What about Tax Deferred Retirement Accounts?

According to Investopedia:

The most common types of tax-deferred investments include those in individual retirement accounts (IRAs) and deferred annuities.

By deferring taxes on the returns of an investment, the investor benefits in two ways. The first benefit is tax-free growth: instead of paying tax on the returns of an investment, tax is paid only at a later date, leaving the investment to grow unhindered. The second benefit of tax deferral is that investments are usually made when a person is earning higher income and is taxed at a higher tax rate. Withdrawals are made from an investment account when a person is earning little or no income and is taxed at a lower rate.

But…

There is One Question that Should Make Every Long Term Investor Shudder

“Do you think that taxes will be higher or lower in the future?”

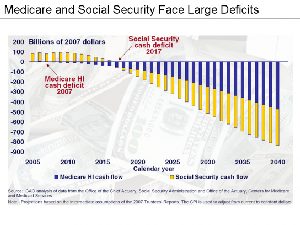

What is your very first reaction to that question? If you are like most it is a roll of the eyes, a frustrated ‘oh-come-on’ sort of sigh and an answer that sounds something like “higher of course.” Most Americans believe that at some point in our future taxes in the United States will have to be increased. Why is this? Well because most Americans are blessed with a little bit of common sense. They may not understand the nuance of the rising debt crisis in Western Europe or even know what the term austerity means, but they do know that social security has funding problems in the future, they know that baby boomers are all over 60, and they understand that Medicare is leaking as well.

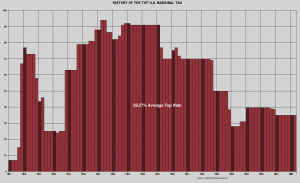

Compound this fact with the reality that our top tax rates right now are actually low relatively speaking. The second chart illustrates what the top tax rate has been in the United States since the beginning of the 20th century. This is why common sense in America makes almost everyone answer the ‘are taxes going higher question’ with that aforementioned ‘oh-come-on’ exasperated sigh.

Federal spending in the red, marginal tax rates low (historically speaking), Western Europe being torn apart over the notion of austerity. Hopefully the picture is coming into focus, somewhere at some point in the future taxes almost have to be raised.

What does this mean for the average individual who has diligently been investing as much as possible in long-term tax deferred savings vehicles like a Traditional IRA or 401k?

Retirement is going to be more expensive that they thought. Or the money that was supposed to last forever just might not last forever, and efforts to make it last forever will result in a severely modified lifestyle during the years in life when most hope that money will no longer dictate how they are forced to live their lives.

Tax Deferred Retirement Account

We’ll assume an income tax rate of 28%. If this individual wants to maintain a $100,000 per year income, they will have to withdraw $100,000 from their tax deferred retirement account plus enough to cover taxes. If all the contributions to the tax deferred retirement account were made with pre-tax money 100% of the distribution will be taxable.

If this individual wants to maintain a $100,000 per year income they will have to withdraw approximately $140,000 from their savings, with $39,000 or so going to Federal and State taxes. This will allow the individual to live on those funds for about 19 years. But in year twenty the account is drained.

The alternative, most would argue, is that they intend to live off of the interest on their savings. Traditional calculations often assume a 5% interest rate this gives the same individual $100,000 to withdraw each year resulting in a net income after taxes of about $72,000. This will keep the principal of the investment whole for the remainder of their lives, but with current interest rates near zero where are you going to earn a safe 5% after inflation?

The Effects of Higher Tax Rates on Tax Deferred Retirement Income

Now imagine the same individual who is drawing on the same savings account has an income tax of say 30% or 35%. While it is impossible to know what the tax rates will be in the future the information above in this post illustrates why it is reasonable to suggest that income tax rates will indeed be higher at some point in the not too distant future. Now one objection to this line of thought is that most accountants will tell their clients that their income tax rate will be lower later in life. But most don’t strive to end up in a lower tax bracket; they want an income that allows them to live the lifestyle to which they are accustomed.

To be fair the example is purely hypothetical, but there is merit to considering how federal income tax is going to impact your retirement income. And once evaluated, steps must be taken to map out a plan that will take into account realistic possibilities of the tax code at the time of withdraw from tax deferred savings accounts.

Alternatives to a Tax Deferred Retirement Account

One thing you might consider is shifting a portion of your Tax Deferred Retirement Account into a Prepaid Tax Retirement Account like a Roth IRA since distributions on these type of accounts are tax-free as long as they meet certain requirements. If you are making new contributions to a Roth IRA they are made in “after tax” dollars. If you are transferring money from a Tax Deferred Retirement Account like your traditional IRA you must prepay the taxes on the transferred amount. The advantage is that the money will then be able to grow tax-free (including any capital gains) and you will not have to worry about tax implications after retirement.

About the Author:

Dean Vagnozzi is an independent financial advisor who founded A Better Financial Plan. His strategies focus on helping investors of any type discover the best way to invest money in a manner that fits their lifestyle and cash flow, putting them on a path to a tax free retirement.