Introduction, History, and Progress of BITCOIN

Just a few short years ago no one had heard of them and now it seems like everybody on the Earth knows about Bitcoin. Bitcoin (a peer-to-peer electronic cash system) was first introduced in October 2008 by two unknown programmers known as alias “Satoshi Nakamoto” and Martti Malmi. When Nakamoto left the project, he gave ownership of the domain bitcoin.org to additional people, separate from the Bitcoin developers, to spread responsibility and prevent any one person or group from easily gaining control over the Bitcoin project. Eventually, Bitcoin.org became an “open source” project with contributors from around the world. Final publication authority is held by the co-owners, but all regular activity is organized through the public pull request process and managed by the site co-maintainers.

Just a few short years ago no one had heard of them and now it seems like everybody on the Earth knows about Bitcoin. Bitcoin (a peer-to-peer electronic cash system) was first introduced in October 2008 by two unknown programmers known as alias “Satoshi Nakamoto” and Martti Malmi. When Nakamoto left the project, he gave ownership of the domain bitcoin.org to additional people, separate from the Bitcoin developers, to spread responsibility and prevent any one person or group from easily gaining control over the Bitcoin project. Eventually, Bitcoin.org became an “open source” project with contributors from around the world. Final publication authority is held by the co-owners, but all regular activity is organized through the public pull request process and managed by the site co-maintainers.

In 2012, at InflationData, we published an article entitled “Civil Liberties Rest Upon Sound Money” about the new currency. Since then the use of bitcoins has grown astonishingly quickly. Being the prescient financial wizards that they are, in 2014 Robert Prechter and our friends at Elliott Wave International began offering their expert financial advisory and educational materials for sale via Bitcoins.

Year after year bitcoins have become better known, but it was not until 2015 that the number of merchants accepting bitcoins for products and services crossed the 100,000 barrier, among them were some of the leading merchants… including Subway, PayPal, Microsoft, and WordPress.

Today there are some 14.6 million bitcoin units in circulation. With the help of bitcoins, you can buy computers on Tigerdirect.com, you can buy pretty much anything on Overstock.com, and you can also send small amounts of currency to people in other countries, without worrying about exchange rates or currency conversion fees. You can even buy cookies, pizzas, and get financial advice for bitcoins.

Advantages of Bitcoin

According to Bitcoin.org there are several advantages to this form of cryptocurrency:

- Payment freedom – It is possible to send and receive bitcoins anywhere in the world at any time. No bank holidays. No borders. No bureaucracy. Bitcoin allows its users to be in full control of their money.

- Choose your own fees – There is no fee to receive bitcoins, and many wallets let you control how large a fee to pay when spending. Higher fees can encourage faster confirmation of your transactions. Fees are unrelated to the amount transferred, so it’s possible to send 100,000 bitcoins for the same fee it costs to send 1 bitcoin. Merchant fees can be lower than PayPal and credit card fees.

- Fewer risks for merchants – Bitcoin transactions are secure, irreversible, and do not contain customers’ sensitive or personal information. This protects merchants from losses caused by fraud or fraudulent chargebacks, and there is no need for PCI compliance. Merchants can easily expand to new markets where either credit cards are not available or fraud rates are unacceptably high. The net results are lower fees, larger markets, and fewer administrative costs.

- Security and control – Bitcoin users are in full control of their transactions; it is impossible for merchants to force unwanted or unnoticed charges as can happen with other payment methods. Bitcoin payments can be made without personal information tied to the transaction. This offers strong protection against identity theft. Bitcoin users can also protect their money with backup and encryption.

- Transparent and neutral – All information concerning the Bitcoin money supply itself is readily available on the blockchain for anybody to verify and use in real-time. No individual or organization can control or manipulate the Bitcoin protocol because it is cryptographically secure. This allows the core of Bitcoin to be trusted for being completely neutral, transparent, and predictable.

But Bitcoin is still not perfect. Bitcoin.org admits there are still some drawbacks of bitcoin.

What are the disadvantages of Bitcoin?

- Degree of acceptance – Many people are still unaware of Bitcoin. Every day, more businesses accept bitcoins because they want the advantages of doing so, but the list remains small and still needs to grow in order to benefit from network effects.

- Volatility – The total value of bitcoins in circulation and the number of businesses using Bitcoin are still very small compared to what they could be. Therefore, relatively small events, trades, or business activities can significantly affect the price. In theory, this volatility will decrease as Bitcoin markets and the technology matures. Never before has the world seen a start-up currency, so it is truly difficult (and exciting) to imagine how it will play out.

- Ongoing development – Bitcoin software is still in beta with many incomplete features in active development. New tools, features, and services are being developed to make Bitcoin more secure and accessible to the masses. Some of these are still not ready for everyone. Most Bitcoin businesses are new and still offer no insurance. In general, Bitcoin is still in the process of maturing.

How is Bitcoin’s Value Determined?

