The year 2024, started out very bullish for Crypto, with Bitcoin (BTC) up sharply… partly due to BTC getting approval for ETFs and partly due to the expected halving which would cut supply. But so far this year, the truism “Buy the rumor, Sell the news” has held for the Bitcoin halving.

Manic-Depressive Markets

One of the key characteristics of volatile markets is that they are like a Manic-Depressive person who is frequently more exuberant than an average person, but also often more melancholy than average as well. For Crypto that means that much of the time the Crypto market is higher than it should be, but sometimes it is lower than it should be. The ETF and the Halving pushed crypto to the manic extreme and it needed a pull-back to shake out weak hands and put it back on the reasonable track.

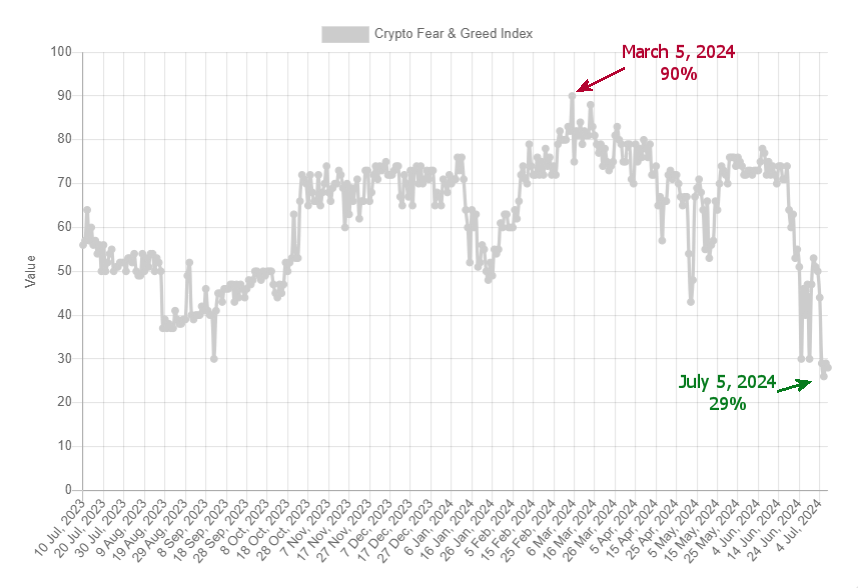

The way to profit in any market is to “buy when others are fearful and sell when others are greedy”. Greed (or exuberance) peaked on March 5th at 90% and then it spent much of May/June in the 70% range, but then it bottomed at 29% on July 5th.

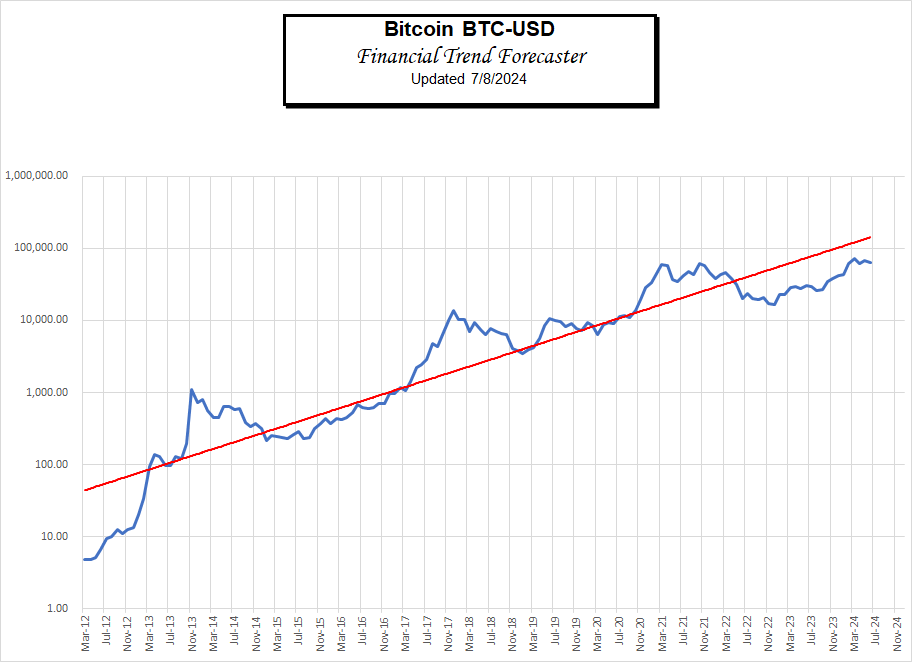

Looking at the Bitcoin logarithmic trendline we see that when it is above the line, Bitcoin is in one of its blow-off tops, and when it is below the line it is recovering from its previous mania.

