to only increase from here) will lead to the sort of problems historically associated with Latin American banana republics, collapsed communist states, and certain countries in Africa. While this is not being adequately discussed in the mainstream, the debt of the supposedly advanced countries is projected to explode beyond the levels that are already tormenting the PIIGS. Put another way, in the decade just ahead, I expect the advanced countries to undergo the same pain we are already seeing in the weak countries.

Supporting that contention, a new paper by the Bank for International Settlements (BIS) points out that when government debt approaches 80% to 100% of GDP, there is a weakening in the economy. Greece and the euro system aren’t just facing an economic weakening but a breakdown of the financial system.

Importantly, the debt-to-GDP ratio of the United States is now (conservatively) at 95%, and demands from a tidal wave of retiring baby boomers will make the deficits far worse. Remarkably, annual deficits of a trillion dollars or more over the coming decade are projected. The US debt-to-GDP ratio will break above 100% in two years or less, and debt could double in the next decade if interest rates rise in concert with a widespread loss of confidence in the government’s ability to manage its fiscal and monetary affairs.

The next logical step in this sovereign debt crisis is for us to see further signs of a loss of confidence in the currency. Such a currency crisis is usually measured by rising inflation that, in turn, leads to higher interest rates, which make the crisis worse. That’s because a vicious debt “death” cycle begins to form, with interest on the debt begetting ever-worsening deficits begetting ever higher interest rates that, in time, leave the country unable to even pay the interest on its debt, let alone pay down the debt itself.

Sounds dramatic, I know – but that is what is happening in Greece. The major difference from historical events of a similar nature is that this time, it is not just the smaller, less developed countries – the so-called banana republics – that are in the throes of a financial collapse but most of the world’s advanced economies. This is certain to end badly.

In the short term, the central banks will print up money for their governments and bankers, but in the long run, the loss of confidence will become so great that currencies self-destruct. As the problems extend around the globe, currencies and bond markets will be wiped out together.

In time, new currencies will have to be issued, almost certainly with some form of link to gold and other commodities. To survive what’s coming, you need to understand the process and try to gauge how fast it may unfold. To shed further light on those issues, in the following I provide data on how serious the situation is and conclude with my predictions for the price of gold.

Central Banks Can Print Paper, But They Can‘t Print Gold

Gold is the only real money. In contrast, the power of central bankers to create fiat money out of thin air has distorted our financial systems beyond anything imagined in the early days of slips of paper issued for gold held at the local goldsmith’s.

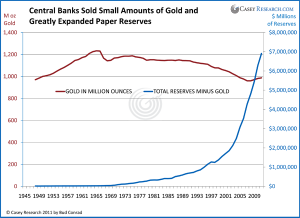

To get a sense of the distortion, we’ll start by looking at the difference between the quantity of gold held by central banks and the amount of paper money they have issued. As you can see in the chart below, the amount of gold held has been surprisingly stable. But the blue line, a close reflection of the narrow definition of money that has been created globally, shows that the quantity of all forms of financial assets has grown dramatically.

The clear point of this chart is that the nominal quantity of the paper money in circulation has been growing much faster than the gold that formerly underpinned that currency and may be called upon to do so again before this is over. Regardless, as the power of money creation greatly benefits the money printers, we expect profligate money spending and creation to continue apace.

Importantly, central banks are no longer selling off their gold but rather are increasing their holdings. You can see that shift in the small upturn in the red line at the right of the chart. Central banks halting gold sales and becoming net buyers of gold decreases supply and increases demand, leading to higher gold prices.

As a related anecdote, Venezuela’s President Chavez recently recalled gold reserves not currently held in Caracas, exciting the gold bulls with the thought that the withdrawal of some 150-200 tonnes of gold from the Bank of England and bullion banks will force a squeeze on traditional stockpiles of gold. Chavez is further proposing to nationalize Venezuela’s gold mines. His many faults aside, I think Chavez understands the situation perfectly and is using his dictatorial powers to move back towards gold faster than slower-moving nation-state competitors.