When millenials hear that “Tricky Dick” took the U.S. off the gold standard they assume it was for some selfish or nefarious purpose, but the truth is quite different. But to understand what really happened, we have to look much further back.

Would you be surprised if I told you that Nixon didn’t take Americans off the gold standard? You might say I’m crazy but let me explain.

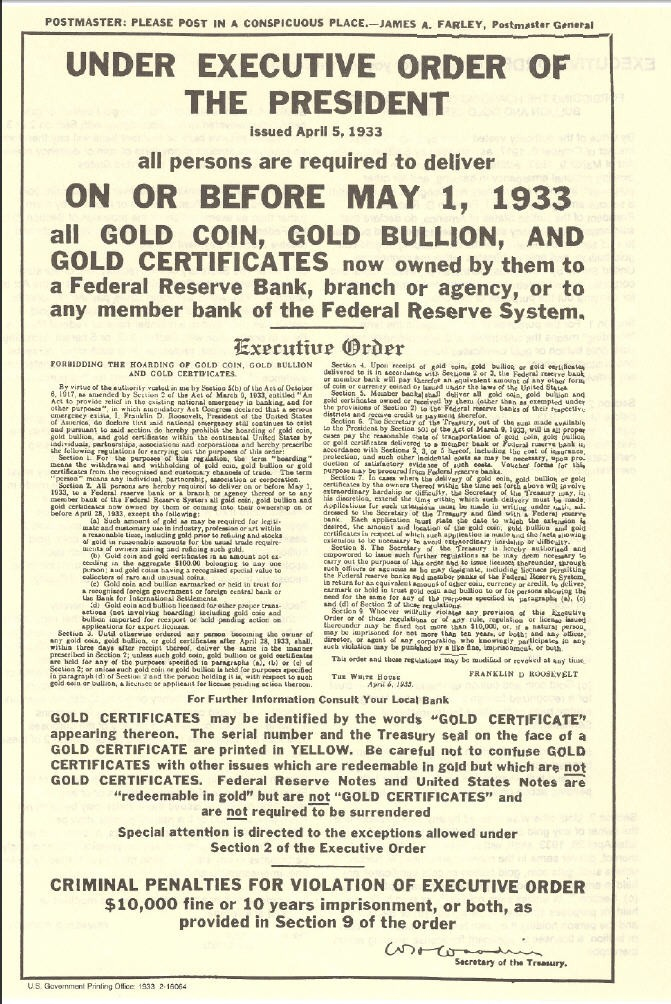

Back in April 1933, good old FDR issued Executive Order 6102, which forbade the HOARDING of Gold Coin, Gold Bullion and Gold Certificates. This effectively required all U.S. citizens to surrender their gold holdings by May 1st. Remember, at that point, gold was money and “hoarding” was a derogatory term vilifying ordinary people who were just saving for their future. But hoarding was portrayed as unpatriotic and antisocial during a national crisis. And justification was made under the Trading with the Enemy Act of 1917, as amended by the Emergency Banking Act of 1933. Imagine if Trump tried an Executive order like this today.

But the country was in the midst of the “Great Depression,” and the country had just experienced a severe bank run that prompted Roosevelt to declare a bank holiday. So, intelligent people didn’t want bank notes but rather something tangible (like gold). Instead, FDR outlaws individuals from owning gold and places stiff fines or even 10 years in prison if people failed to turn in their gold. At the time, gold was $20.67 an ounce, so FDR’s $10,000 fine for holding gold was equal to 483.79 ounces of gold! That much gold would cost about $1.4 million today. So, naturally, most people complied with his executive order.

This was not an outright confiscation, but rather, a mandatory “buy-back” at the official gold price (i.e., $20.67 an ounce). However, once the gold was safely in government coffers, the Gold Reserve Act of 1934, adjusted the official price of gold from $20.67 per ounce to $35 per ounce. Thus robbing citizens of 69.33% of the value of their gold, and bringing the money supply back to 1930 levels (i.e., eliminating the deflation of 1930-33) . This allowed the government to massively inflate the money supply to counteract the deflationary forces of the Depression.

At this point, it was illegal for U.S. citizens to own gold but theoretically every dollar was backed by gold (at least as far as foreign governments were concerned).

Roosevelt’s 2nd Gold Trick

During WWII most of the world got itself into massive debt. And the biggest creditor was the U.S. i.e., the rest of the world owed us a boatload of money, so the leaders of the world got together in Bretton Woods, New Hampshire in July 1944. But Roosevelt held all the cards (and all the gold). So, FDR convinced the world’s leaders that the dollar was “as good as gold,” so rather than everyone having to hold gold, they could just hold dollars instead. The Bretton Woods system included 44 countries who agreed to “peg” their currencies’ value to the U.S. Dollar and the Dollar was “peged” to gold at $35/ounce. To guarantee that it stayed that way any member country could exchange their U.S. dollars for gold at the rate of $35 per ounce.

Between 1944 and 1970 the U.S. government “fudged” on its printing a bit, inflating the dollar to more than the equivalent of $35/ounce while everyone pretended that it was still worth $35. Right from the start France didn’t like the Bretton Woods Agreement, so in the 1970s France decided to call Uncle Sam’s bluff and wanted the gold. Afterall, who wouldn’t want to buy gold at a discount?

France Calls the U.S.’s Bluff

When France tried to collect the gold, Nixon was in a pickle. If he let it continue, France and all the other countries would empty Fort Knox and we would be left with no gold. So, Nixon was forced to abandon FDR’s deal. This was called “closing the gold window”. This is often portrayed as a bad thing, but it had the consequence of not only allowing market forces to set currency values (creating the FOREX market) but also allowed U.S. citizens to own gold once again.

So, the real person responsible for taking us off the gold standard was FDR who stole the gold from Depression Era citizens. And setting a chain of events into motion that resulted in printing too many dollars. Nixon actually opened the door for private citizens to own gold again. But somehow Nixon gets the blame.

After pulling the rug out from under the gold standard Nixon had to figure out a way to prop up the dollar. So, he and Kissinger came up with the idea for the “PetroDollar” where oil producing countries would only accept U.S. Dollars for their Oil thus continuing the demand for Dollars among foreign countries. This was an epic move for the U.S. on par with his move to keep inflation low for 50 years.

For more info see:

- Understanding Roosevelt’s 1933 Gold Confiscation

- Oil, Petrodollars and Gold

- How Nixon’s Revolutionary Move Influenced U.S. Inflation For 50 Years

Nixon Did something good?

He also opened up trade with China paving the way for Amazon and putting a lid on inflation for the next 40 years. It also

squeezed Russia who was our primary advisary at the time. Most people forget that he won his second term in a landslide.