Can Saudi Arabia Prevent The Next Oil Shock?

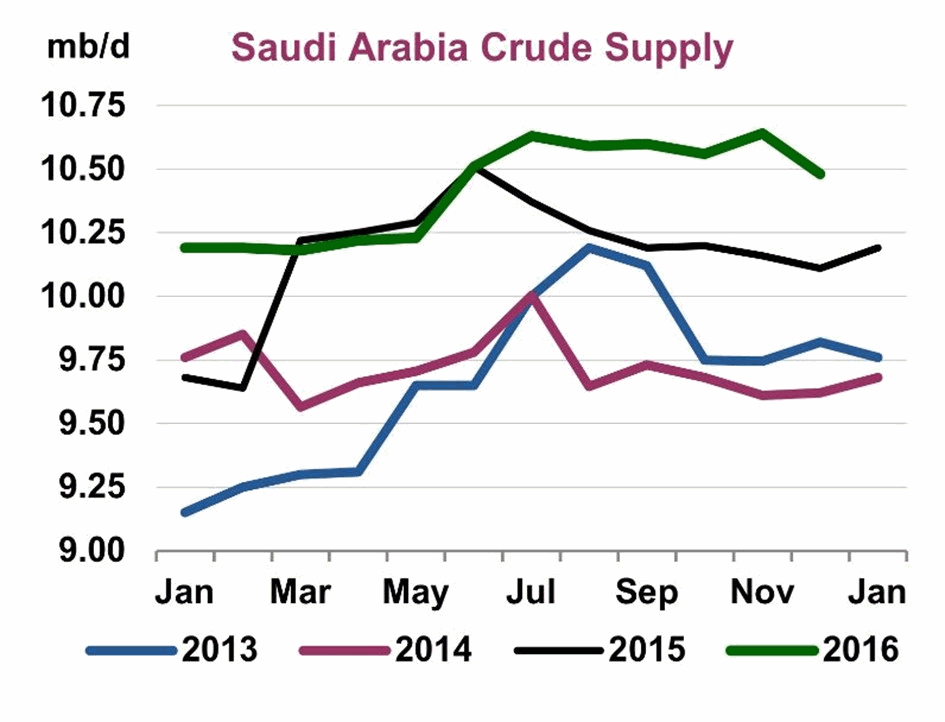

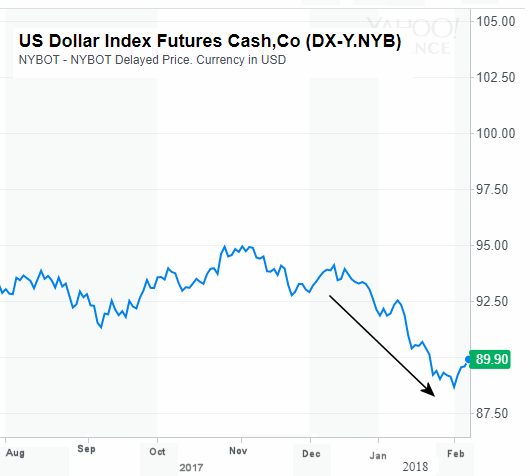

Current volatility in the global oil market is, according to most analysts, due to fears that markets are facing a severe threat. A doomsday scenario is being painted in the media which suggests that oil prices will collapse as Moscow and Riyadh allow for OPEC compliance to slip, and that a glut of Saudi crude will be hitting the market. This assumes that Saudi Arabia is able to produce at least 12.5 million bpd, But no one has really assessed the Saudi spare capacity capabilities…

Can Saudi Arabia Prevent The Next Oil Shock? Read More »