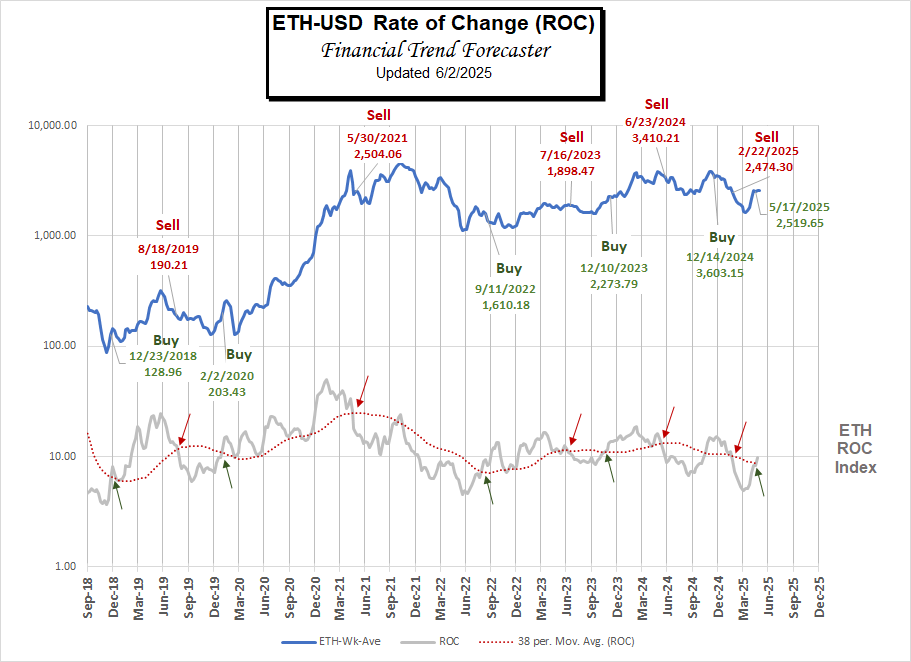

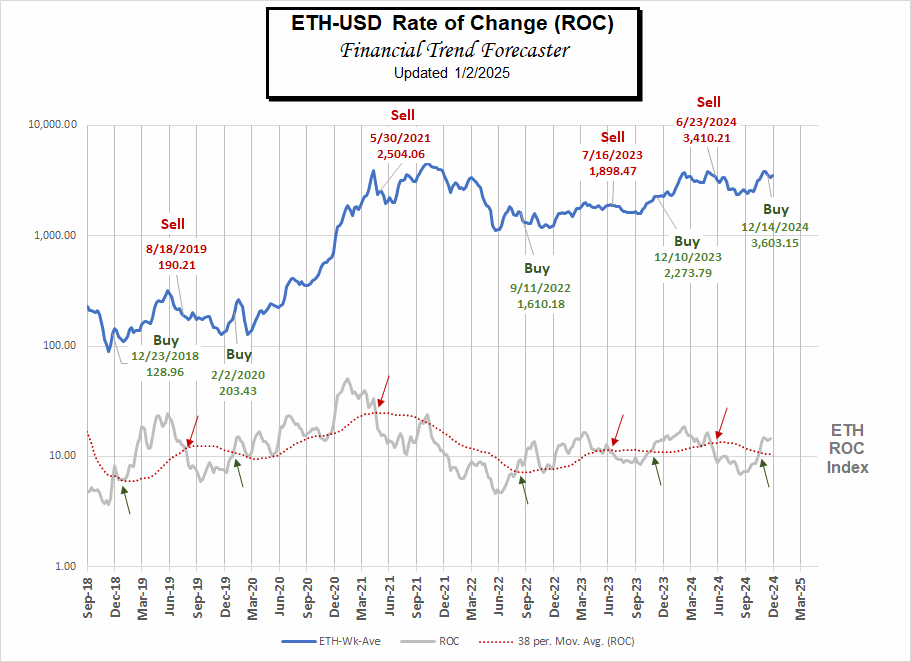

Discover why the crypto bear market may have started in January 2025, according to Bitwise CIO Matt Hougan. While many investors watched Bitcoin soar, hitting its all-time high (ATH) of $126,198 on October 5, 2025, underlying market weakness was quietly building. Retail-focused altcoins had already begun rolling over, and institutional inflows temporarily masked the downturn.

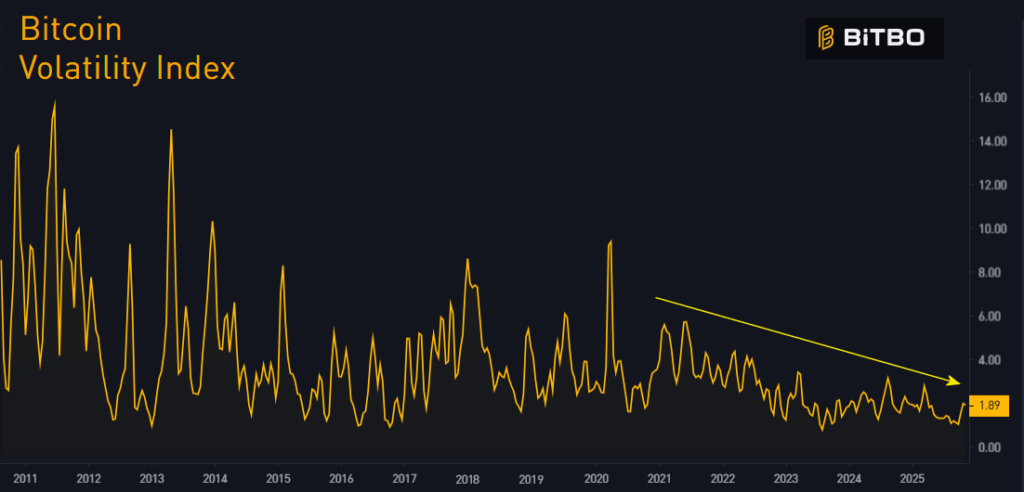

Hougan’s analysis contrasts with W.D. Gann’s principle that “time is more important than price”, highlighting that market cycles often shift before headline prices reflect them. Another key factor is the rise of “paper Bitcoin,” with ETFs and custodial products creating synthetic supply that could influence volatility and scarcity.

Understanding these dynamics is crucial for investors. Paying attention to time cycles, market sentiment, and actual on-chain supply can help you navigate bear markets, preserve capital, and identify long-term opportunities in crypto. Don’t just watch BTC price; watch the cycles beneath it.