The price of a bitcoin is determined by supply and demand. When the demand for bitcoins increases, the price increases, and when demand falls, the price falls. There is only a limited number of bitcoins in circulation and new bitcoins are created at a predictable and decreasing rate, which means that demand must follow this level of inflation to keep the price stable. Because Bitcoin is still a relatively small market compared to what it could be, it doesn’t take significant amounts of money to move the market price up or down, and thus the price of a bitcoin is still very volatile.

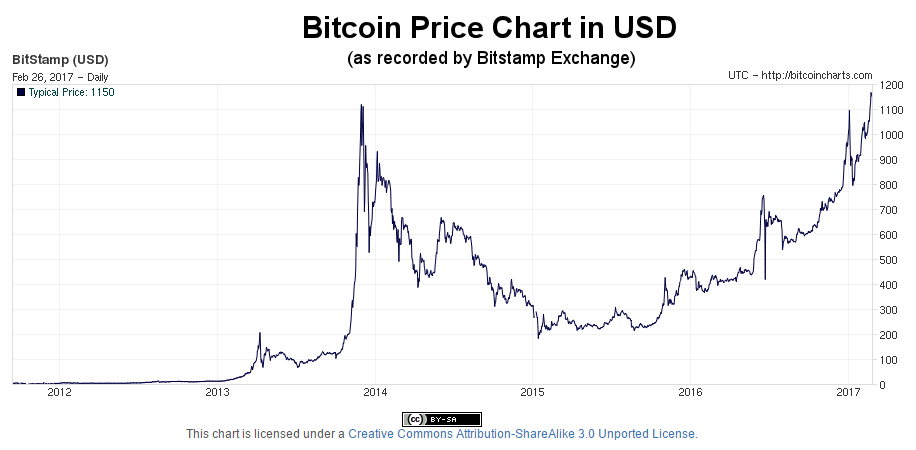

Bitcoin price peaked in late 2013 after a major mania developed. The bubble popped as the bitcoin exchange in Tokyo “Mt. Gox” is shut down due to “theft, fraud, mismanagement, or a combination of these”. According to Gizmodo, “Version 0.9.0 of the “Bitcoin Core” software includes five significant changes to help prevent attacks on the currency. The weakness which appears to have led to the Mt. Gox debacle saw malformed transactions similar, but not identical, to legitimate transactions already processed fool the Bitcoin software. In turn, those illegitimate records didn’t sync with the official Bitcoin blockchain, and funds were then incorrectly calculated. Now, though, those mutated transactions can no longer be relayed or mined, and discrepancies such as mutations or doubles-spends within wallets are now reported immediately.”

In other words, because it is open-source software, as soon as a vulnerability is detected the cyber-community rushes in to create a solution and the end product is more secure than it was initially. So the Bitcoin core is constantly being analyzed and upgraded in addition to being redundantly stored on sites around the world.

Throughout 2014 the price of bitcoins fell and eventually bottomed in 2015 at around $200. From there it worked its way higher and as of this writing it is trading at or above the previous 2013 high.

Bitcoins are Finite

One major problem with most currencies is that there is nothing to stop governments from printing an infinite amount of them. This erodes the value of the existing currency and can cause them to become worthless through hyperinflation like the currencies of the German Weimar Republic and Zimbabwe.

Bitcoin is unique in that only 21 million bitcoins will ever be created. However, this will never be a limitation because transactions can be denominated in smaller sub-units of a bitcoin, such as bits – there are 1,000,000 bits in 1 bitcoin. Bitcoins can be divided up to 8 decimal places (0.000 000 01) and potentially even smaller units if that is ever required in the future as the average transaction size decreases.

How does Bitcoin work?

From a user perspective, Bitcoin is nothing more than a mobile app or computer program that provides a personal Bitcoin wallet and allows a user to send and receive bitcoins with them. This is how Bitcoin works for most users.

Behind the scenes, the Bitcoin network is sharing a public ledger called the “blockchain”. This ledger contains every transaction ever processed, allowing a user’s computer to verify the validity of each transaction. The authenticity of each transaction is protected by digital signatures corresponding to the sending addresses, allowing all users to have full control over sending bitcoins from their own Bitcoin addresses. In addition, anyone can process transactions using the computing power of specialized hardware and earn a reward in bitcoins for this service. This is often called “mining”.

To learn more about bitcoin go to the Bitcoin.org FAQ.

Below there’s a wonderful infographic “The Rise and Rise of Bitcoin” created by Total Processing which will give you an idea of the history and progress of this cryptocurrency’s flow. It describes the yearly improvements of the bitcoin system.

You might also like:

- Bitcoin Trends

- Cryptocurrency: Is Bitcoin the Future of Money?

- Bitcoin: The New Safe Haven?

- Oil Is Now More Volatile Than Bitcoin

fintrend.com is very informative but it loads very slow. You should use caching plugin-in buddy

Payza,

Thanks! We do use a caching plugin but have experienced a lot of Denial of Service attacks lately. Sorry.