These days, when we hear about “debt” in the news media, it is often Greece’s debt that is the topic of discussion. According to the media it seems that Greece’s debe must be way out of proportion with the rest of the world. Many experts believe that no matter how much austerity is imposed Greece will never be able to repay it. And unfortunately with all the benefits they have granted themselves, things like retirement at 55 for government workers, repayment doesn’t seem likely.

Other primarily Southern European countries that make up the “PIIGS” i.e. Portugal, Ireland, Italy, Greece and Spain are occasionally mentioned as being only slightly better off and therefore the next dominoes to fall. At other times we will hear about how bad the United States debt is and how the only “good” country in Europe is Germany. When looking at debt you can’t just look at the total debt because a “big” country might have what appears to be a huge debt while in reality a small country might have a proportionally much larger debt.

So often we will look at the debt per capita but that might not provide a good view either since a rich country could afford much more debt per capita than a poor country. So typically we will look at Debt divided by Gross Domestic Product (GDP).

According to Investopedia Gross domestic product is:

“The monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory. “

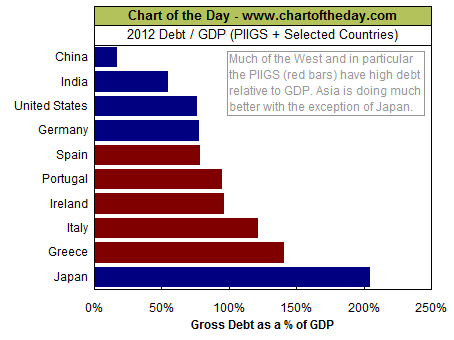

But if you look at the following chart of Debt divided by Gross Domestic Product created by our friends at Chart of the Day, you might get a different picture.

The first thing you might notice is that Japan which is perceived as a fairly good credit risk is actually at a much higher debt level than Greece.

As you would expect the other PIIGS nations are slightly better off than Greece. Another surprising thing is that The “Savior” of Europe i.e. Germany is really no better off than Spain. And the United States is just microscopically better off than Germany. And finally for perspective we see India and then China has just a fraction of the debt the U.S. has.

What is the Problem?

The problem is that historically once a country reaches the 100% Debt to GDP level it is rarely able to dig itself out of the hole. At 100% that means that it would take everything the country produces in an entire year to pay off the debt. This means that in order to pay off the debt everyone would have to give up eating and buying anything so the debt could be repaid. Obviously, that isn’t going to happen. So what could happen? Perhaps 5% of the GDP could be used for 20 years. China could do that because GDP is growing at 8% a year so theoretically they could consume 3% growth and repay debts with 5%. The U.S. is currently growing at less than 2.5%. So in order for us to repay 5% the economy would have to grow at a higher rate or people would have to be willing to accept an economy shrinking at 2.5% (now that’s austerity) to be able to put 5% toward repaying the debt. Even that probably won’t happen. At almost 150% for Greece, the prospects of them ever paying off the debt are mighty slim. But the problem is actually even worse.

Why GDP actually Understates the Problem

My major problem with using GDP is that it includes “Public Consumption and Government outlays” which may not be productive in nature. Basically, inflating the Gross National Product (Production excluding Government) by adding non-productive bureaucratic paper shuffling to it. If we looked at these same countries versus their GNP the percentage of debt would be much higher because the divisor would be much smaller.

See Also:

Global Debt Market: Biggest Bubble of All Time?

Which is Better: High or Low Inflation?

What if They Stop Buying Our Debt?

European Debt Crisis: “Imagine the Worst and Double It”

The European Debt Crisis and Your Investments

Is the United States Bankrupt?

Is the US Monetary System on the Verge of Collapse? |