Why Bifurcating Your Information Matters

By David Galland, Managing Director Casey Research

In addition to saving yourself time and worries by mostly ignoring public information, learning to discern the difference between good and bad information can lead to better decision making, in your everyday life and in your investments.

As a case in point, during the conference here, someone in the audience asked a question about quantitative easing. Doug Casey took hold of the microphone and replied along the lines of, “People need to stop using constructs such as ‘quantitative easing.’ Those are just terms that politicians have come up with to obfuscate the truth. The proper term for quantitative easing is currency debasement, plain and simple.”

Going back to the observable, we know from history what happens when a king or officialdom adopts a policy of energetic currency debasement: the currency units being debased invariably become worth less and less. There is no example in history where debasing a currency doesn’t drive the purchasing power down over time. And certainly, none where debasing a currency causes it to appreciate over time.

Jumping back to public information, “everyone” knows that the dollar is king… the best car in the junkyard, the two-ply toilet paper in a world where all other currencies are mere single ply. But is that accepted truth actually true?

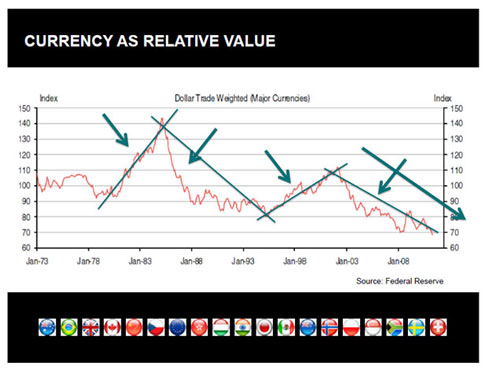

Take a look at the following two charts, taken from the presentation that Frank Trotter, president of EverBank Direct, gave in Cafayate. The first shows the US dollar against 19 major currencies. It’s hard not to note that the mighty dollar has been in a long-term downtrend.

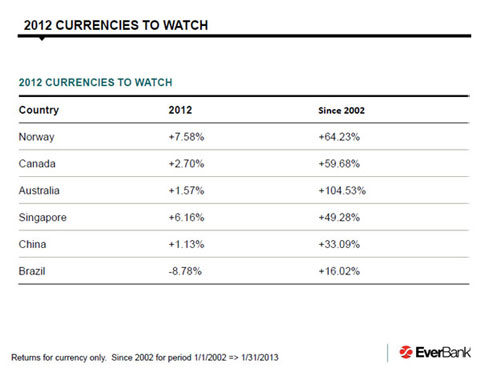

The second of Frank’s charts show the one- and ten-year performance – through 2012 – of some of the EverBank World Currency team’s favorite currencies against the dollar.

Of course, not shown in this mix is the performance of gold, the über-currency, over the same time periods. In 2012 gold rose by only about 3.5%, but for the ten-year period, it rose from $278 to $1,657, a gain of about 500%.

I’ll have a bit more to say about gold, and particularly gold stocks, momentarily… but before that, I want to toss out one more item of observable information as it relates to today’s economy, political environment, and the outlook for the dollar.

The chart here is of federal spending in trillions of inflation-adjusted dollars. That means that the increase in spending shown accurately reflects the growth in government in real terms (as opposed to reflecting the decline in purchasing power from the currency debasement).

It also shows the scale of the purportedly draconian cuts in federal spending to be made as part of proposed austerity measures… revealing all the hand waving about the severe consequences of said cuts as just so much public information… or, if you prefer, misinformation.

What you can also observe from this chart is that the federal government has grown into a behemoth, a huge prop under the economy… the world’s largest economy, for the record. The idea that the politicians will find the backbone to cut this level of spending back to the point where it balances the budget is ludicrous. Even if enough of them wanted to make such cuts, the ensuing depression would trigger a public backlash that would see them voted out of power in the proverbial blink of an eye.

Which is to say that the current trend of currency debasement is almost certainly going to continue until it simply can’t anymore.

And that brings me back to gold and particularly gold stocks.

*****

Downturn Millionaires

Even though the first of the two events here in Cafayate was beginning, the partners of Casey Research got together and decided that the state of the gold share market had reached such a dismal state that we had to take action on behalf of those of our subscribers with investments in these markets.

And so we hit the phones and email and arranged for Jonathan Roth, a highly respected journalist and filmmaker, to fly down to Argentina, picking up a crew in Buenos Aires on the way. Our purpose was to tap into the minds of some of the conference speakers, as well as mining share experts back in North America who were invited to join by live video feed.

The program, which some wit back in the office named Downturn Millionaires, has as its primary mission to put today’s junior mining share markets into a clear perspective.

And that perspective, I am convinced after moderating the impromptu webinar, is that the meltdown in the junior resource stocks over the last year has created a once-in-a-generation opportunity for life-changing profits. That’s because while gold bullion has been largely flat over the last 12 months, the junior gold and silver shares have been positively bombed out.

And by bombed out, I refer to the observable fact that even great companies – with great management teams, money in the bank, and large proven resources of gold and silver in supportive political jurisdictions – have seen their share prices lose over 50% of their market value over the past 12 months.

That this has occurred against the backdrop of only a modest consolidation in gold bullion prices and a massive global commitment by central bankers to currency debasement, represents a huge disconnect.

So, what’s it to be? Is the long bull market in precious metals and precious-metals shares over? Or does the disconnect point to just the sort of once-in-a-generation profit opportunity for those bold enough to act (selectively, of course)?

The program features Doug Casey, Bill Bonner, Rick Rule, John Mauldin, and Louis James, the globe-trotting senior editor of our International Speculator service who talks about the specific stocks to add to your portfolio today.

The program is now live on the Casey Research site. Because of the importance of the topic, we have made it available to everyone to watch for free.

Register to watch this online video event now.

See Also:

- So Long, US Dollar As World’s Reserve Currency

- What are High Yield Bonds?

- Germany Will Exit Euro

- How the Golden Reset Button Could Drive the Price of Gold to $20,000.

- Bank Runs Can’t Happen- Right?

Recommended by Amazon:

- The Dollar Crisis: Causes, Consequences, Cures , Revised and Updated

- The Collapse of the Dollar and How to Profit from It: Make a Fortune by Investing in Gold and Other Hard Assets

- Currency Wars: The Making of the Next Global Crisis

- This Time Is Different: Eight Centuries of Financial Folly

- The Ascent of Money: A Financial History of the World