A variety of factors, including worries about the US dollar, inflation, the stock market and trade sanctions have led people to consider alternative investments for their future. Precious metals have always been an alternative due to their negative correlation to other markets. This means that often when stocks or currencies are falling precious metals are rising. There are 4 precious metals to consider for investment and to secure retirement.

Gold

Gold is one of the most sought-after precious metals that goes back for as long as humans have been aware of it. Pharaohs were buried with it and kings have made their crowns out of it. It is malleable, durable, and conducts both electricity and heat. While it does carry value in its use in industrial applications, it is most commonly valued for its use in jewelry, status, and a form of currency.

Historically, gold has been valued as currency. Currently, its value is set by the market 24-hours a day, 7-days a week. The price of gold is affected by the demand of the people and governments. Even today, if the market panics investors still rush into gold and the price goes up. See: Gold is a Crisis hedge.

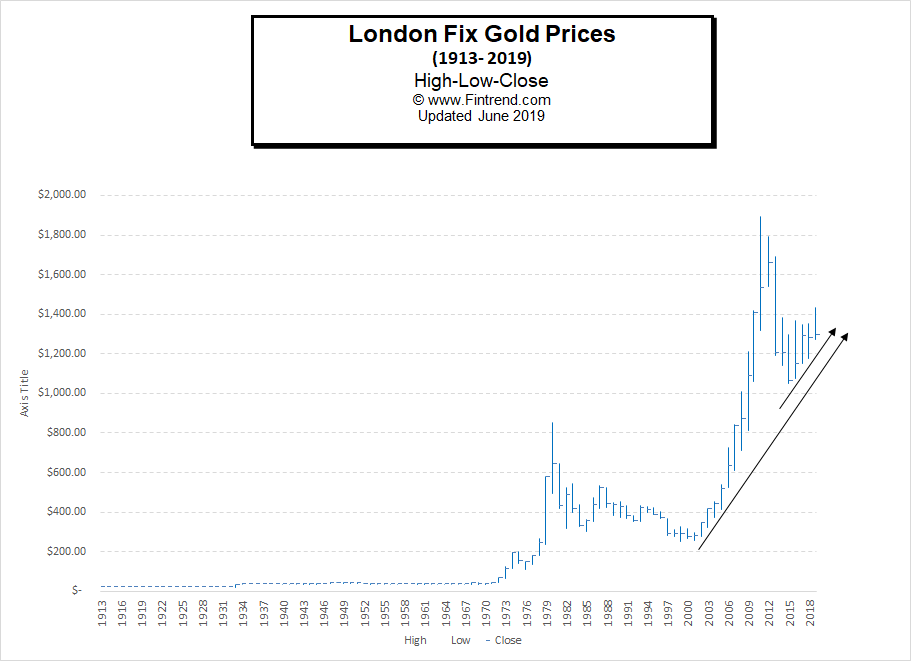

From the chart below we can see that from 1913-1931 the price of gold was fixed by the U.S. government at $20.67 per ounce (but it fluctuated slightly on the London market based on both demand and political winds). Then due to market forces, in 1933 President Franklin Roosevelt was forced to revalue gold to $35 an ounce (after confiscating it from U.S. citizens). In 1971, President Nixon was again forced to admit that gold was worth more than the “official” price and he let its price float free (i.e. be determined by the open market). Subsequently, the price rose to $800/ounce before settling into the $300 range.

Then from 2000 onward the price of gold once again took off reaching almost $2000/ounce. Then fell back to the $1000 range. Since then gold has consistently made higher lows.

Silver

The price of silver fluctuates for different reasons than gold. Silver plays a role as an industrial metal as well as a store of value. This makes it more volatile in the market than gold. While silver can trade fairly in line with gold when it comes to investment demand, the supply and demand of industry also play an influence on its market price. New innovations play a pivotal role in the fluctuating price of silver.

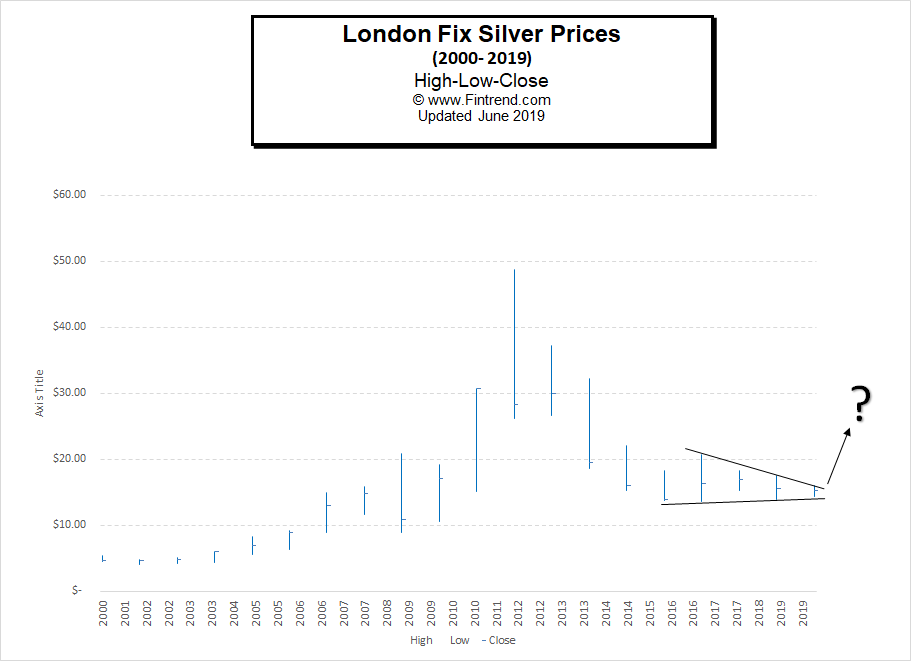

The chart below shows the price of silver from 2000 through 2019. We can see that it spiked along with gold in 2012 then settled back down with apparent support around the $14/oz range. The chart appears to be forming a “pennant” which could result in a strong upward breakout.

