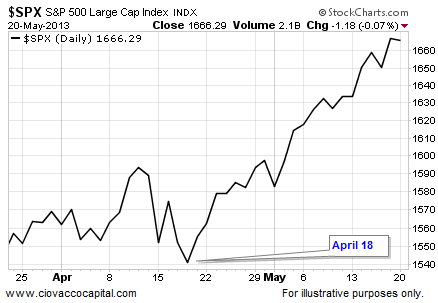

Since the S&P 500 made an intraday low of 1,536 on April 18, the widely-followed stock index has tacked on 130 points and the markets have migrated back to full-bore risk-on mode.

Wednesday Wind-down?

Two key events this Wednesday could give investors an excuse to book some profits:

- Federal Reserve Chairman Ben Bernanke will speak before Congress.

- Fed minutes are due to be released.

There appears to be little evidence to suggest Bernanke will drift from his recent guarded optimism stance on the economic outlook, which means his comments may be stock market-friendly. On the Fed minutes front, the release is based on the meeting when the statement “The Committee is prepared to increase or reduce the pace of its purchases…” was added. The key term was “increase”. Therefore, the minutes may prove to be dovish or stock market-friendly as well.

Hard To Predict Market’s Reaction

Even if we had advance copies of Bernanke’s speech and the Fed minutes, it would be difficult to predict the reaction of the fickle financial markets. Therefore, the best way to handle Wednesday’s Fed-related events may be to see how traders react and make allocation tweaks if needed.

Bulls Have Tight Grip

With unprecedented and simultaneous intervention from central banks in the United States, Europe, and Japan, one of the best ways to stay aligned with money-making opportunities is to simply pay attention to what is happening and what is working. As demonstrated in the video below with various charts, ratios, and markets, what “is happening” is the bulls are in complete control.

Aston Martins and Acquisitions

The bull/bear debate always comes down to the risk tolerance and confidence of investors. Bloomberg reported a 1961 Aston Martin Jet took in a record $4.85 million at auction last weekend, which tells us someone is confident. Similarly, Yahoo’s reported acquisition of Tumblr shows companies are willing to trade cash for what they see as growth opportunities.

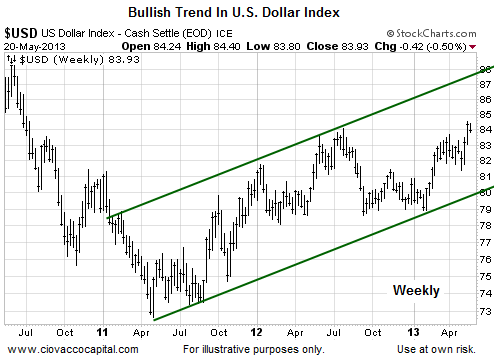

Weak Dollar Script Not Working

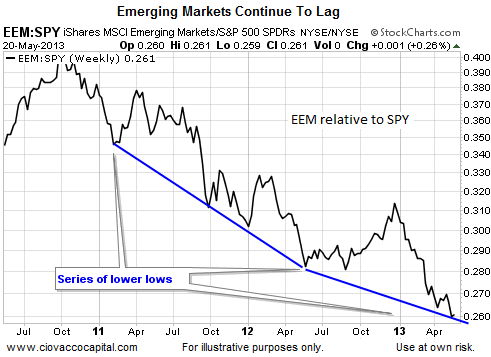

In recent weeks, we have been favoring U.S. stocks over emerging markets (EEM), precious metals (GLD), and commodities (DBC) due in part to ongoing strength in the U.S. dollar (UUP).

The “risk-on” script over the past several years has been for “weak dollar” assets, such as emerging markets, to lead during periods of increasing risk appetite. With a strong U.S. dollar in play, emerging markets continue to lag the S&P 500 rather than lead (see below).

Materials: The Most Important Sector?

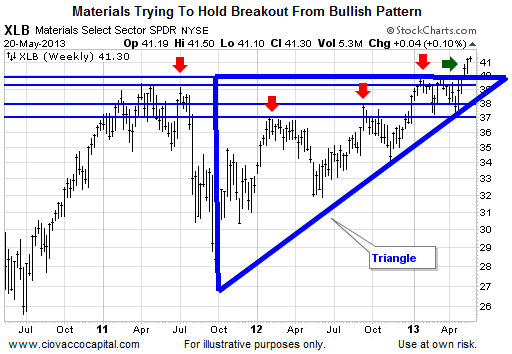

As we will cover shortly, stocks recently broke out in a bullish manner relative to bonds. Materials stocks, a recent market laggard, are trying to complete a similar push higher. When laggards begin to “catch up”, it is typically a good sign for the entire stock market. As shown in the chart below, the materials ETF (XLB) was turned back at several points of logical resistance over the past two years (see red arrows). The green arrow highlights a breakout above a typically bullish chart pattern know as a “triangle”. If materials continue their ascent, the S&P 500 could push significantly higher.

Risk-On Beating Risk-Off

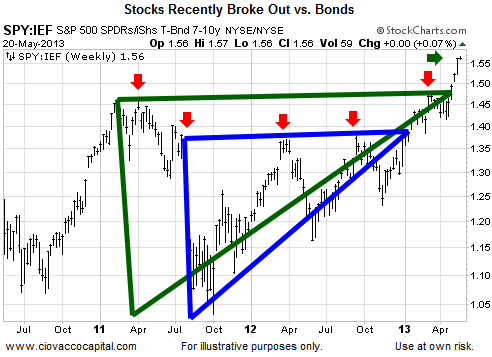

The monthly labor report released in early May gave many investors renewed economic confidence. A logical and often pondered question is would I rather be in stocks or in bonds. The stock/bond ratio below [(SPY) vs. (IEF)] rises when stocks are in greater demand relative to bonds. Conversely, the ratio falls when investors have a greater desire to buy bonds relative to stocks. The red arrows below show numerous occasions during the last two years where stocks failed at logical points of resistance. The green arrow highlights a breakout above a typically bullish chart pattern known as a triangle. The chart below also represents a bullish breakout by risk-on relative to risk-off. As long as the chart below maintains its bullish look, we will favor stocks (VTI) over bonds (TLT).

Investment Implications

Investment Implications

As noted in the charts and video above, the bulls have a firm grip on the markets (as of the close on May 20). Using the “pay attention to what is happening” approach, as long as conditions continue to favor bullish outcomes, we will favor stocks over fixed income instruments. If emerging markets and materials stocks can begin to show leadership, we would also be more inclined to favor economically sensitive or cyclical ETFs, such as financials (XLF), over more defensive sectors, such as consumer staples (XLP).

See Also:

- The Greatest Wealth Transfer in History

- Stock Market: When Do I Buy a “Buy”?

- Natural Disasters That Have Created Investment Opportunities

- Stock Market Basics

- The State of the Toronto Stock Exchange

Recommended by Amazon:

- A Beginner’s Guide to Investing: How to Grow Your Money the Smart and Easy Way

- Investing 101

- The Neatest Little Guide to Stock Market Investing: 2013 Edition

- Strategic Stock Trading: Master Personal Finance Using Wallstreetwindow Stock Investing Strategies With Stock Market Technical Analysis

- The Five Rules for Successful Stock Investing: Morningstar’s Guide to Building Wealth and Winning in the Market