Often we have preconceived notions about what affects the price of gold. Commonly it is believed that inflation is the primary factor in the price of gold but in an article entitled Is Gold really a good Inflation Hedge? I showed the history of Gold and how it really was a fear hedge rather than an inflation hedge. Over the long term gold is a commodity and it tends to hold its value well compared to other commodities. But in the short run it is a commodity and is affected by supply and demand factors just like any other commodity. Over the last 10 years gold has increased at a much higher rate than inflation. If gold was a pure inflation hedge that could not happen. So there are other factors as well. One is interest rates. Gold does well when interest rates are low since it doesn’t have to compete against other things that pay higher yields (since gold doesn’t pay a dividend). In today’s article Jeff Clark looks at the effects of the economy on the price of gold. He shows some interesting charts that at a quick glance don’t make any sense. But it is worth a second look. ~Tim McMahon, editor

The Economy vs. The Price of Gold

By Jeff Clark, Senior Precious Metals Analyst

Despite some positive data, the global economy is showing signs of slowing, a remarkable development in itself when you consider all the money printing and deficit spending that’s transpired over the past few years. According to the IMF’s overview, global growth was less than expected in the first quarter of 2013, at just over 3%, which is roughly the same as 2012. The lower-than-expected figures were driven by significantly weaker domestic demand and slower growth in emerging-market economies, a deeper recession in the euro area, and a slower US expansion than anticipated. The report concludes that the prospects for the world economy remain subdued.

Many investors consider a weak economy to be a bearish environment for commodities, including gold. Doug Casey says we have entered into what will become known as the Greater Depression. That’s as bearish as it gets, so should we expect gold to decline if the bears are right?

One of the most rocky economic periods in modern times was the late 1970s. For those who don’t remember, the period was characterized by:

- Unexpected jumps in oil prices, leading to soaring gasoline prices and rationing

- A falling dollar

- High and accelerating inflation

- Record interest rates

- Bank failures

- Wars, including the Iranian Revolution (1978), the Iran-Iraq war (1979), the Russian invasion of Afghanistan (1979), and the Iranian hostage crisis (November 4, 1979 to January 20, 1981).

Outside of the Great Depression, it’s hard to identify more trying economic circumstances.

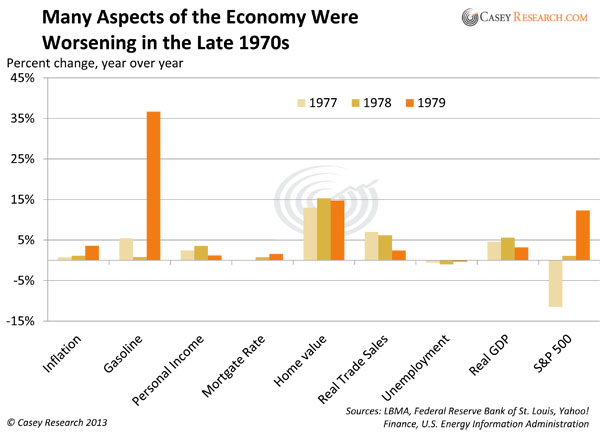

Here’s a closer look at the three-year period from 1977 through 1979. In the following chart, we looked at the economic indicators that affected citizens and investors the most, showing which were getting better and which, worse. These factors would all have affected market sentiment and the appetite to invest in gold at the time…

[Editor’s Note: How can you have negative unemployment? This chart shows the change in the rate from the previous year. Negative numbers means that it was down by that much from the previous year. In 1979, Gasoline prices were up more than 35% from the previous year and overall inflation was up 3.6% from the previous year.]

You can see that by the time 1979 hit, inflation was rising, gas prices were soaring, incomes were dropping, and mortgage rates were climbing. The S&P was rising, but not so much in real terms. GDP growth was high, but it was clearly not a rosy time for consumers or workers. Key points:

- Nominal GDP in 1979 increased 10% year over year, but it was 4.5 percentage points less than in 1978, when the economy expanded a whopping 14.5%. Real GDP changes didn’t reach those highs but kept to the trend: in 1978 the growth was 5.6%, while during 1979 the economy expanded only 3.1%, notably slowing down.

