Gold has been a valuable investment since the dawn of time. It’s always been a prized possession that is in demand no matter where you live on the globe. Here are four reasons why you should still be investing in this timeless classic.

There Are Less Gold Supplies Being Produced

The actual production of gold that is mined has greatly reduced over the last decade. According to the Mining Journal, exploration companies have spent 60% more over the last decade than they spent over the previous 18 years. So you would think they would have a lot more to show for it. But they only discovered 41 new deposits (i.e. an average of 4.1 deposits per year) compared to 222 discoveries in the earlier 18 year period (average of 12.3 deposit per year). And those discoveries were considerably smaller as well. The earlier period discovered 1.72 billion ounces (95.55 million ounces per year) while the recent decade only discovered 215.5 million ounces ( 21.55 million ounces per year). While this may sound like a lot, gold demand remains strong. In 2018, Jewelry accounted for 2,241.2 metric tonnes of gold demand, investment accounted for 1,164 metric tonnes, Technology used 334.8 metric tonnes and Central Banks sucked up 656.3 tonnes.

India and China are some of the largest markets for gold, and growing affluence is increasing demand for gold.

An analyst at CFRA research recently claimed that the most prolific gold reserves had already been found and miners are struggling to grow them. The average grade of new deposits is on the decline, which means the value of gold already on the market is increasing. It’s becoming cheaper for many miners to buy gold in the stock market than to look for it themselves, which further changes the market trends.

Hedge Inflation

Speak with any financial advisor and they’ll tell you that an important consideration of your investment portfolio is to consider the impact of inflation. If the long term average inflation rate is around three percent per year, your investments need to make more than three percent return per year to simply break even. According to the gold price forecast, “Gold prices have been correcting since September, and investors are beginning to wonder if it’s the right time to buy? With our Gold Cycle Indicator below 100, the odds are beginning to favor an intermediate low.”

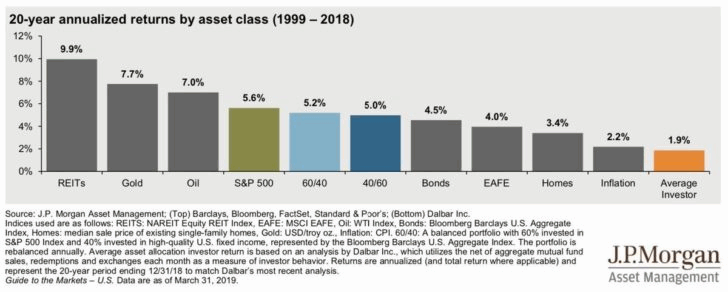

As we can see from the above chart gold was the second-best performing asset over the last 20 years providing an average annual return of 7.7% while inflation averaged 2.2%.

Gold Tends to Be Negatively Correlated to Other Assets

Stocks, bonds, currencies, and gold are all independent and often when one falls others will rise. Initially, back in 2008 when the housing crisis hit everything fell. This was primarily because liquidity dried up and people who bought stocks on margin were forced to sell other assets to cover their losses. Gold is the only asset that is not simultaneously someone else’s liability. So gold rebounded much quicker than liability based assets simply because when everyone is insolvent you can never be sure if you will get repaid but gold will always be gold.

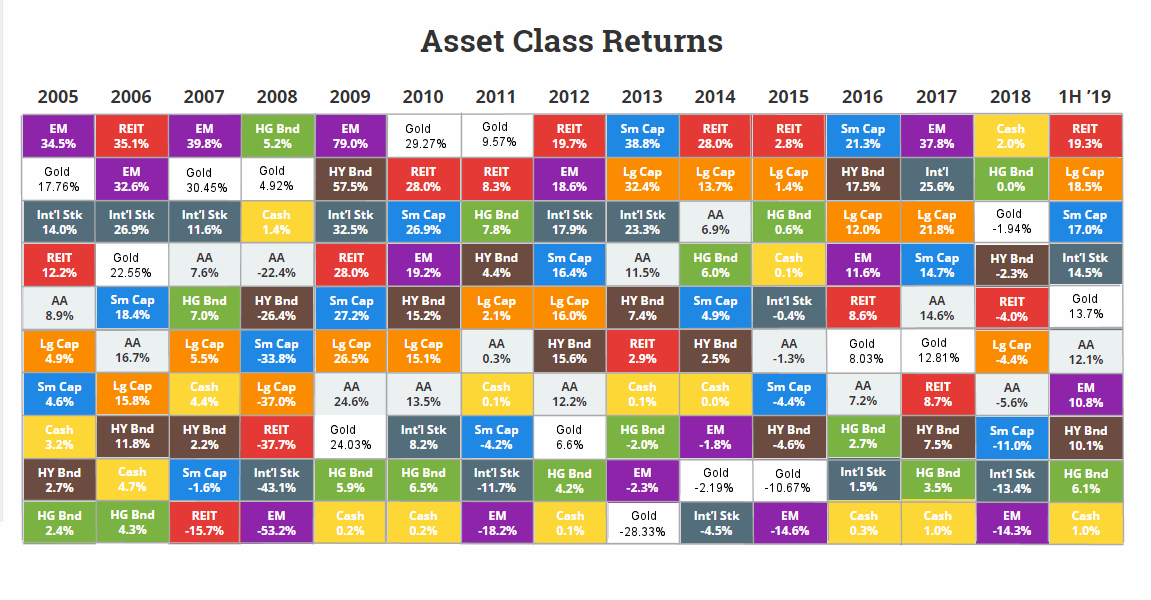

The following table shows the best performing asset class for each year since 2005. As we can see gold was # 1 in 2010, and 2011. Even in 2008, it increased by 4.92% when Large Cap stocks were down -37% and a year later (in 2009) it gained 24.03% and another 29.27% in 2010.

Gold Tends to Hold its Purchasing Power

Unless you buy at the absolute peak gold will retain its purchasing power better than paper assets. Gold is a commodity so when inflation drives up the price of commodities it drives up the price of gold as well. Gold is also a crisis hedge so when people become fearful they tend to buy more gold. The fear can be the fear of inflation or the fear of a market crash. It can even be the fear of government confiscation or default.

So having 5% to 10% of your portfolio in gold-related assets will tend to smooth out the ups and downs of your portfolio helping you to sleep better at night.

You might also like: