Oil Rally Reaching Limit

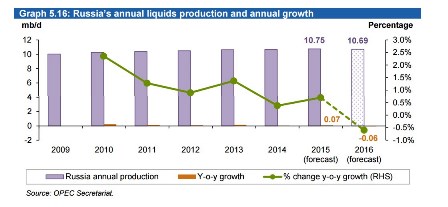

Oil prices have rallied by about 50 percent from their February lows, topping $40 per barrel. But the rally could be reaching its limits, at least temporarily, as persistent oversupply and the prospect of new shale production caps any potential price increase.

U.S. oil production has steadily lost ground over the past two quarters, with production falling more than a half million barrels per day since hitting a peak at nearly 9.7 million barrels per day (mb/d) in April 2015. American oil companies have gutted their budgets and have put off drilling plans, with many projecting absolute declines in 2016.

Oil Rally Reaching Limit Read More »