We’ve collected a variety of calculators in order to help you with your financial analysis.

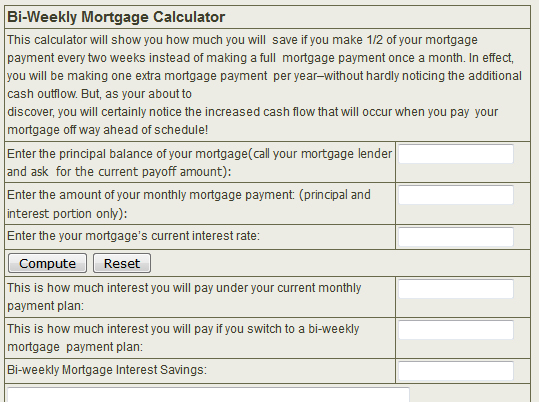

Bi-Weekly Mortgage Calculator

Save thousands of dollars with this painless method. Bi-Weekly mortgage payments drastically reduce the interest paid and the time to pay off your mortgage! Read More about how a Bi-Weekly Mortgage works.

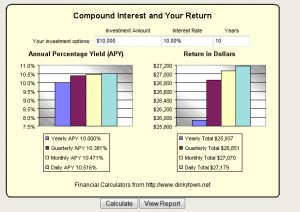

Compound Interest Calculator

Compound Interest has the ability to multiply money almost magically. There is a story that Einstein was once asked, “What is the most powerful force in the universe?” his immediate response was “Compound Interest”.

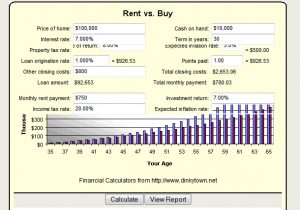

Rent vs. Own Calculator

Should you rent or should you buy your own home? For many years this has been an easy decision, it was everyone’s dream to be able to buy a house and with low interest rates more and more people were able to afford it. Plus rapid appreciation in home values made owning almost a “no-brainer”. But with home prices falling it is becoming more difficult to justify a home purchase. This calculator will take the guess work out of the decision and help you decide which is better financially.

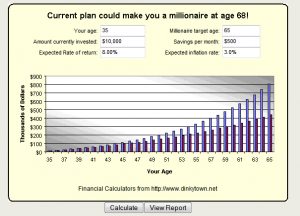

Millionaire Calculator

What will it take for you to save One Million Dollars? This Millionaire Calculator helps you find out.

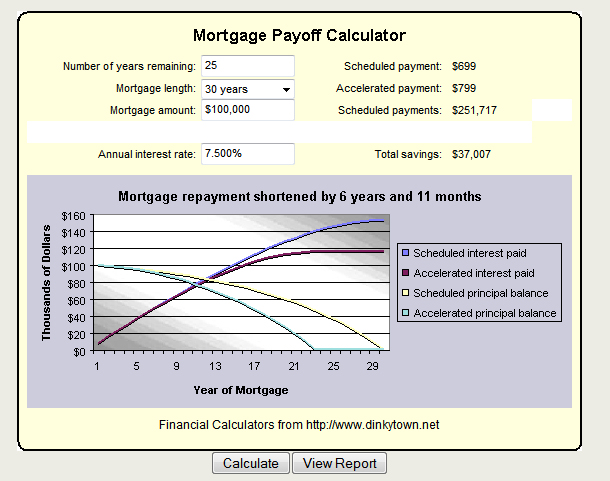

Mortgage Payoff Calculator

Paying Off your mortgage early will literally save you thousands upon thousands of dollars in interest payments over the life of your loan. It always amazes me how just a few extra dollars a month in payments can drastically reduce how much interest you pay over the life of your loan. This calculator will help you see how mucch you can save.

Salary Inflation Calculator

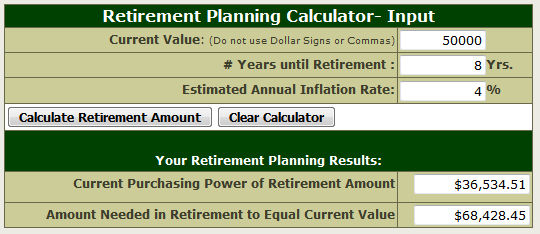

Retirement Planning Calculator

This calculator takes the amount of money you think you will need for retirement, for instance $1,000,000 ($1 Million) or an annual amount like $50,000 and allows you to input the number of years until you retire and then you input your estimate of the annual inflation during those years (say 4%) and the calculator will tell you how much you will need in future dollars to have the same purchasing power as the current amount you think you will need.