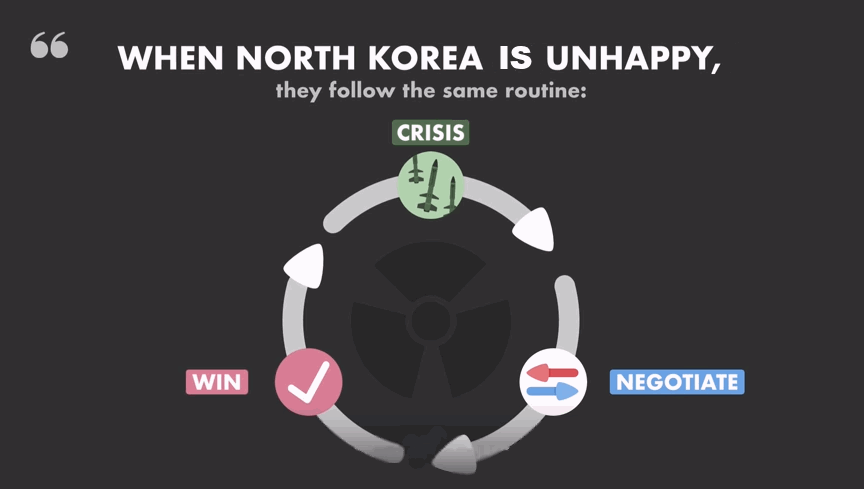

North Korea is making quite a bit of news these days with its crazy war threats and threatening missile launches. It knows that in the past, brinkmanship has gotten it concessions from every U.S. President since Clinton. During Clinton’s Presidency, North Korea began its “Saber Rattling” in response former President Carter began negotiations that resulted in an agreement that North Korea would cease work on Nuclear weapons in exchange 500,000 tons of oil a year and $4 billion toward the construction of a light-water reactor capable of producing nuclear energy (but not weapons). By 2003, North Korea had breached that agreement. In 2005, North Korea reached another agreement to stop production in exchange for economic and energy aid. That deal unraveled in 2008. Since 2008 there hasn’t been much done in negotiations between North Korea and the U.S.

But now Korea is once again rattling its sword… perhaps in hopes of more appeasement money. In the following article, Nick Cunningham looks at another resource that North Korea has but can’t tap. ~Tim McMahon, editor

North Korea’s Hidden Resource

Of course, there are no official reports on how much North Korea’s mineral wealth really is, but according to rough estimates from earlier this decade, Pyongyang’s deposits of coal, iron ore, zinc, copper, graphite, gold, silver, magnesite, molybdenite, and many others, are worth between US$6 trillion and US$10 trillion, as per South Korean projections reported by Quartz.

Before the fall of the USSR, North Korea had prioritized mineral mining and trade with fellow communist partners. But the mining industry has been in decline since the early 1990s, due to decades of neglect and lack of funds for infrastructure development to support mining activities.

Now North Korea’s mining sector trade is under a full ban by the UN, as Pyongyang has stepped up both nuclear missile tests and belligerent rhetoric in recent months. The UN started banning trade in metals last year, but there have been reports that Kim Jong-Un’s regime has grown increasingly inventive in circumventing sanctions.

The UN introduced last month a full ban on coal, iron, and iron ore, after having banned trade in copper, nickel, silver, and zinc in November last year. China also implemented the coal import ban, cutting off an important economic lifeline of the regime. Coal trade has generated over US$1 billion in revenue per year for North Korea, the U.S. Department of Treasury said at the end of August, when it slapped sanctions on Russian and Chinese entities for supporting the regime.

On Monday, following North Korea’s latest nuclear test on September 2, the UN Security Council banned the supply, sale, or transfer of all condensates and natural gas liquids, and banned Pyongyang’s exports of textiles such as fabrics and apparel products. The latest sanctions, however, are not imposing a full oil embargo as the U.S. called for in recent weeks. The sanctions instead are capping refined petroleum products and crude oil supply, after the U.S. dropped its demand for full oil ban, to avoid China vetoing the UN resolution.

All the sanctions leading to Monday’s strongest prohibitions so far have been designed to stifle North Korea’s trade in minerals and cut off money for the regime.

North Korea has staked most on coal mining, the cheapest and easiest to mine, compared to precious metals or rare earth metals mining, for which Pyongyang has neither the funds nor the infrastructure or know-how to develop.

North Korea has sizeable deposits of some minerals. Its magnesite reserves are the second largest in the world behind China, and its tungsten deposits are likely the sixth-largest in the world, Lloyd R. Vasey, founder and senior adviser for policy at the Center for Strategic and International Studies (CSIS), wrote in April this year. North Korea sits on sizeable deposits of more than 200 different minerals, and “all have the potential for the development of large-scale mines”, Vasey said.

North Korea doesn’t have either the funds or the infrastructure to develop those resources. It’s also officially banned to export them.

Yet, “The Democratic People’s Republic of Korea is flouting sanctions through trade in prohibited goods, with evasion techniques that are increasing in scale, scope and sophistication,” a UN report of a panel of experts from February this year concluded.

“Diplomats, missions and trade representatives of the Democratic Peoples’ Republic of Korea systematically play key roles in prohibited sales, procurement, finance and logistics. In particular, designated entities are trading in banned minerals, showing the interconnection between trade of different types of prohibited materials,” the panel’s report reads.

According to UN experts—as of February this year—North Korea had adapted to the stricter sanctions “through various tactics, including identity fraud.”

“Their ability to conceal financial activity by using foreign nationals and entities allows them to continue to transact through top global financial centres,” according to the report.

According to a more recent investigation by ABC Four Corners, North Korea has business interests in Asia, the Middle East, and even Europe, contrary to the common perception that it is a very isolated country. Office 39—one of the departments of its Workers’ Party—is “the ultimate slush fund”, reportedly generating up to US$1.6 billion annually for Kim’s lavish lifestyle, while 70 percent of people are food insecure.

“North Korea is very sophisticated in concealing the fact that it is, indeed, North Korea doing business overseas. It’s good at hiding in plain sight,” Andrea Berger, Associate Fellow at the Royal United Services Institute (RUSI), told the program.

You might also like:

- Asteroid Mining: Science Fiction or Science?

- Rare Earth Investment Update

- Gold, silver, and rare earth; which is right for you?

- Move Aside Lithium – Vanadium Is The New Super-Metal

The original article appeared here and has been reprinted by permission.