Platinum

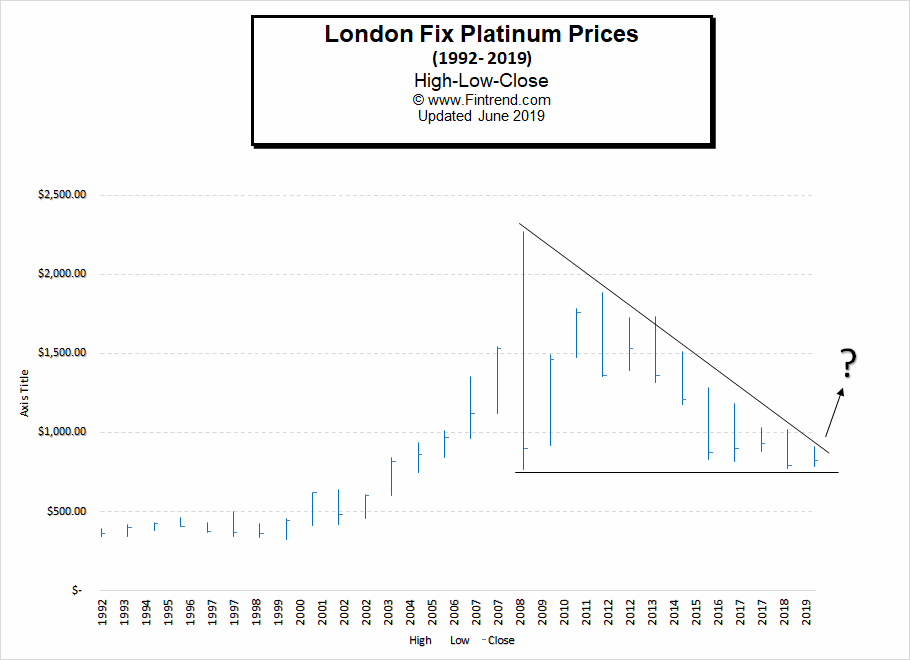

Platinum has the tendency to get a higher price on the market than gold due to its rarity. Far less platinum is removed from the ground every year than gold, which makes it a rarer commodity. It is also considered an investment metal but also an industrial metal. It is used heavily in the auto industry; mainly in automotive catalytic converters. Therefore, the price of platinum is greatly influenced by auto sales in relation to ‘clean air’ legislation. Platinum prices have also formed a “pennant” with current lows approaching the support levels of 2008 at $763. Once again a “breakout” could result in a very strong upward move.

Palladium

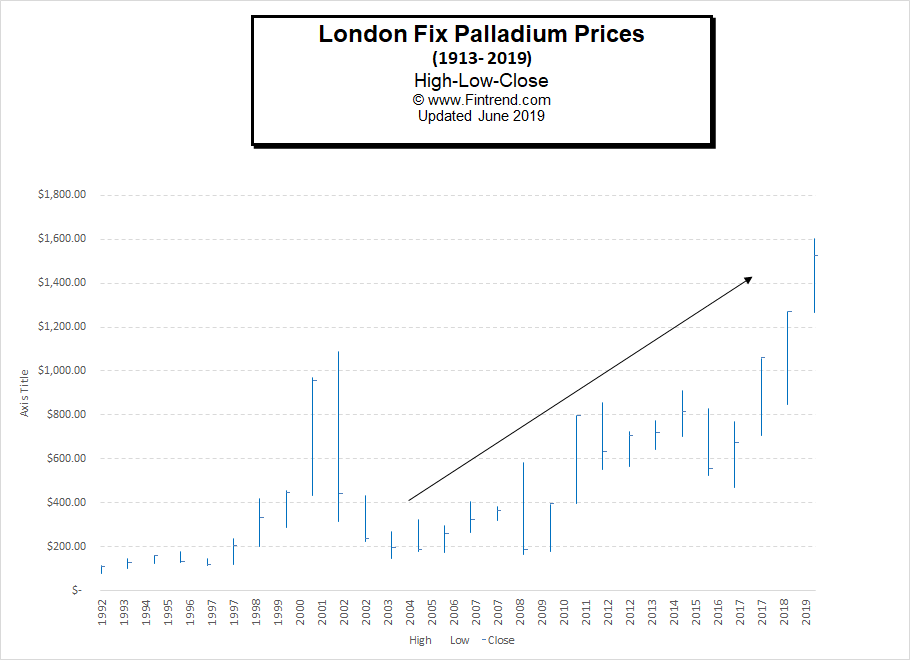

This particular precious metal is far less known by many then silver, gold, and platinum. Palladium is one of the six platinum group metals and is commonly used in the exhaust system in cars. The crackdown on pollution from vehicles has driven up the price of palladium in recent years. This is the result of the supply not meeting the demand. This metal is also used in jewelry, dentistry, and various electronics.

There are many reasons to diversify into gold, silver, platinum, and/or palladium. It is even possible to put part of your IRA into precious metals. Just be sure you follow the IRA portfolio regulations. A provider such as McAlvany ICA can assist you with the details.

You might also like: