When looking at prices of anything from cars to oil to gold or stocks… we need to keep in mind our personal frame of reference. We see prices as they are priced in our currency i.e. the currency that we earn in.

Companies

International companies are especially aware of this as their income can be in one currency while their expenses are in another. A good example would be a company whose manufacturing plant is in China or Mexico but their primary sales were in the United States. They would benefit from low labor costs plus a “weaker” currency.

Retirees

Many Retirees have also benefited from currency differentials. For 20 or 30 years now people have been retiring overseas in places such as Costa Rica or Mexico. So their retirement income is in Dollars but their expenses are in Pesos. So in addition to a lower cost of living, they would also benefit if the Dollar appreciated against the local currency. Of course, the Dollar could depreciate against the local currency as well thus eliminating some of the benefits of the lower cost of living. More recently, people began avoiding the currency risk by living in a low cost country that uses the U.S. dollar like Panama or Ecuador.

Gold

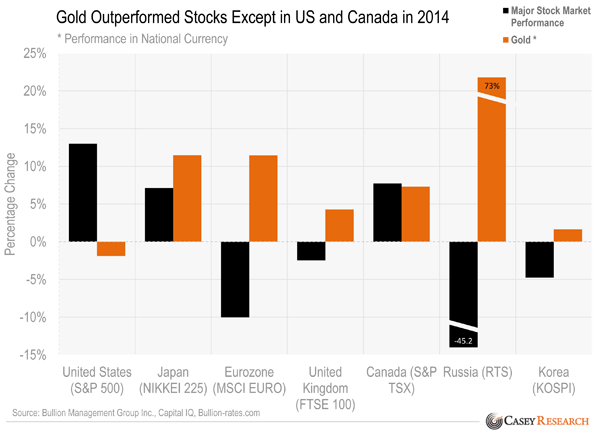

Using a U.S. centric frame of reference we might think that gold didn’t perform very well in 2014 but people from the rest of the world would disagree.

Today, Jeff Clark, Senior Precious Metals Analyst for Casey Research looks at the effects of currencies on the price of gold. ~Tim McMahon, editor.

Gold Was Up 73% in Rubles Last Year!

By Jeff Clark, Senior Precious Metals Analyst

But he ignored all that. He turned to the investment section and began to scan the page, looking for the latest price of one specific investment. He went past the headline that screamed Russia’s inflation rate was up to 11.4% last year, as well as the article detailing the ruble’s debilitating 46.5% fall. He knew all those things and had experienced them firsthand.

He went directly to the page that quoted the price of gold in rubles.

And there it was. And this time, it wasn’t just a short price quote, but a full article on the topic of gold, starting with a headline that warmed his heart.

“Gold Price in Rubles Rises 73% in 2014”

The article detailed how gold had soared last year due to the depreciation of the ruble. What especially pleased him was that gold rose more than the ruble fell. It also outpaced the rise in inflation.

The article included a chart of the last six weeks’ price movement, during which the ruble had taken an especially ugly drop.

Dmitry wasn’t surprised to read that it wasn’t just the gold price in rubles that was up last year…

The price of gold rose against ALL currencies in 2014—except the US dollar. Yes, gold was up in the euro, Japanese yen, Swiss franc, Canadian dollar, British pound, Australian dollar, New Zealand dollar, Chinese renminbi, Indian rupee, Swedish krona, Brazilian real, Israeli shekel, and South Korean won.

Even more interesting was that gold outperformed most stock markets around the world…

Most investors outside North America not only saw their currency lose value but also lost money in their stock market. His fellow Russians were hit especially hard. Whoever owned gold, though, had avoided these debilitating losses and was actually sitting on a profit.

The article concluded by congratulating those with the foresight to buy gold, which, unfortunately, didn’t include many of his fellow citizens—but it did include him.

Dmitry has every right to feel pleased with himself. While inflation raged all around him, the currency fell through the floor, and global crises remained escalated, his investment in gold had done exactly what it was supposed to do: protect him against currency and monetary calamity. In fact, he’d gained more with gold than he lost in ruble purchasing power.

He’d read warnings that this could happen—warnings others had dismissed as the ravings of loony gold bugs. He had been skeptical, frankly, and it hadn’t happened exactly as he thought it would, but now he sure was glad he’d decided to play it safe and bought some gold as insurance.

He wondered what those in North America thought about this phenomenon… Did they see the writing on the global economic wall—or did they imagine they were immune because their stock market had risen so much while gold remained weak in their currency? Did they really believe their central bankers were wizards endowed with supernatural powers others lacked? Didn’t they remember Ben Bernanke insisting in 2007 and 2008 that there was no crisis and that everything was under control?

It seemed to Dmitry that many of them were kidding themselves, because he knew that at some point, the very thing that happened to inflation rates and currency values in his country could happen to theirs. And how gold would respond—as he now knew firsthand.

Like him, sensible Americans who bought gold while it was on sale wouldn’t know the timing but would be prepared for the inevitable outcome of the currency-destroying policies their central bank had adopted, just like all the others. He hoped they saw it coming and envied their chance to take advantage of relatively low prices.

Tomorrow, the January BIG GOLD will be released. And it won’t be just any issue, but a 50-page blockbuster edition that interviews 17 experts on precious metals and includes two actionable steps to kickstart 2015: a discount on international bullion storage and a new recommended stock, one that Jeff Clark described as a must-own company that came with both safety and high potential. Check it out here.

You might Also Like:

- Driving Down Oil Prices Just to Hurt Russia is “Simplistic”

- How “Paper Gold” Affects the Price of the Metal

- A GREAT Model to Understand Gold’s Price Swings

- The Story of Gold’s Future History

- The Difference Between FIAT and Real (Music and Gold)