For the last decade we have seen a rapid rise in student debt, with graduates now leaving college with an average $37,173 in student debt, 70 percent more than a decade ago. By now, you may have heard that America’s student loan debt topping $1.4 trillion as of April this year. As we try to understand how the United States’ economy got to this point and what we can do about it, there are a few noticeable trends to keep in mind. Here are three of them:

Private Loans are on the Rise

Despite their higher interest rates, private funding is becoming more sought out as more Americans head into higher education. In 2011-12, after the credit crunch, the private loans volume in America was $5.2 million. In 2014-15, that number had risen to $7.5 million and for 2016-17, private loan originations increased 5.6 percent. This brought the total private loans to $63.95 billion, of which 84 percent was attributed to undergraduate loans.

What has influenced this increased reliance? Well, according to CollegeBoard.com, students are increasingly trying to bridge the gap left between their federal funding and the increased cost of college each year.

More Students are Leaving School with Debt

In 2016, almost 70 percent of undergraduate student were graduating with not only their bachelors degree but also over $37000 in student debt. In 2015, graduates left school with $35,000 in debt.

Sadly, most Americans carry their student loans into their 40s, with approximately 60 percent of them expecting to pay off their loans in their 40s. This is twice as long as the standard repayment plan. So what is driving this delay? Well the 3-5 percent year on year increase in tuition certainly puts a strain on finances along with the rising interest rates on federal loans.

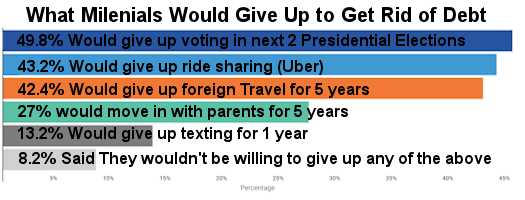

According to Credible.com millenials are willing to take some pretty drastic steps in exchange for loan forgiveness:

But perhaps the problem isn’t as bad as we think. After all, only 27% would be willing to suffer the horrors of living with parents in exchange for eliminating student debt and a scant 13.2 % would be willing to give up texting for a single year in exchange for eliminating their entire student debt.

Federal Loan Default Rate- Up

The federal student loan default rate increased a worrying 17 percent from 2015. Borrowers are struggling to repay their loans with 4.2 million Americans defaulting on their loans as of the end 2016. This rise has been linked to the rise in college tuition and also the percentage of student who complete their college degrees. Interestingly, households with private loans showed a declined default rate.

Increased burden from higher monthly student loan repayments have played a huge part in Americans making life changing decisions later in life including buying a home. It is taking a longer time to save deposits and many young Americans are willing to seek loan forgiveness or face a lowered credit score from defaulting. So what can we do?

Many Americans remain unaware of the various repayment options available to them including refinancing and loan forgiveness. Better education and incentives such as tax breaks, are needed about student loans and its options, aimed specifically at high school seniors considering college.

Another solution would be to lower the interest rates on federal loans and make more funds available to subsidize state colleges. By doing so, it will decrease reliance on private funding and also reduce the repayment amounts. Extension of repayment terms from the current term of 10 years and also linking repayments to income levels are also worth exploring.

Generally, having a college degree is meant to give individuals greater ability and earning power. It acts as the stepping stone for some of the most important decisions in life including buying your first home. However, America’s student debt continues to pile up and with the rising cost of education, it will continue to hamper economic growth for years to come. Economic pressure continues to grow on both households and federal resources and loan repayments continue to be pushed to the backseat as other financial obligations take precedence.

You might also like: