Like all modern debt-based economies China fears deflation. Governments borrow money and then continue to “roll it over” ad infinitim. This means high inflation allows them to repay their debt with cheaper dollars (or Yuan). Debt-based economies are like giant Ponzi schemes they have to continue to grow or they implode. Without inflation, the “house of cards” collapses. Deflation is the opposite of inflation and means that money is getting more valuable rather than less valuable, putting the whole scheme in danger.

From 2014 through 2022, China experienced moderate inflation averaging around 2%. But beginning in 2023 inflation began dropping as we can see in this chart from Macrobond.

Shanghai Stock Exchange

Shanghai Stock Exchange

Although stocks are not considered part of the M2 money supply they are a form of wealth and global liquidity. When the stock market decreases people feel poorer and become less liquid. In June 2015, the Shanghai Stock Exchange Composite Index peaked at 5166.4 but by December 2018 it had fallen to 2493.9 losing over half of its value. From there it rallied through September 2021 gaining back some of its losses to just over 3700.

Three years later, in Mid-September 2024, the stock market had ground its way ever lower to just over 2700. This is a major loss over an eight-year period. During the same period the NYSE had gone from around 10,000 to just under 20,000. So, the Chinese government was getting desperate. The U.S. FED was maintaining a tight money supply policy and if China tried to loosen it could suffer from Currency exchange issues.

Money goes where it is treated best, so if China lowers interest rates to try to increase liquidity, but another country pays a higher rate, investors will simply sell the low-rate currency and invest in the higher-rate currency. This tends to negate the loose money supply policy because all the excess liquidity will flow to the currency paying the higher rate.

China’s Real Estate Market

Unfortunately for China, the Stock market wasn’t its only problem. China’s Real Estate Market has been collapsing as well. And once again this is deflationary.

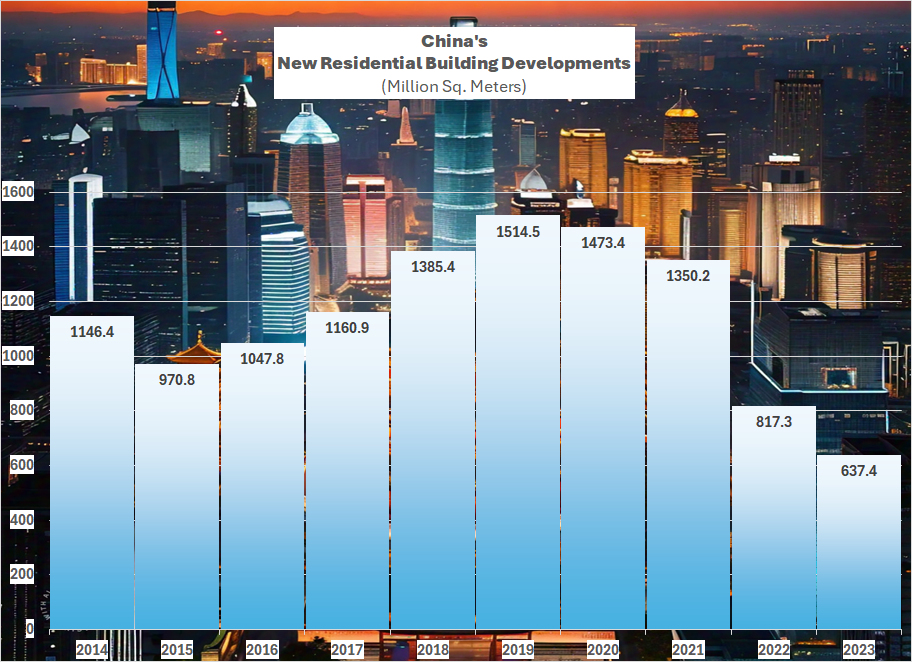

Beginning in 2015 China was building like crazy. Investors could borrow money on speculative building projects and average “retail” investors believed Real Estate was the path to becoming a Millionaire. So, millions of square feet of building projects were started without worrying about who was going to live there. Eventually, the bubble burst and builders went bankrupt with many of the projects going unfinished. So, as you would expect by 2023 new building is only a fraction of the building just a few years ago.

Based on these deflationary factors the Chinese Government was desperate to loosen the money supply.

The Chinese Government Fires its Monetary Bazooka

When the FED Signalled that it would be easing China took that as a signal to go “all-in” on easing. The FED lowered the FED funds rate by ½% and the Peoples Bank of China (PBOC) lowered its reserve requirement by ½% (50 basis points). This means banks have an additional 1 trillion Yuan to lend and with Fractional Reserves that can multiply even further.

In addition, the PBOC reduced its “seven-day reverse repurchase rate” from 1.7% to 1.5%. They also cut rates for their “medium-term lending facility (MLF) and they cut their prime rate by 20-30 basis points. All of these actions combined drastically reduce borrowing costs, stimulate economic activity, and boost liquidity.

The PBOC also cut mortgage interest rates by ½% and lowered the minimum downpayment for a mortgage from 25% to 15% this should make housing accessible to many more people. Hopefully, absorbing some of the excess real estate. They also made cheap loans available to local governments who want to buy some of that excess real estate. These loans are now available to cover 100% of the loan amount!

To provide extra liquidity to boost the stock market, the PBOC created an 800 billion yuan ($113 billion) swap program for insurers, brokers, and funds to buy stocks. In addition, they’ve made $42.5 billion available to Commercial Banks for stock market interventions.

Calling this a Monetary Bazooka is no overstatement this is a massive boost in liquidity and it has already begun to have effects on the markets.

Market Effects

Liquidity tends to boost markets around the world and they have had the intended stimulative effect on the Shanghai Market as it rocketed from the September 13th low of 2704.1 to 3336.5 on September 30th. Just the thought of all this additional liquidity has also goosed markets around the world.

The NYSE is up roughly 2% from 19,121.50 on September 13th to 19,516.44 on September 30th. This is perhaps due more to the FED rate cut than China’s stimulus. The U.K. FTSE 100 started the year bullish but has been trending sideways since May and hasn’t changed much since mid-September. After crashing on August 5th to 31,458 when the BOJ lowered rates it has since rebounded to 38,701 on September 2nd. Then it fell to 35,620 on September 11th then rebounded to 39,830 before settling at 38400 on September 30th.

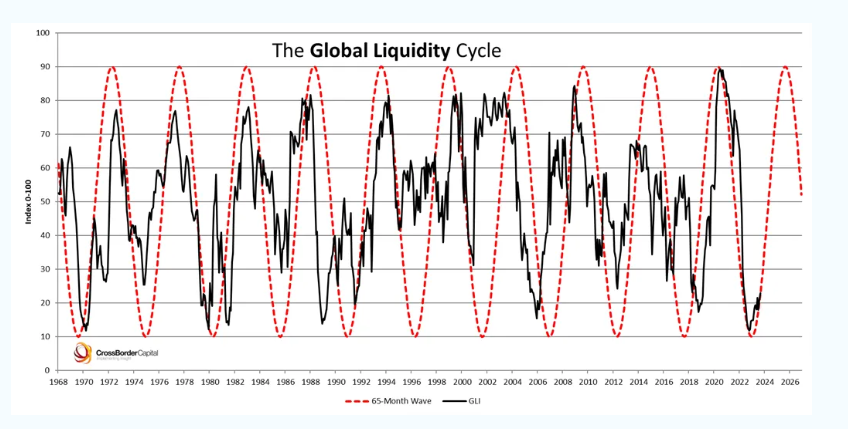

The Global Liquidity Cycle

Global Liquidity tends to be cyclical. The stylized 65-month cycle is in red and the actual Global liquidity is in black.

According to the extrapolated data, the Global Liquidity Cycle should next peak around September 2025, following its December 2022 trough.

You can read more about the Global Liquidity Cycle here.

You might also like:

- How Much is the Money Supply Growing?

- Is Gold Overpriced?

- How Washington and the Fed Caused the Commercial Real Estate Crisis