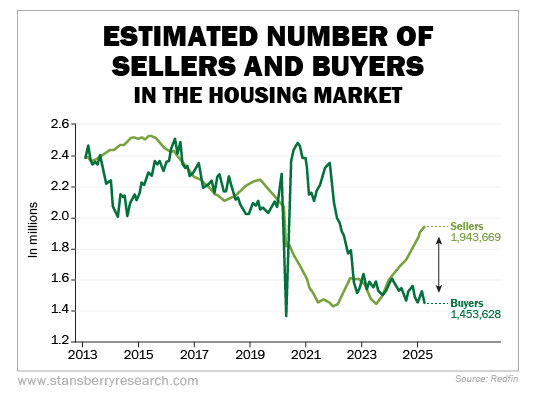

If you’ve been keeping an eye on the housing market—or even just talking to friends about real estate—you’ve probably noticed things feel a lot different than they did a couple of years ago. In 2025, the U.S. housing market is cooling off after the wild ride it took during the pandemic. Prices are softening, inventory is growing, and—for the first time in a long while—there are actually more people looking to sell homes than there are buyers eager to snap them up. According to Stansberry Research and Redfin, sellers outnumber buyers by about 500,000.

High Interest Rates Are Still Hanging Around

One of the biggest reasons the market feels slower right now is that mortgage rates are still pretty high. Back in 2020 and 2021, buyers were locking in rates around 2–3%, which helped fuel bidding wars and rising prices. Fast forward to 2025, and the average 30-year fixed mortgage rate is hovering above 6.5%.

That jump in rates drastically increases monthly mortgage payments. Making it especially hard for first-time buyers. For example, a 30-year, $400,000 mortgage at 6.5% would cost $2,528.27 per month, compared to only $1,580.48 a month for a 2.5% mortgage. An extra thousand dollars a month is enough to make many buyers hit pause.

But high rates don’t just affect new buyers. They’re also keeping a lot of current homeowners from selling. Many people who locked in those super-low pandemic rates don’t want to trade them in for something twice as expensive. This is known as the “rate lock-in effect,” and it was a big reason why inventory stayed tight for a while. But apparently sellers are now getting impatient.

Buyers Are Taking Their Time

With higher rates and more listings, buyers in many areas now have something they haven’t had in a while: breathing room.

Gone in most areas are the days of 20-offer bidding wars and waived inspections. Today’s buyers are being more thoughtful. Many are waiting to see if prices fall further, or hoping that mortgage rates will eventually come down. Others are choosing to rent a bit longer or explore more affordable areas.

In short, demand is cooler, but that’s not necessarily a bad thing—it’s helping to bring some balance back to the market.

But The U.S. Is Not Uniform

Not every market is the same. According to Construction Coverage, the Northeast still has a fairly robust Real Estate market with the top five markets in the U.S. being Connecticut, New Jersey, Massachusetts, Rhode Island, and New Hampshire. Conversely, the five worst real estate markets are: Florida, Texas, Montana, Idaho, and South Carolina.

Despite Construction Coverage’s conclusions, US News says that several Florida, South Carolina and Texas locations are among the fastest-growing cities in the U.S. including Wildwood, Florida #1 fastest growing (just outside The Villages), Hilton Head, South Carolina #2, Leander, TX #3, Naples, FL #5, Zephyrhills, FL #7, San Marcos, TX #8, Conroe, TX #9 and Bonita Springs, FL #10. But as we’ll see below, many other cities in Florida and Texas are having to reduce prices to induce a sale.

As a matter of fact, according to US News of the top 25 fastest growing places, nine are in Florida, seven are in Texas, and two are in South Carolina. Much of that growth may be due to demographics as the fast growing places like Wildwood are retirement havens.

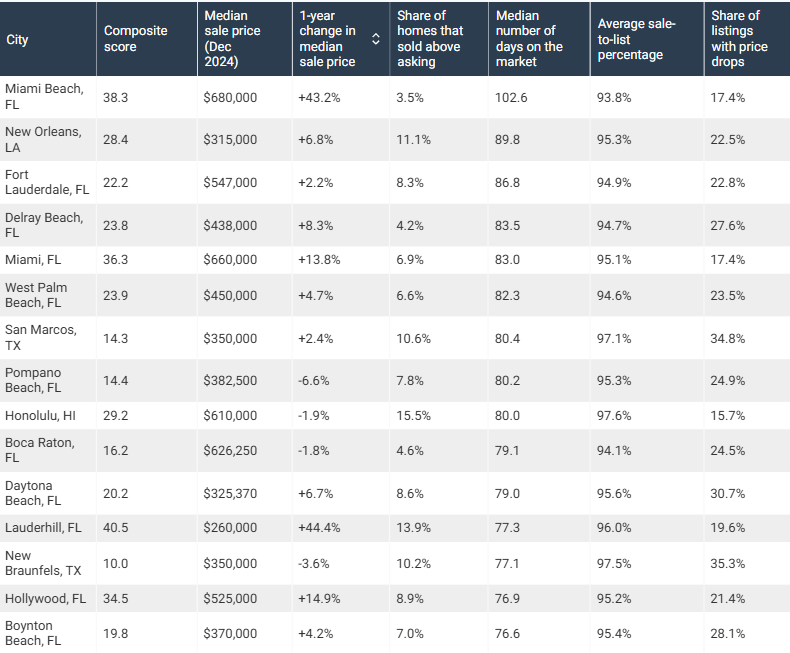

These cities (of all sizes) took the longest for homes to sell, and had a significant percentage of homes with sellers reducing their asking price. However, Miami Beach sends mixed messages. Median prices are UP 43.2%, but 17.4% of the listings had to lower their prices, and it took a whopping 102.6 days to sell a house on average.

Cities with the fastest turnover:

Cities with the fastest turnover:

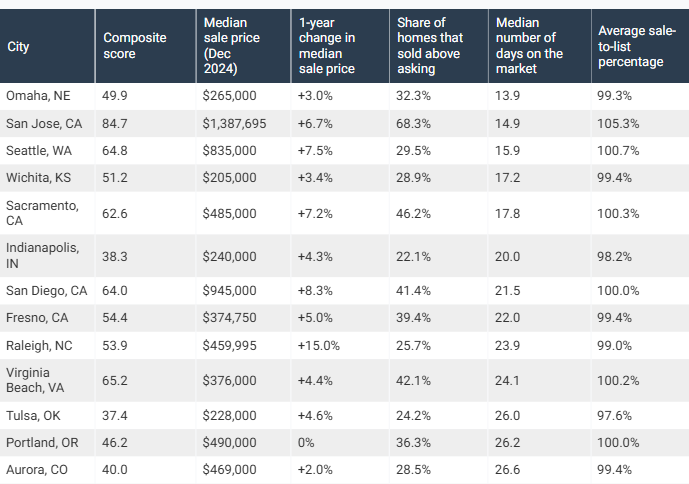

But, some places still had a hot real estate market with houses only on the market for a couple of weeks.

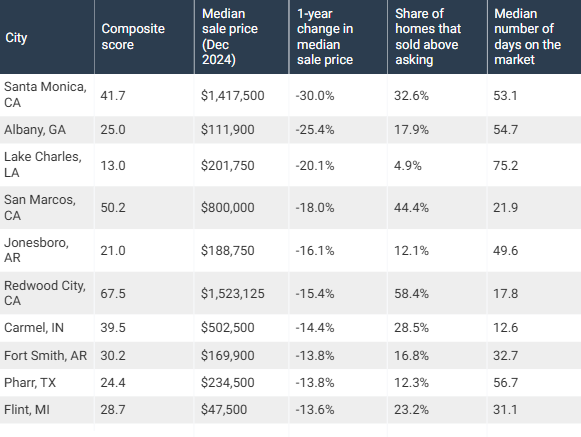

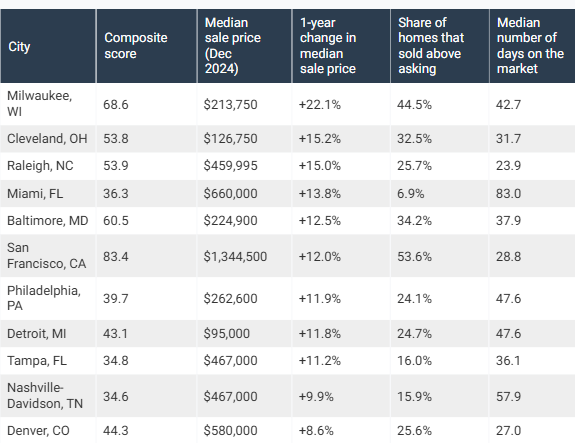

Looking at just large cities, according to Construction Coverage, these had the greatest change in median sales price:

Santa Monica homes actually fell 30% in price, although 32.6% of the sales were above asking price.

So, the U.S. market is still a mixed bag; some areas are having difficulty selling homes, while other areas are booming.