The most recent factor is the sudden eruption of the long simmering feud in Libya between rival factions. The attack on Tripoli by the Libyan National Army (LNA), a militia led by Khalifa Haftar, led to a spike in oil prices on Monday as the market priced in the possibility of supply outages.

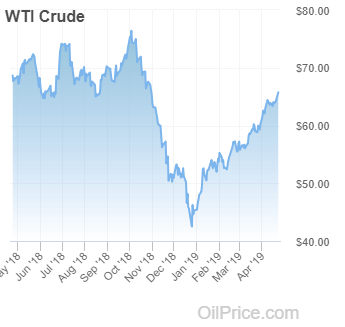

One oil export terminal near Tripoli is the most obvious asset at risk. “If this port were to be shut down due to the fighting, this could see a delivery outage of up to 300,000 barrels per day,” Commerzbank said in a note on Tuesday. “The oil market is already undersupplied, so if supply from Libya also falls away the supply deficit will become even bigger.” Brent jumped to $71 and WTI to $64 on the news, the highest level in five months.

Intriguingly, speculators have only recently turned bullish on crude oil in terms of their positions in the futures market. “Indeed, our money-manager positioning index implies that speculative funds only moved from neutral to positive on oil in the latest week,” Standard Chartered wrote in a report on April 9. The investment bank argued that major investors only began to properly factor in geopolitical risk in the last few days, having overlooked risk for much of this year. Standard Chartered analysts said that the “supply security” of Libyan oil is “low,” and that output could decline in both the short and medium term.

Meanwhile, the U.S. shale industry has already begun to slow down. Weekly EIA data put U.S. output at 12.2 million barrels per day (mb/d) last week, a jump of 100,000 bpd from the week before (the EIA rounds off to the nearest 100,000 bpd on these weekly estimates). More accurate retrospective data found that U.S. production actually declined in January by 90,000 bpd, offering solid evidence of a slowdown.

Most analysts still see strong U.S. supply growth this year, but the gains have slowed significantly. Standard Chartered looked at three-month periods, which it argues shows a clear deceleration in production growth over the past year. “The 3m/3m change peaked at 861kb/d in August, and has declined since, reaching just 140kb/d in March,” the investment bank wrote.

Goldman Sachs argues that these bullish factors will continue. “We expect the drivers of this deficit to persist through 2Q19: the ‘shock and awe’ implementation of the OPEC cuts, global activity sequentially accelerating, further tightening of US oil sanctions and an only moderate increase in shale production for now,” Goldman analysts wrote in an April 8 report. However, the investment bank said that prices could begin to decline in the second half of the year as OPEC+ begins to unwind the production cuts and U.S. shale picks back up. On top of that, some “long-cycle” projects could hit the market in 2020, leading Goldman to project a $60 Brent price for next year.

In fact, while the oil market is moving very much in an upward direction, not everyone believes that it will last. “The mood is increasingly turning bullish, but several feedback loops are about to start spinning that stand in the way of a prolonged oil rally,” Norbert Ruecker of Julius Baer told Reuters. “Russia already signaled its willingness to raise oil output from June. Fuel remains costly in emerging markets, with soft currencies adding to high oil prices.” Russian President Vladimir Putin said at a forum in St. Petersburg that he was comfortable with oil prices where they are, and seemed to suggest that his government was not yet sold on the idea that OPEC+ should extend production cuts.

The higher prices go, especially over such a short time period, the more that cracks will begin to surface in the OPEC+ group. Saudi Arabia clearly wants to stick with the cuts, still smarting from the downturn last year. Russia is less keen.

Meanwhile, some economic concerns still linger. The IMF warned about slowing growth, expecting global GDP to expand by 3.3 percent this year, down from 3.6 percent last year. One glaring weak spot is the fact that emerging market currencies are lagging far behind the rally in commodities and global equities. Higher oil prices and a persistently strong U.S. dollar have put pressure on an array of currencies, and the weakness will make crude oil much pricier in many countries. That, in turn, could dampen demand.

Nevertheless, declining output in Iran and Venezuela, and the threat of severe outages in Libya, at a time when U.S. shale growth has slowed is a powerful combination pushing oil prices to new highs.

This article by Nick Cunningham of Oilprice.com originally appeared here and has been reprinted by permission.

You might also enjoy: