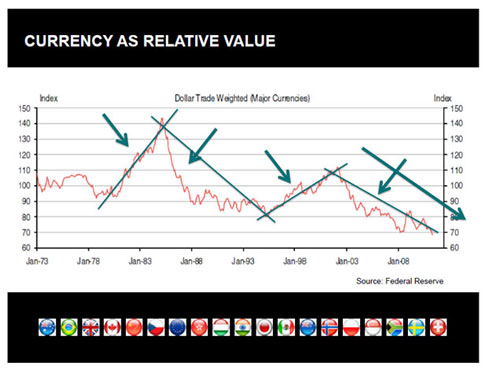

Is the Dollar Really King?

In addition to saving yourself time and worries by mostly ignoring public information, learning to discern the difference between good and bad information can lead to better decision making, in your everyday life, and in your investments. As a case in point, during the conference here, someone in the audience asked a question about quantitative easing. Doug Casey took hold of the microphone and replied along the lines of, “People need to stop using constructs such as ‘quantitative easing.’ Those are just terms that politicians have come up with to obfuscate the truth. The proper term for quantitative easing is currency debasement, plain and simple.”

Is the Dollar Really King? Read More »