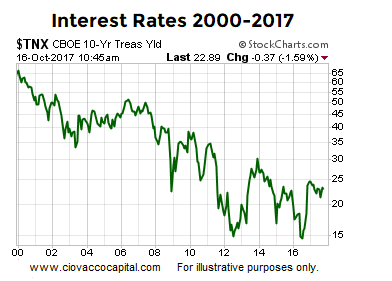

Lower Rates Longer

When interest rates are low and economic data is improving, stocks typically get an added opportunity-cost boost relative to bonds. From The Wall Street Journal:

“Leaders of the world’s largest central banks indicated that weak inflation in advanced economies could prolong the post-crisis era of easy-money policies. Despite a broad-based improvement in the global economy, wages and consumer prices remain stubbornly low, making central bankers wary of removing their stimulus measures too quickly, they told a Group of 30 banking conference here on Sunday.”

The Voice Of Experience

Given the favorable tailwinds for equities, this week’s video explores a prudent question:

What Advice Would Jesse Livermore Have For Investors In 2017?

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode.

Hit Esc to exit full-screen mode.

Valuations Impacted By Low Rates

In his characteristically unshakeable manner, Buffett opines on the elevated market with CNBC’s Becky Quick: “We’re not in a bubble territory or anything of the sort.” In fact, he argues, “measured against interest rates, stocks actually are on the cheap side compared to historic valuations.”

See Also:

- Bitcoin Trends

- The “Amazon Effect” Is Coming To Oil Markets

- Bulls, Bears and Fed Bond Purchases

- Gold Production

- The $10 Trillion Resource North Korea Has But Can’t Tap

This article by Chris Ciovacco of Ciovacco Capital Management originally appeared here and has been reprinted by permission.