So, even though 2024 started exhuberently it still hadn’t reached a full blowoff top. We can assume that when crypto is close to the red line it is fairly priced. With that in mind, we can see that BTC is currently underpriced (not as underpriced as it was in early 2023, but still underpriced).

Note: I did not randomly draw the red line, it is the “exponential trendline” calculated by Excel.

Why the Crash?

In addition to “needing” to shake out weak hands, there is a good technical reason why BTC sold off on July 4th-5th. Several factors conspired to drive the price down. For those conspiracy-minded, it may seem that the price was purposely driven down. The first factor driving the price down was the release of a massive quantity of BTC that had been held off the market due to the bankruptcy of MT Gox. They finally sorted out the legalities and returned the BTC that had been held in custody. The recipients had been forced holders for almost a decade and naturally wanted to take some profits. The other factor (with more suspicious timing) was the selling by both the German and the U.S. governments of BTC that had been confiscated due to criminal activity. Why was it sold on a holiday when even the Germans would have known that trading would be lighter than normal? That’s certainly not the way to maximize the return on your assets.

This sell-off has spooked many crypto holders and convinced even some long-term holders that the bull market is over. But this is actually the typical pull-back that follows a halving. And Crypto has a lot of bullish news on the horizon with an Ethereum ETF in its near future (perhaps even this week) and pro-crypto rhetoric seeping into politics.

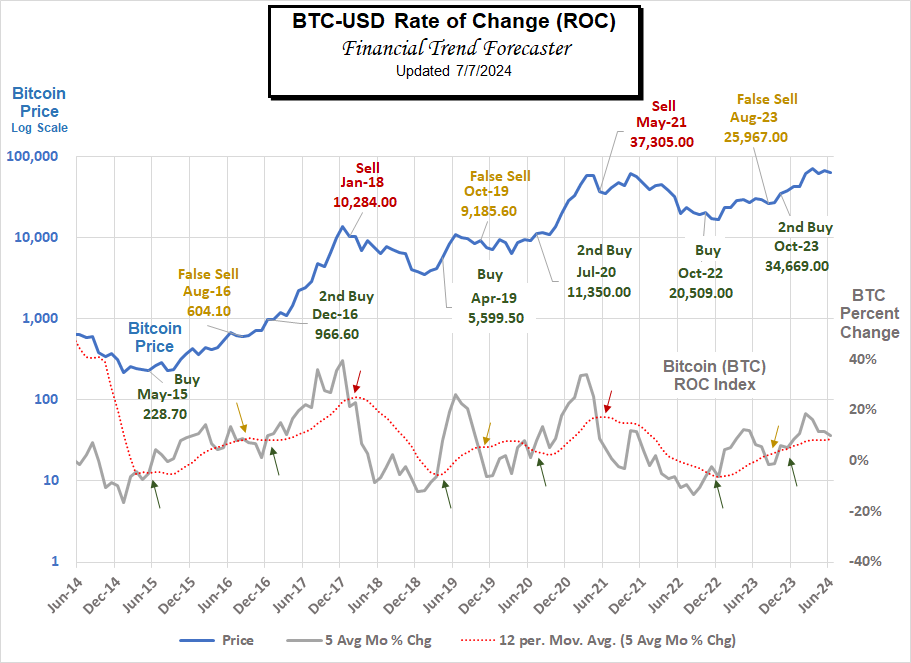

For more information about where we are in the Crypto cycle, see our current Crypto ROC projections.

You might also like:

- Applying the ROC to Crypto

- The Modern Day Wild West: Crypto Scams And Opportunities

- Blockchain Goes to Ethiopia

- Ripple the Cryptocurrency of Banks

- 4 Investments Making Waves in the Technology Sector

- How High Inflation Drives Countries Towards Crypto

- Can Crypto Solve Venezuela’s Hyperinflation Problem?

- Cryptocurrencies and Inflation

- Cryptocurrency: Is Bitcoin the Future of Money?