- Inflation was dramatically accelerating. The ’70s was a hard time for the dollar, much of it connected to the energy crisis. Annual inflation grew from 5.7% in 1976 to 7.6% in 1978, and accelerated to 11.2% in 1979. Prices were up significantly, especially those that had energy costs associated with them, squeezing the average American budget tighter and tighter.

- Gasoline prices rose almost 37% in 1979. This obviously impacted spendable income. It would be the equivalent of national gasoline prices hitting $4.54/gallon by December after starting the year at $3.32.

- Real disposable personal income slowed in 1979, growing only 1.2%, compared to a 3.5% growth rate just a year earlier.

- Mortgage rates were already high—and then shot higher. The interest rate to mortgage a home went from 8.8% in 1978 to 11.2% in 1979. Home values were rising dramatically due to inflation, though rate increases cooled the pace, as values slowed to a 14.7% rate in 1979 vs. 15.3% in 1978.

- Real manufacturing and trade sales (listed as Real Trade Sales in the chart) weakened from 7% in 1977 to 2.4% in 1979. This is a broad indicator that includes manufacturing, merchant wholesalers, and retail sales. The likely culprit for the drop was falling personal incomes as prices were rising.

- The S&P 500 went from negative territory in 1977 to logging a 12.3% gain in 1979. As inflation rose, so did nominal stock prices, but the real gain was a mere 1.1%.

- Unemployment was decreasing during this period, from 7.1% in 1977 to 5.8% in 1979. This may seem at odds with a slowing economy, but labor looked cheap since prices were growing faster than wages. Also, unemployment is a lagging indicator—and it sharply worsened later, when another recession hit in 1980.

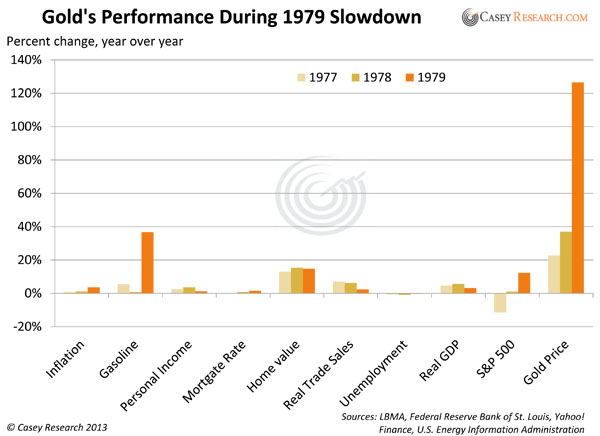

So how did gold perform during this challenging economic environment?

While there are many variables at play and no two economic time periods will be the same, this history lesson signals that a sluggish economy is not necessarily an obstacle for gold doing well. Indeed, some of these factors directly contributed to the rush to gold, which is not just a commodity, but the single best tool for storing and transferring wealth (money) ever devised.

In short, there is no contradiction between Doug Casey’s gloomy global economic outlook and his bullishness on gold. In our view, the former is the reason for the latter, and a very good reason to buy. If the history of the current bull cycle for precious metals even slightly rhymes with what happened in the 1970s, the market mania that lies ahead should bring us the biggest and fastest gains on our investments to date.

| Tomorrow’s BIG GOLD outlines why we think buying this month will reward investors not just in the long-term but quite possibly in the short-term as well. The bullion discounts we offered last month have been extended for 30 days solely for BIG GOLD readers—this is the time to pounce, so take advantage of weak prices while they’re still available. |

[Thanks to research assistant Alena Mikhan for her contributions to this report.]

See Also:

- What is the Economy Usually Doing When Gold Goes Up?

- A Reader Question About IRAs and Gold Stocks

- How Does Gold Fare During Hyperinflation?

- What Happens to Gold if We Enter a Recession or Depression?

- Its Weight in Gold: The Real Prices of Things

- Why would Gold fall during an Investment Crisis?

- Inflation adjusted Gold Price Chart

- How Global Financial Developments are Affecting the Price of Gold

- Beginners Guide to Gold Investing

- The Case of the Disappearing Gold

- Why (and How) China is Boosting the Price of Gold

Would you mind taking a look at this company and letting me know what you think. You seen well versed in terms of how Gold reacts to different models.

http://www.karatbars.com/?s=goldasmoney

Thank you in advance if you can make the time to take a look.