Confined War Scenario

In the confined war scenario conflict is limited to Gaza, Israel, and the Palestinian territories. Under this scenario Bloomberg estimates that oil would increase by $4/barrel due to supply disruptions in the Middle East, worldwide GDP would suffer a minor -0.1% drop, worldwide inflation would increase by 0.1%, and the VIX volatility index of the market would not be really affected.

This is based on the results of the kidnap and murder of three Israelis by Hamas in 2014, which resulted in a strong response by Israel which left more than 2000 people dead. In that case, “Fighting didn’t spread beyond the Palestinian territory, and its impact on oil prices — and the global economy — was muted.”

So far this year, due to the Biden administration’s overtures to Iran, Iran has been increased oil output by 700,000 barrels per day. Bloomberg estimates that if that production is curtailed due to U.S. pressure that could result in an increase in the price of oil by $3 to $4 per barrel. This loss of production could be offset if Saudi Arabia and the UAE increase production from their spare capacity.

Proxy War Scenario

In the proxy war scenario, the war spreads to Lebanon, Syria and unrest develops in the Middle East. Under this scenario Bloomberg estimates that oil would rise by $8/barrel, Global GDP would take a -0.3% hit, global inflation would rise by 0.2% and the VIX would rise by 8 points.

We are already seeing the seeds of this scenario with shots fired in Lebanon and Syria. These areas have Iranian-supported armed groups which could turn this into a proxy war between Iran and Israel. Israel’s former Military deputy chief of staff, Yair Golan says, Hezbollah (a Lebanese militant group) could join the fighting.

Back in 2006, Hezbollah briefly attacked Israel and crude oil jumped $5 per barrel. This could trigger a 10% increase in current oil prices sending them up to about $94 a barrel. Egypt, Lebanon, and Tunisia are currently suffering from “economic and political stagnation” which makes them ripe for a repeat of the 2010 “Arab Spring,” which would result in an increase in market volatility and about $300 billion of lost global output.

Direct War between Iran and Israel

Although the odds of this scenario happening are low, the stakes are high. This could easily trigger a global recession with much higher oil prices, a falling stock market and higher inflation. According to Hasan Alhasan, a research fellow at the International Institute for Strategic Studies, “No one in the region, not even Iran, wants to see the Hamas-Israel conflict escalate into an all-out regional war.” If this were to happen Iran would activate its network of proxies and partners in Syria, Iraq, Yemen, and Bahrain. It also has alliances with China and Russia, while Israel has ties with the U.S.

Direct involvement of Russia and China is unlikely. China has shown that with its response to Russia and Ukraine. It is willing to benefit financially from closer relations with Russia but it really doesn’t want to get involved in the war. Russia has its own problems and doesn’t need to get involved in the Middle East’s problems.

But with a fifth of the world’s oil supply coming from the Gulf region, there are supply disruption risks. In 2019, pro-Iranian militants used a drone strike on Aramco facilities to take almost half of Saudi oil supply offline. A repeat of this would have devastating effects on the price of oil and the world economy. This could send oil prices to $150/barrel. Iran could also close the Straits of Hormuz which handles one-fifth of the world’s daily oil supply. In either of these cases, Saudi Arabia and the UAE oil supplies may not be able save the day.

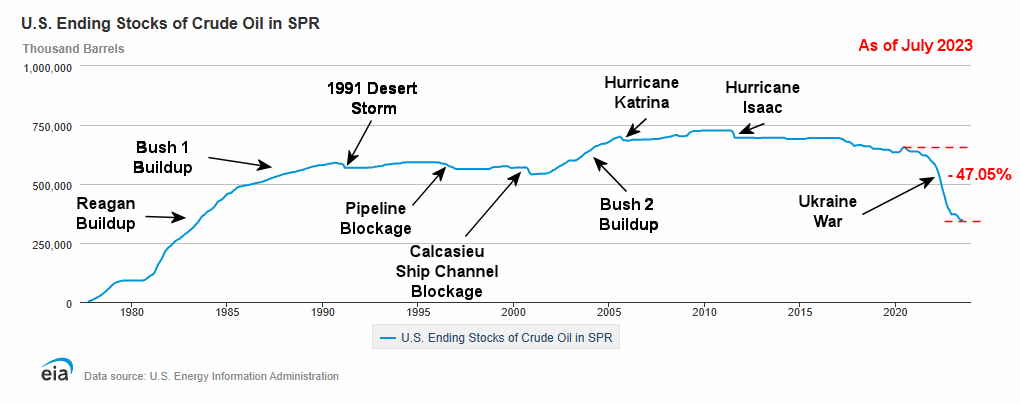

Biden has already drawn down our Strategic Petroleum Reserves by just over -47% so our reserves are not available to save the day either.

Bloomberg estimates that “An oil shock this big would also derail the worldwide effort to rein in prices — leaving global inflation at 6.7% next year.”

You might also like: