Renewable Energy Trends in 2019

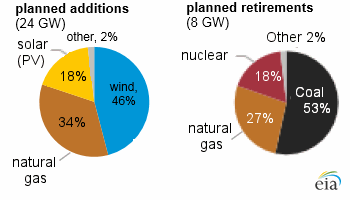

According to a new report from the U.S. Energy Information Administration (EIA) 2019 will be a good year for renewables. A whopping 46% of new electricity production will come from Wind power and 18% will come from Solar Photovoltaic power with the remaining increase coming from clean burning Natural Gas for a total increase in generating capacity of 24 gigawatts (GW). On the other hand, 8 gigawatts (GW) of electrical generating capacity will be retired this year 53% of that will be coal fired, 27% natural gas and 18% will be nuclear powered plants.

Renewable Energy Trends in 2019 Read More »